-

The regulator's latest Quarterly Map Review shows credit unions' good run continuing, but some states remain stuck in a rut.

October 11 -

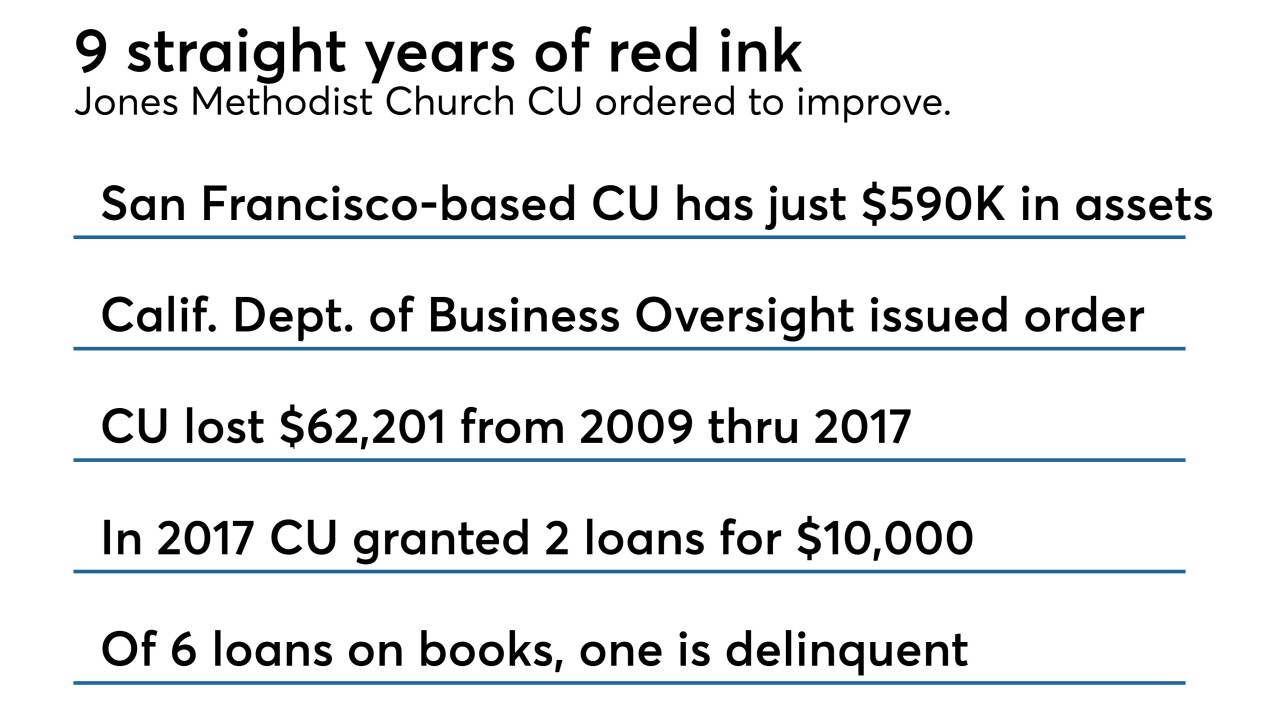

Jones Methodist Church Credit Union has been ordered to address "unsafe or unsound practices" following nine years of losses and other problems.

October 10 -

The late-filing credit unions will pay a total of about $4,100 to the U.S. Treasury.

October 9 -

Net income up is up for the industry on average, but the number of federally insured credit unions has dropped to 5,480.

September 6 -

SDCCU’s member base increased by 10 percent during the first half of 2018, while total assets remain at $8.4 billion.

August 30 -

At the recent CU Leadership Conference in Las Vegas, credit union representatives offered their ideas for the next round of reg relief.

August 21 -

Credit unions in the Badger State saw significant increases in loans and net worth, while delinquencies dropped slightly.

August 13 -

The Las Vegas-based credit union posted yet another positive quarter with $2.55 million in net income in Q2.

July 31 -

The nine CUs will together pay a total of $3,109 to the U.S. Treasury.

July 18 -

Credit unions in the Silver and Golden states saw strong increases in growth and deposits during the first quarter of 2018.

July 18 -

The industry is slated for another busy week, with more bank results on the horizon, plus a nomination hearing for Trump’s pick to head the CFPB.

July 13 American Banker

American Banker -

The National Credit Union Administration's quarterly map of state-level performance data sees a continuation of many long-running trends, but a handful of states can be thankful they're no longer at the bottom of the pack for certain performance metrics.

June 15 -

While credit unions posted strong lending numbers and growth stats, the overall number of federally insured credit unions continued to decline during the first quarter of 2018.

June 7 -

One expert on call reports offered more than a dozen examples of how credit unions can avoid making common mistakes when filing 5300s with NCUA.

May 25 -

A major study recently named the $2.5 billion-asset CU the No. 1 performing credit union in California.

May 23 -

CEO James Schenck told attendees at the credit union's 2018 annual meeting that last year saw record growth, including a 10% increase in membership and more.

May 21 -

The San Diego-based credit union’s member base increases 10.5 percent in the first quarter, with total assets up to $8.4 billion.

May 11 -

The California-based credit union says membership saw ‘solid’ growth in the first quarter of 2018.

May 10 -

The credit union has come a long way from when it started with just 40 refinery employees and their families as members.

May 1 -

The credit union saw deposits grow by 9 percent and loans grow by 7 percent, while returning more than $1.8 million in member dividends.

May 1