-

The regulator is also evaluating relocating one regional office and scaling back from five regional offices to as few as three.

January 12 -

The Dodd-Frank Act is just the latest in a long string of policy out of Washington that harmed the greatest banking system devised by man.

January 10 Louisiana Bankers Association

Louisiana Bankers Association -

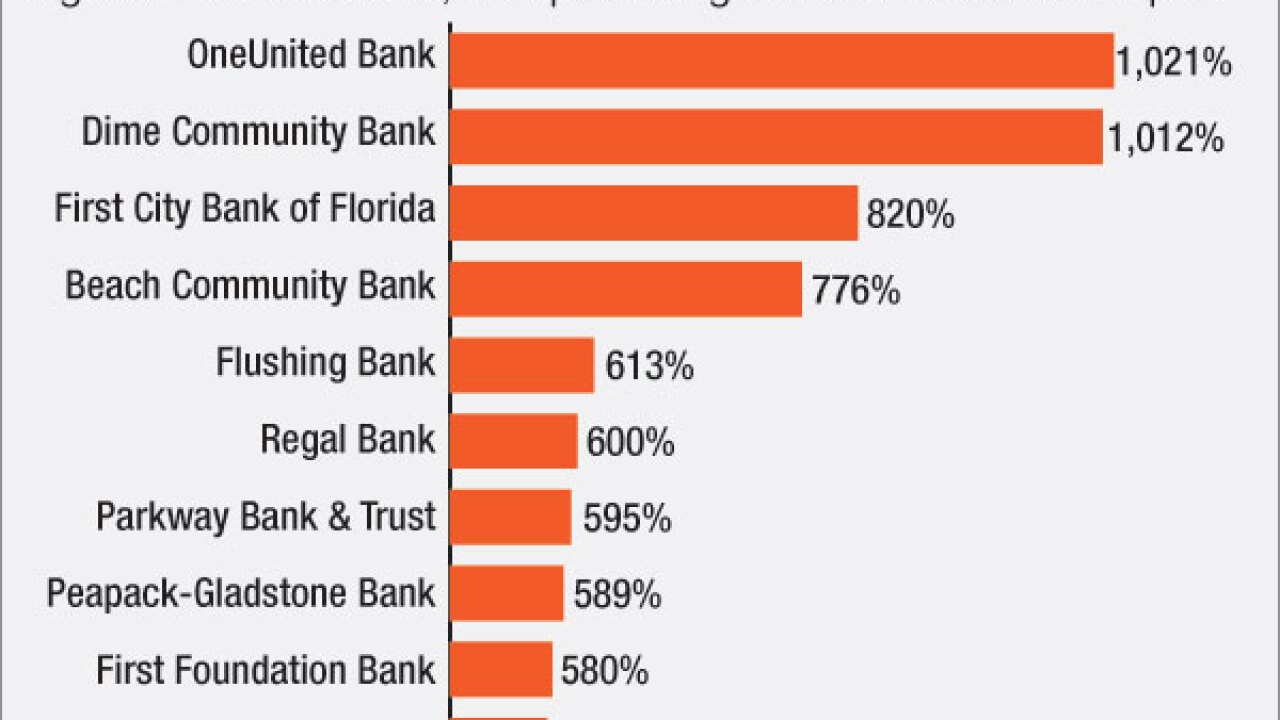

Regulators have warned about the dangers of high commercial real estate concentrations despite bankers' assertions that they are managing risk better than they did before the financial crisis. Still, CRE concerns could influence M&A and loan diversification in 2017.

December 22 -

While other banking laws may be headed to the chopping block, the Community Reinvestment Act can address the needs of communities defined by their economic struggles.

December 12 Buckley LLP

Buckley LLP -

The Office of the Comptroller of the Currency is expected to downgrade Wells Fargo's Community Reinvestment Act rating in January to "needs to improve," from "outstanding," according to a story by Reuters, citing unnamed sources.

December 7 -

A Republican president and GOP-controlled Congress have the opportunity to disentangle the current regulatory web that leads to overlapping jurisdiction and duplicative rules.

December 7

-

You'd rather have a heart surgeon who has done a lot of bypasses than a novice, right? Perhaps the same thinking should apply to commercial lenders, according to several university researchers challenging the orthodoxy that making too many of the same kind of loans can only spell doom.

November 30 -

Regulatory costs may be warranted, but neither Congress nor the executive branch assessed the cost of the Dodd-Frank Act before its enactment.

November 11

-

While regulators discuss a potential federal fintech charter, another possible solution for firms trying to avoid multistate licensing already exists: the trust charter.

November 8 -

The piling on at Wells Fargo has reached an unprecedented level, even for a bank. Fifteen investigations are underway into Wells' phony account openings. Experts are quantifying the damage to Wells' reputation and what the bank can do going forward to repair it.

October 25 -

Two San Francisco supervisors on Tuesday introduced a resolution that would "end all business with Wells Fargo," in response to the fake account scandal and other practices that have harmed consumers.

October 18 -

Without investigations by the Los Angeles Times and city prosecutors, the Wells Fargo account scandal would never have come to light. Where were federal regulators?

October 13

-

For regulators to develop a unified framework for fintech companies to operate in, they first have to come to a consensus.

October 5 -

The Consumer Financial Protection Bureau filed a lawsuit this week against a Van Nuys, Calif., credit repair company for deceptively marketing its services and charging consumers illegal fees.

September 23 -

For First Foundation, the government-backed program should help address a recent CRA exam's criticism that it has "poor penetration among businesses of different revenue sizes."

September 14 -

The Federal Financial Institutions Examination Council has released updated cybersecurity guidance for bank examiners.

September 9 -

Without incentives to shoot higher, banks usually settle for "Satisfactory" on their Community Reinvestment Act exams, but many find that not getting a better grade has consequences.

September 8 K.H. Thomas Associates

K.H. Thomas Associates -

The $29 billion-asset company said in a regulatory filing Thursday that the "needs to improve" rating will likely restrict its ability to make acquisitions and open branches.

September 2 -

With even community banks getting hit by ransomware attacks, there's a long list of cybersecurity practices that bankers can expect their supervisors to scrutinize during upcoming exams.

September 1 -

Hillary Clinton's proposal for regulatory relief for smaller institutions largely tracks with ideas already discussed, but her backing could keep alive the momentum for a reg relief plan should she win in November.

August 26