-

The regulators plan to drop the 3% limit on bank investments in venture capital funds; Visa invests in another fintech startup.

January 28 -

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

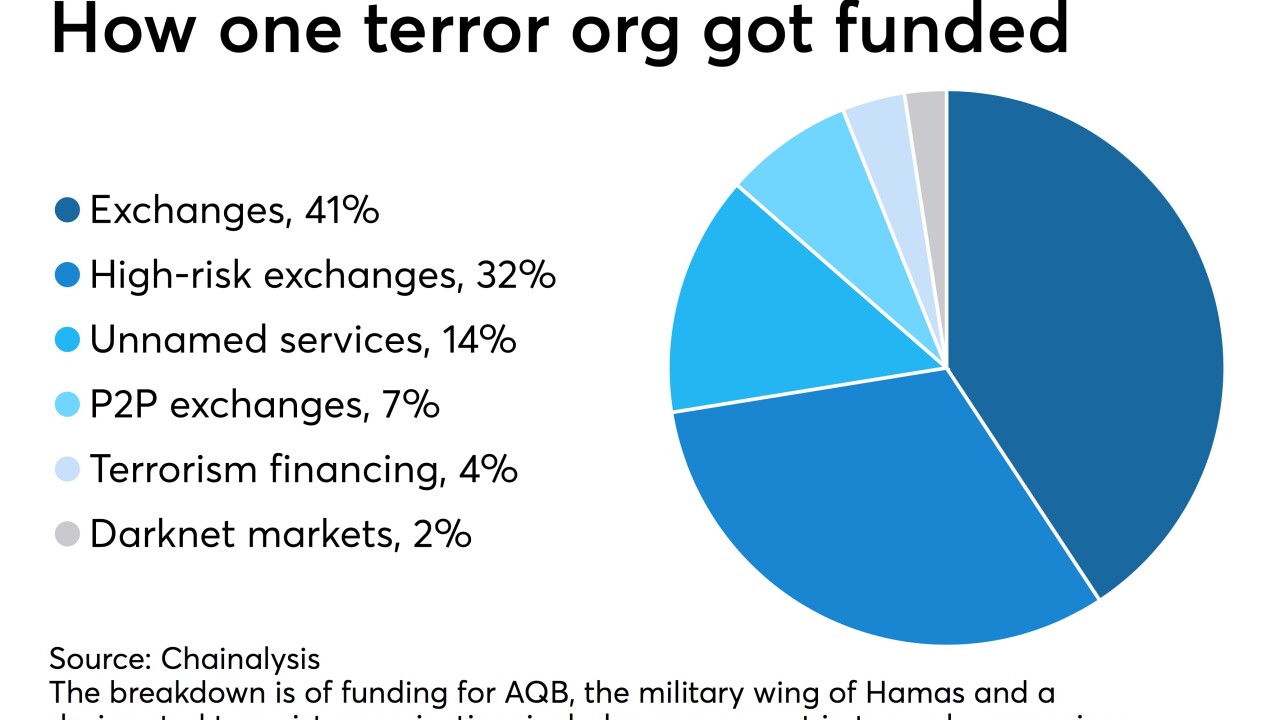

Terrorism financing schemes using cryptocurrencies are growing in sophistication, according to researcher Chainalysis, which helps law enforcement track digital-coin transactions.

January 17 -

Open banking and identity services are both still evolving to meet the needs of the new digital economy. These communities will need to connect at the hip to prevent fraud, avoid identity theft and to deter other financial crimes, like money laundering.

January 14 Regions Bank

Regions Bank -

Stephen Calk and the bank where he formerly served as CEO are both arguing that his bribery trial should be held in Illinois. Prosecutors oppose the move.

January 13 -

A North Carolina group is trying to take regulators' cue to work together. A successful effort could encourage others to follow its lead.

January 12 -

Travelex unable to deliver cash to major banks following a New Year’s Eve cyberattack; Rep. Katie Porter says the bank is undermining purpose of its punishment.

January 10 -

Cybersecurity, AML compliance and consumer protections top the credit union regulator's list.

January 8 -

Southern Security FCU is part of an inmate reentry program that could be a model for institutions looking for innovative ways to add members and live up to the industry's "people helping people" ethos.

January 7 -

Granting a third party access to a bank's systems in exchange for more advanced technology can help prevent fraud, but it can also attract cyberattacks.

January 6 Regions Bank

Regions Bank