-

Its latest feature makes it one of several mobile-only challenger banks in the U.S. that charge no overdraft fees of any kind.

August 27 -

Margin expansion may grind to a halt if the Fed holds rates steady or cuts them further. The problem is regionals tend to lack the side businesses that the big banks possess to offset lending slumps. Check out our annual ranking of banks with $10 billion to $50 billion of assets.

August 12 -

The Los Angeles unit of Royal Bank of Canada plans to use FilmTrack to handle more complex transactions for major networks, studios and distributors.

August 6 -

The number of transactions to send money across borders has risen for 36 consecutive months, but this could eventually slow.

July 25 -

Accounts that offer high interest rates can bolster fee income and lower noninterest expenses, though credit unions have to carefully watch these products to ensure they actually make money.

July 24 -

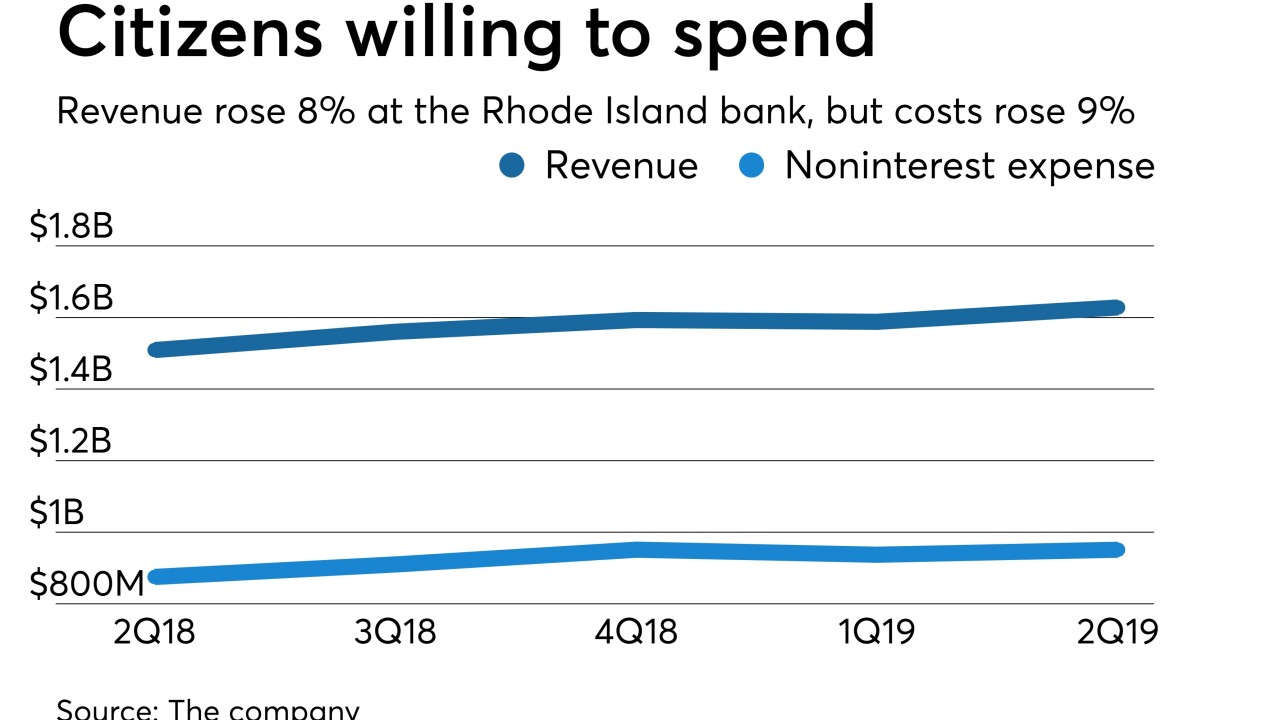

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

Executives at the Minneapolis bank, who expect two Fed rate cuts this year, said they can rely on growth in noninterest income to soften the blow.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

New York Attorney General Letitia James said there is “no basis to believe” that the overdraft rule has harmed small banks and credits unions.

July 2 -

To make a credit card top of wallet and build interchange income, credit unions must develop trust, provide great service and ensure the card works every time.

June 13 Member Access Processing

Member Access Processing