-

Even with fee revenue already down, Oregon-based Providence FCU has cut its overdraft fees by half. Some analysts say the move could pay off if the economy goes south.

October 7 -

The Pittsburgh company is not interested in bank acquisitions, CEO Demchak says; why Citi, Wells, JPMorgan are seeing a spike in API calls; FHFA's Mark Calabria details next steps on GSE reform; and more from this week's most-read stories.

September 13 -

Annual fees aren’t scaring customers away from American Express Co.’s credit cards. Roughly 70% of cardholders the lender added in the second quarter have premium, fee-paying cards, Chief Financial Officer Jeff Campbell told investors at a conference Tuesday in New York.

September 10 -

Charging customers $40 for a $10 overdraft “makes no mathematical sense,” Chime CEO Chris Britt says in a critique of traditional banks.

September 8 -

Its latest feature makes it one of several mobile-only challenger banks in the U.S. that charge no overdraft fees of any kind.

August 27 -

Margin expansion may grind to a halt if the Fed holds rates steady or cuts them further. The problem is regionals tend to lack the side businesses that the big banks possess to offset lending slumps. Check out our annual ranking of banks with $10 billion to $50 billion of assets.

August 12 -

The Los Angeles unit of Royal Bank of Canada plans to use FilmTrack to handle more complex transactions for major networks, studios and distributors.

August 6 -

The number of transactions to send money across borders has risen for 36 consecutive months, but this could eventually slow.

July 25 -

Accounts that offer high interest rates can bolster fee income and lower noninterest expenses, though credit unions have to carefully watch these products to ensure they actually make money.

July 24 -

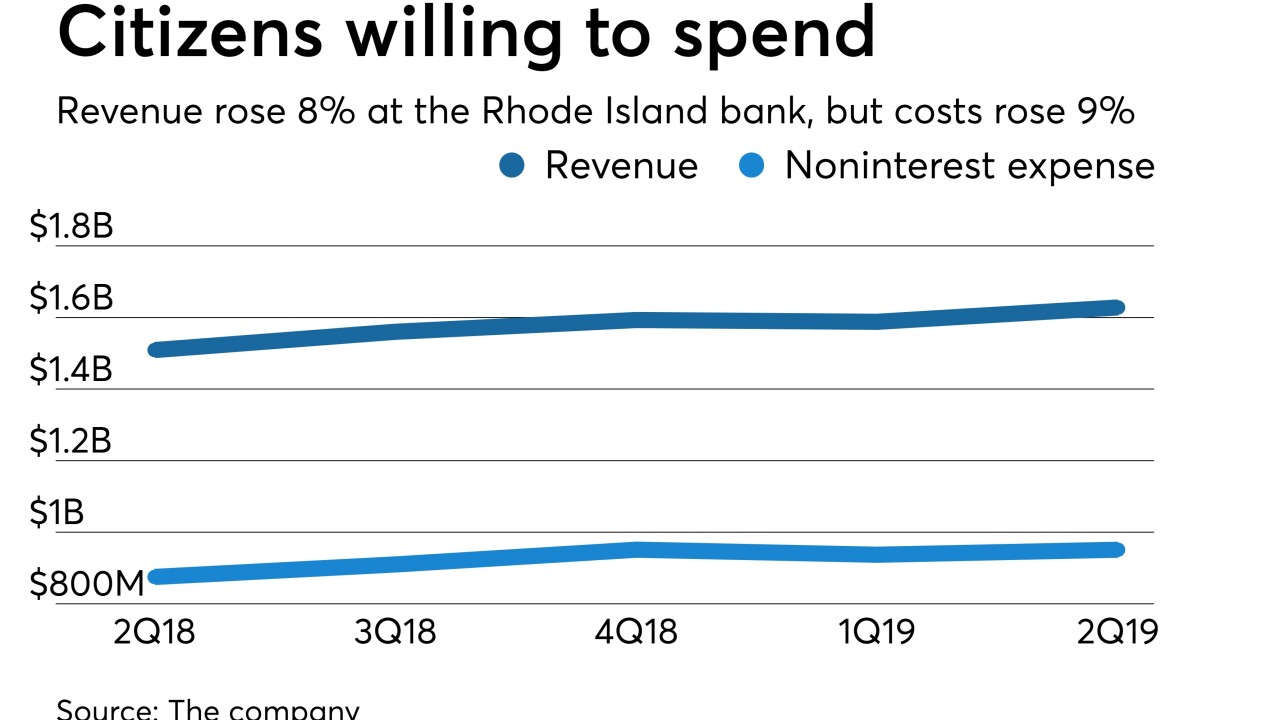

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21