-

The banking giant nonetheless saw strong growth in net new assets in the first quarter and a 14% jump in returns from asset management fees.

April 12 -

Citigroup's earnings topped analysts' estimates as corporations tapped markets for financing and consumers leaned on credit cards.

April 12 -

The company reported net interest income that slightly missed analyst estimates, a sign the benefit of higher interest rates may be waning amid pressure to pay out more to depositors. Costs rose on higher compensation and an FDIC assessment.

April 12 -

The company missed estimates for net interest income in the first quarter, a sign that muted loan growth and increased pressure to pay out more for deposits are eating into the benefit of higher rates.

April 12 -

Some online banks that offer high-yield savings accounts are making those products a little less high-yielding. Banks are also shortening the duration of new CDs, hoping that anticipated rate cuts by the Fed will enable them to start paying less to consumers.

April 9 -

Based on the pace of deals through late March, the banking industry is on track for the most branch sales since 2021. Buyer interest has mounted alongside the need to acquire deposits, following hits to funding bases last year.

April 5 -

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

The Evansville, Indiana bank named an interim chief financial officer after Brendon Falconer was charged with child molestation.

April 1 -

Mariya Rosberg is named Americas head of banking and financial services at Marsh McLennan's Oliver Wyman unit; startup ZayZoon raised $15 million in a new funding round; and more in the weekly banking news roundup.

March 28 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26 -

Federal Reserve Gov. Lisa Cook said in a speech Monday the central bank is monitoring record highs in the stock market to see if it proves to be a bubble.

March 25 -

A key bank stock index ticked up after the Federal Reserve hinted that it could lower rates later this year. But there are still a number of economic uncertainties that are holding shareholders back.

March 20 -

A trio of Republican Congressmen stated they will investigate how the program got fast-tracked by the Biden Administration.

March 19 -

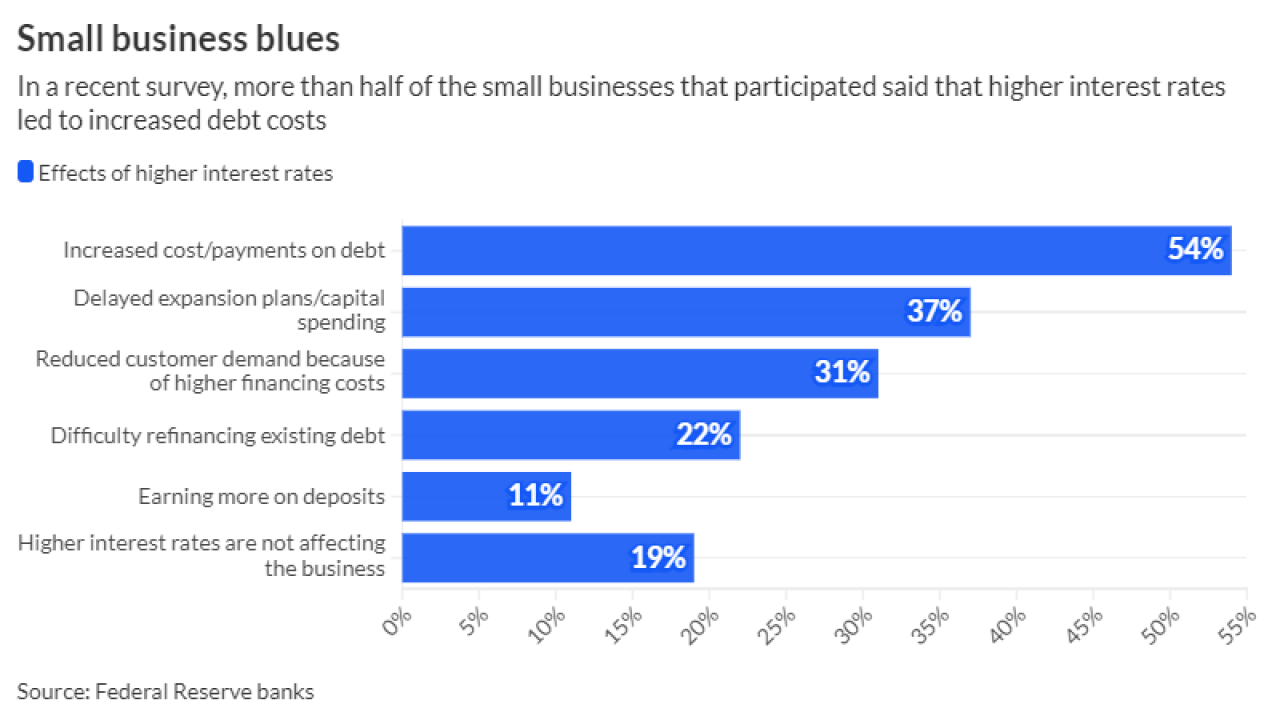

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

March 18 -

Peapack-Gladstone's wealth unit is pursuing an ambitious de novo expansion in New York and perhaps elsewhere because M&A has become expensive as private equity money has inflated seller expectations.

March 13 -

Midsize lenders have largely defied the most dire predictions following Silicon Valley Bank's demise. But the nation's largest banks still have structural advantages, and the regionals remain hampered by their real-estate heavy portfolios and the continuing impact of high interest rates.

March 11 -

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

March 11 -

Here's how the former regulator thinks Fannie Mae and Freddie Mac could exit conservatorship and where he sees the residential market headed this year and next.

March 8 -

MoneyLion saw continued financial growth in 2023, achieving four straight quarters of positive earnings. In 2024, it plans to develop a partnership with EY to bolster its enterprise services.

March 7