-

Requiring banks to test themselves is likely to be a waste of time in the current crisis, says a former Senate Banking counsel.

April 3 Corporations and society initiative at Stanford Graduate School of Business

Corporations and society initiative at Stanford Graduate School of Business -

Sandler and his wife, Marion, built a small California thrift into a powerhouse before selling it to Wachovia prior to the housing collapse, but were heavily criticized for engaging in some of the same practices that caused the financial crisis.

June 5 -

New president suggests less regulation and meets with bank leaders; state and city check for illegal lending activity.

May 21 -

Although higher corporate debt could hurt the economy, Federal Reserve Chair Jerome Powell argued changes made since the last crisis will guard against a meltdown.

May 20 -

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

May 15 -

These programs are becoming a more common employee benefit but many lack some of the tools users need to be successful.

March 26 FinFit

FinFit -

Flourish, a fund backed by Pierre and Pam Omidyar, invests in startups that address social and financial inequities yet (key caveat) are still promising moneymakers, a top official of the fund explains.

March 13 -

The bureau's director, Kathy Kraninger, faced a barrage of criticism from Senate Democrats on the agency's lack of enforcement actions, a reversal on Military Lending Act examinations and changes to the payday loans rule.

March 12 -

The director of the Consumer Financial Protection Bureau has asked Congress to clarify its ability to conduct exams that ensure compliance with the Military Lending Act.

January 17 -

Its data-driven financial management services for workers who live paycheck to paycheck — and a contract with Walmart — have attracted executives from Facebook, Slack and elsewhere as well as a major investment from the head of Box.

January 10 -

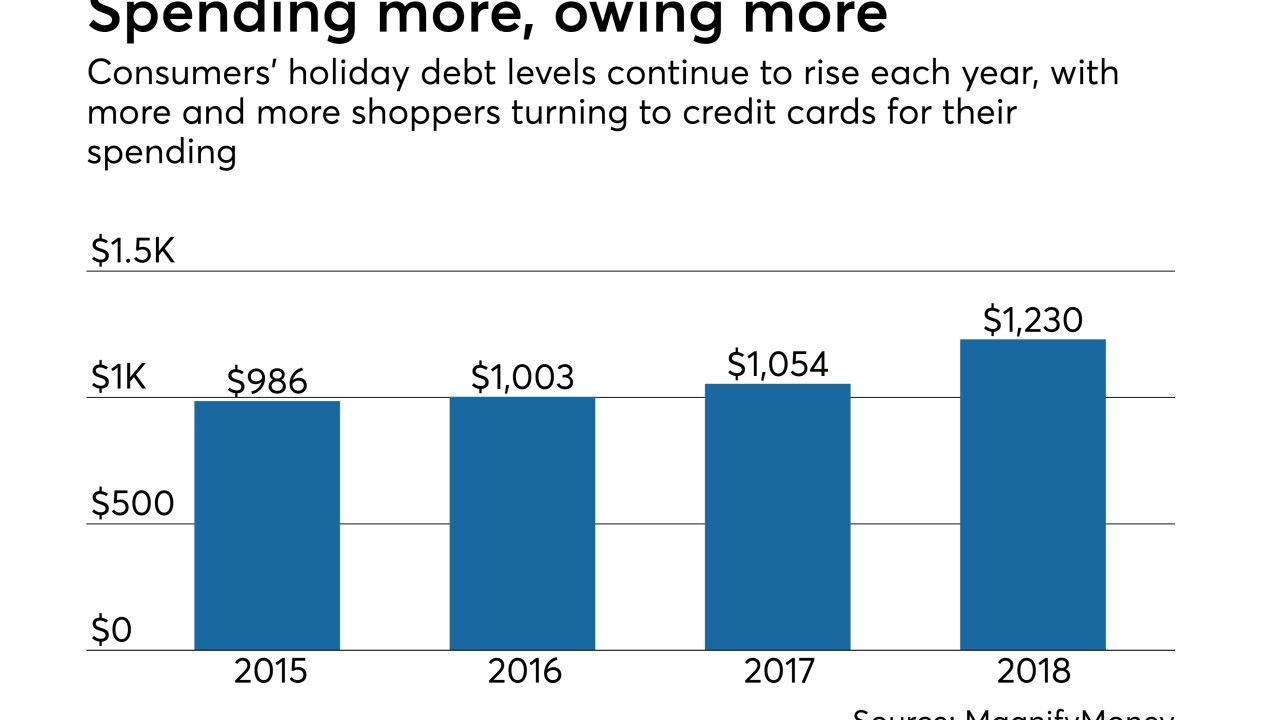

A pair of studies released Thursday show consumers once again added to their debt burden during the holiday season even as they admit to needing more financial education.

December 27 -

From stress tests to tailoring the Dodd-Frank Act to the Volcker Rule, the banking agencies have a number of important proposals to finalize in the coming year. But there are several potential obstacles that could throw those plans off track.

December 26 -

Several challenger banks are trying to relieve consumers’ financial stress by offering tools that guide better habits.

December 10 -

The bureau says it lacks explicit authority to conduct routine supervision of lenders’ compliance with service member protections, but the decision has sparked pushback from the Defense Department and groups representing military personnel.

October 11 -

Jonathan Walker of the Center for the New Middle Class and Mark Schwanhausser of Javelin discuss ideas for helping women facing financial difficulties.

June 21 -

The information request is the 11th issued by the agency since acting CFPB Director Mick Mulvaney in January launched a review to examine the bureau's practices.

April 4 -

It’s not just hourly workers who struggle to make ends meet — many managers also often find themselves short on cash each month. To help employees cope, the retail chain is using a tool developed by the fintech Even to give them access to their wages before the next pay period.

February 8 -

Banks are being pushed into the background of popular digital experiences. But they can reappear on interfaces that customers use daily by doubling down on financial wellness efforts.

August 11

-

Dr. Dan Geller, behavioral economist and author of "Money Anxiety," explains why Americans are more stressed about money than ever before and how fear affects their decisions about financial products and banks.

June 27