-

Enloe State Bank in Texas becomes the first bank to fail in 17 months; BB&T dangles promise of bonus payments to top executives if they stay; where JPMorgan Chase’s Finn experiment went wrong; and more from this week’s most-read stories.

June 7 -

Someone reportedly was burning paper at the Texas bank on a recent Saturday night, and a state regulator cited "insider fraud and abuse" after Enloe was closed.

June 3 -

Regulators closed The Enloe State Bank in Texas late Friday, marking the first failure in 17 months and the first in the Lone Star State in over five years.

May 31 -

Edward Rostohar, who was CEO of CBS Employees Federal Credit Union, could face up to 15 years in prison following a $40 million scheme that brought down the institution.

May 16 -

Chief Financial Officer Steve App will be succeeded by Bret Edwards, who is now head of the FDIC's division of resolutions and receiverships.

May 9 -

Deutsche Bank and Commerzbank end merger talks; the digital money transfer unit has more than 40 million digital users, second only to JPMorgan Chase.

April 25 -

Despite consensus that regulators should ease so-called “living will” requirements by some degree, critics charge that a proposal by the Fed and FDIC could undo gains in making large banks easier to resolve.

April 15 -

Edward Rostohar was arrested after his wife informed authorities he stole from CBS Employees Federal Credit Union and was preparing to flee the country.

April 1 -

The National Credit Union Administration liquidated the $21 million-asset institution after determining it was "insolvent with no prospects of restoring viable operations."

March 29 -

PricewaterhouseCoopers settled a lawsuit in which the FDIC accused it of negligence in its role as external auditor for Colonial Bank. But FDIC board member Martin Gruenberg objected because the firm did not accept blame.

March 15 -

The National Credit Union Administration board held its monthly open board meeting Thursday – likely board member Rick Metsger's last hearing with the panel before two new members join.

March 14 -

Despite strong performance in the industry overall, analysts expect regulators to shutter more institutions in the years ahead.

January 3 -

The National Credit Union Administration board voted to decrease the normal operating level for the share insurance fund in addition to prioritizing alternative capital as part of its regulatory reform.

December 13 -

The National Credit Union Administration on Thursday approved a two-year budget as the board credited the merger of two funds with helping CUs stave off assessments amid a surge in liquidations.

November 15 -

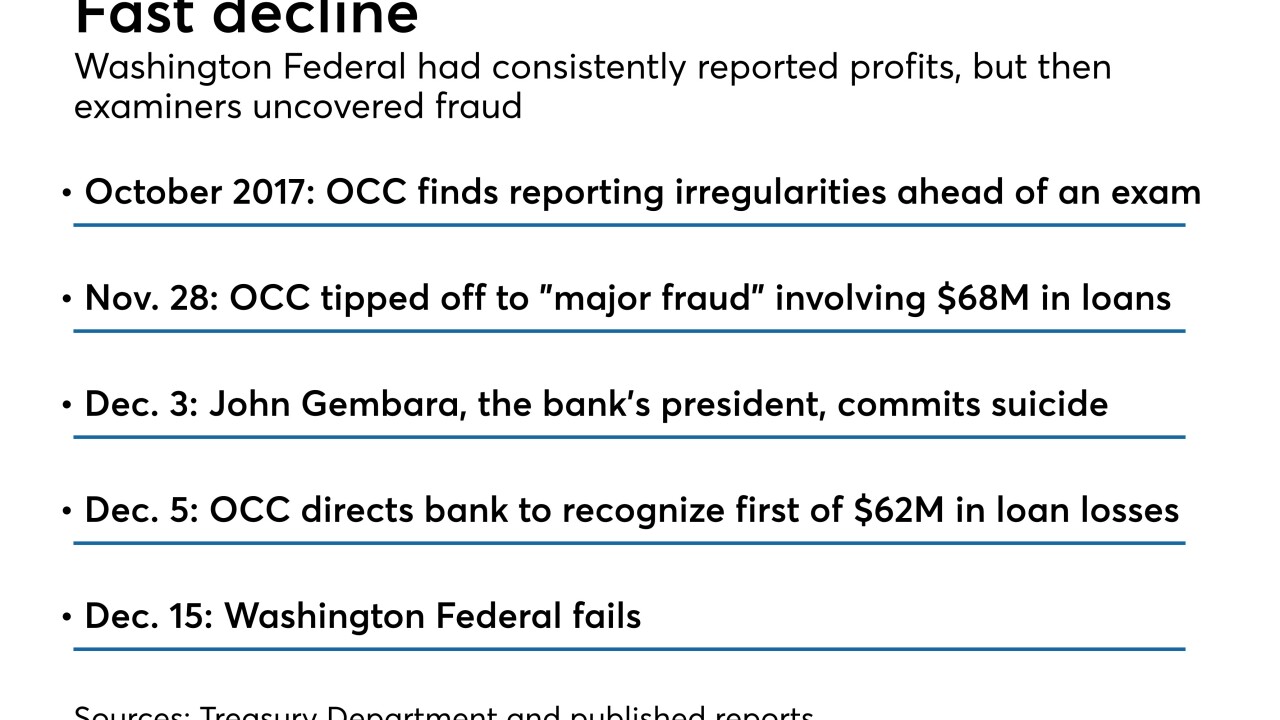

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

The $263 million portfolio has been covered by a loss-share agreement since an investor group bought the failed BankUnited in 2009.

November 5 -

Federal regulators shuttered the institution, which had just $3 million in assets, after it became insolvent with no viable path forward.

October 12 -

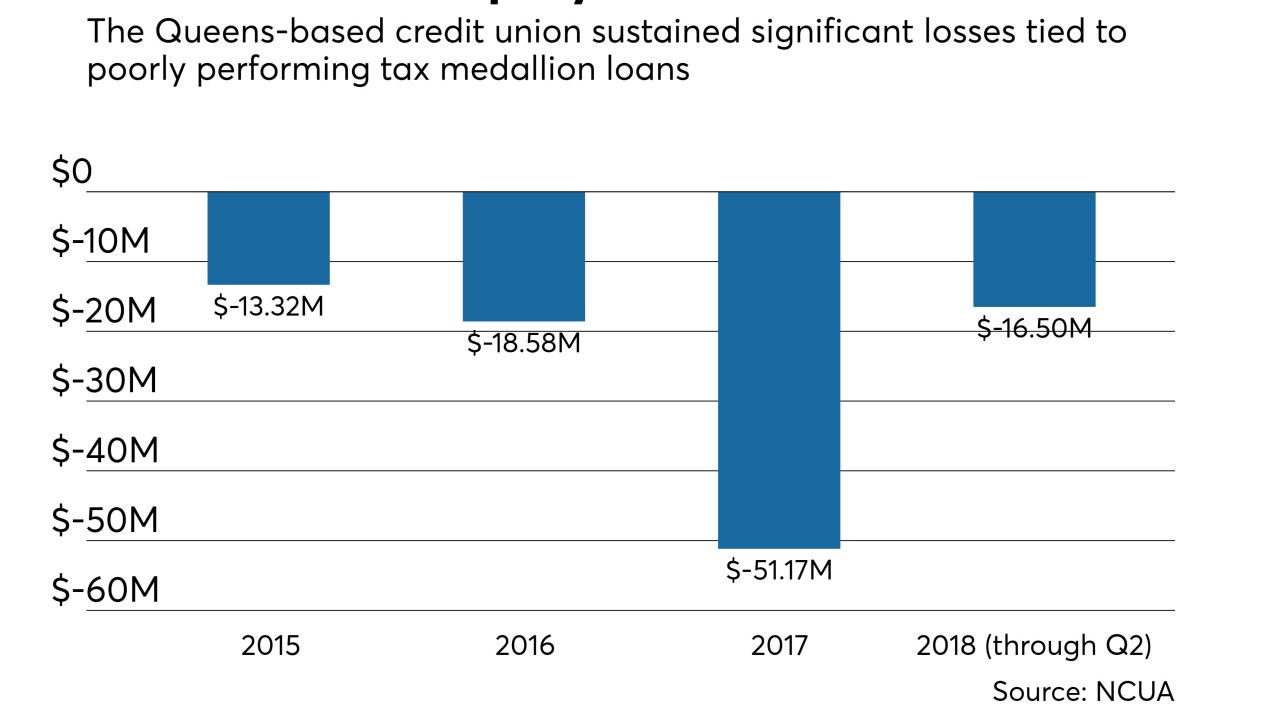

NCUA liquidated LOMTO Federal Credit Union following years of significant losses due to poorly performing taxi medallion loans.

October 1 -

After months of negative headlines, including administrative charges against a former CEO, regulators shuttered the NYC-based credit union.

August 31 -

A credit union in Swansea, Wales, has collapsed and will cost the UK's Financial Services Compensation Scheme nearly $647,000 to reimburse members' insured funds.

August 31