-

A long-anticipated financial rule could help law enforcement root out illegal activity, but it requires banks to keep extra-close tabs on certain business clients. That won't be easy.

May 16 Promontory Financial Group

Promontory Financial Group -

What was unusual about CEO Kam Wong's alleged fraud wasn't that it happened but that it happened at such a large credit union.

May 14 -

A long-anticipated financial rule could help law enforcement root out illegal activity, but it requires banks to keep extra-close tabs on certain business clients. That won't be easy.

May 11 Promontory Financial Group

Promontory Financial Group -

The embattled company said Thursday that the asset cap imposed by the Federal Reserve will likely remain in place through “the first part of 2019.” Is this a sign of further delays to come?

May 10 -

A river of drug-cartel money flowed through the U.S. arm of Dutch banking giant Rabobank, and now federal investigators are pursuing criminal cases against former senior executives for allegedly covering it up.

May 10 -

Kam Wong, chief executive at the high-profile, $2.9 billion credit union that serves the NYPD, among other municipal workers, has been charged with fraud.

May 8 -

Trump-appointed regulators are making headway on easing regulations. But there's one critical voice missing.

May 4 -

The class-action lawsuit filed by investors alleged that bank executives deliberately failed to disclose the full nature of its cross-selling practices to shareholders.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

A new strain of malware that targets cryptocurrency users — but not users of mainstream payment options like bank accounts — highlights how much the cybercrime game is changing behind the scenes.

May 4 -

Attorneys for then-President Robert Harra said he is innocent and will file an appeal. The case centers on a scheme said to have been carried out during the crisis years, before the bank was sold to M&T.

May 3 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 3 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

The National Credit Union Administration has banned seven former credit union employees from participating in the affairs of any federally insured financial institution.

April 30 -

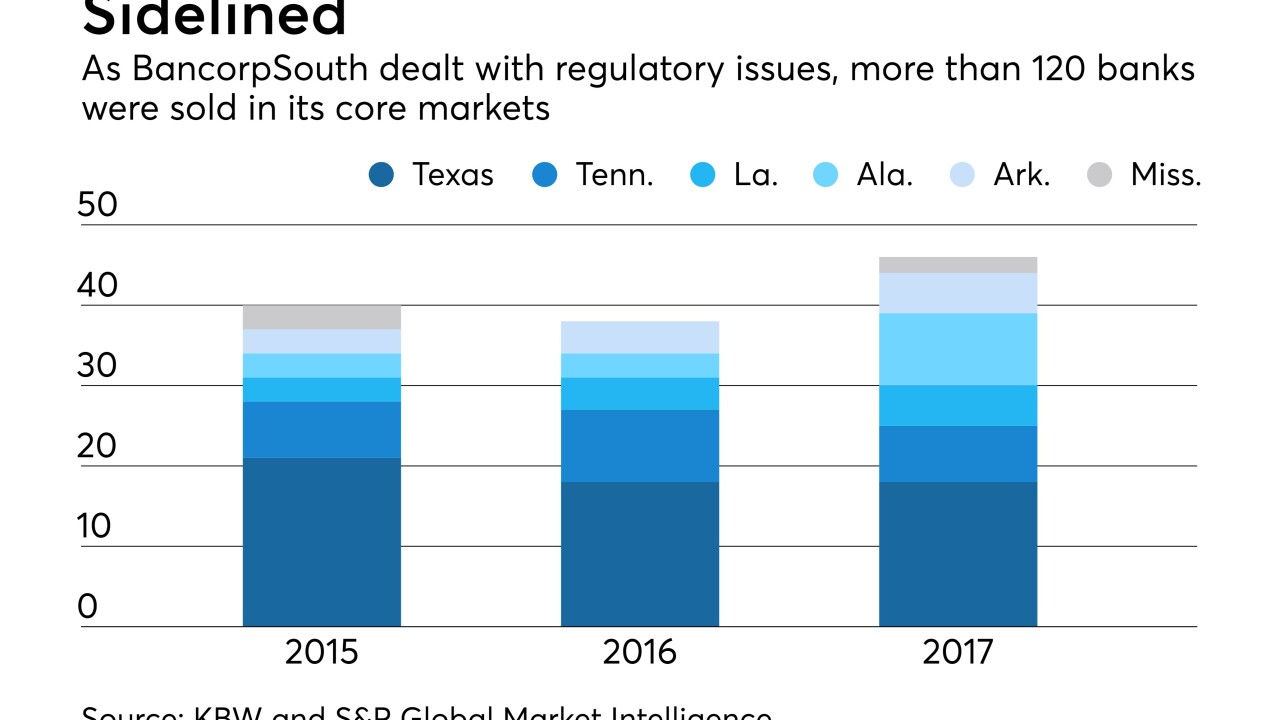

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

When regulators recognize ICOs as securities offerings, they will likely require issuers to fully comply with standard Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance pressure, according to Ron Teicher, CEO of EverCompliant.

April 25 EverCompliant

EverCompliant -

CEO Tim Sloan and board chair Elizabeth Duke fielded tough questions Tuesday on everything from the embattled bank’s culture to its ties to the private prison industry.

April 24 -

A federal grand jury in Charlotte, N.C., has indicted a former credit union CEO with fraud in connection with the U.S. government's Troubled Asset Relief Program.

April 20