-

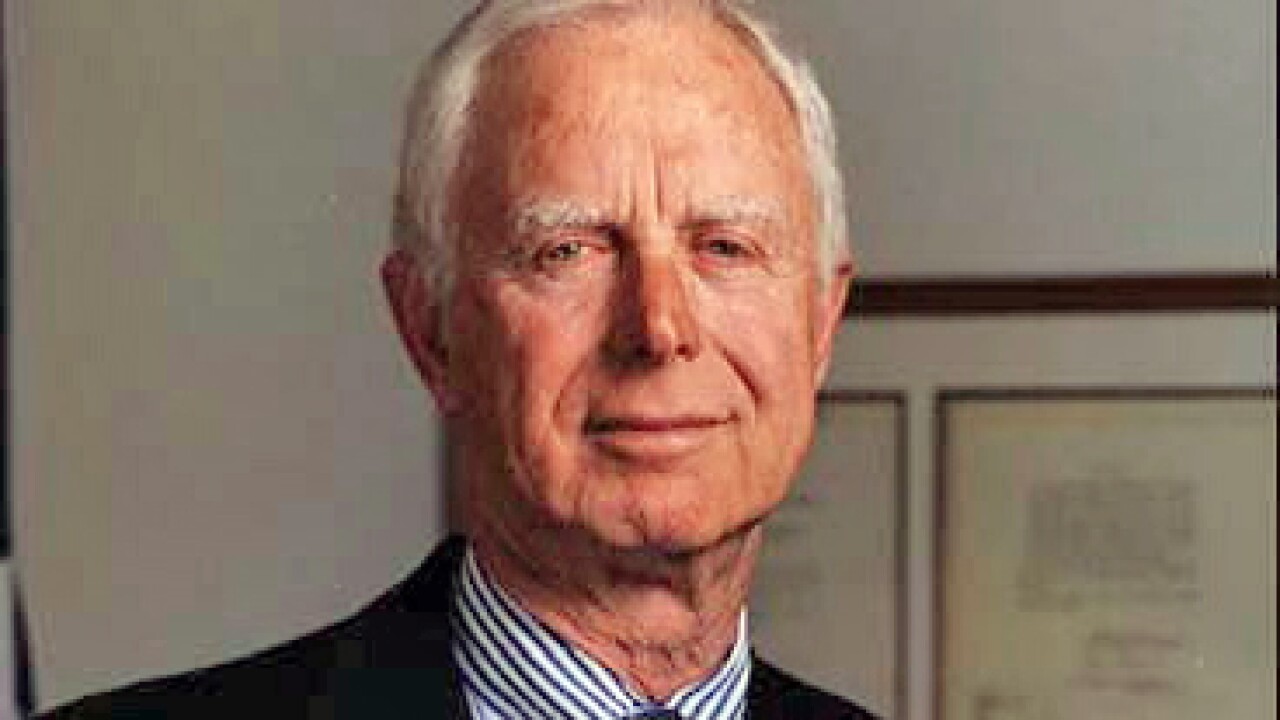

Arthur Levitt says seemingly daily scandals highlight the lack of oversight and corporate governance shortcomings of financial technology firms, but two marketplace lending executives responded that more mature companies have just as many problems.

September 28 -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

It's Yvette Hollingsworth Clark's job to make sure consumer, cyber and other protections are embedded into the design of digital products.

September 25 -

The payments processor Square has big plans in banking — but even after filing an application to charter an industrial loan company, it still doesn’t see itself as a competitor to most financial institutions.

September 19 -

The Independent Community Bankers of America had initially called for a moratorium in response to SoFi's application, and says now that Square's bid "has significantly increased our concerns."

September 15 -

Banks should not be fatalistic about the threats posed by tech companies in financial services. Incumbents still hold the upper hand.

September 15 Centana Growth

Centana Growth -

Few lawmakers have stated positions on fintech applications for industrial loan company charters. It may not stay that way.

September 13 -

Square became the third fintech firm in recent months to seek out a bank charter. Others are likely to follow.

September 11 -

Many of the arguments in this debate have less to do with the applicants’ qualifications than with traditional banks’ fear of new, innovative competitors.

September 11 Milken Institute's Center for Financial Markets

Milken Institute's Center for Financial Markets -

States must recognize how their patchwork of different regimes stifles innovation, but they also have an opportunity to help maintain U.S. competitiveness in the global fintech marketplace.

September 7 Arizona

Arizona