-

In 2017, the National Credit Union Administration board approved provisions to make mergers more transparent. But one of those changes has become a casualty of the government closure.

January 25 -

With SBA lending at a standstill, many small businesses can't access the capital they need to create and retain jobs, Stephen Steinour says.

January 24 -

The question of what banks are doing to aid government workers shows how the industry is still struggling to rebuild its image following the crisis.

January 24 -

U.S. Commerce Secretary Wilbur Ross said unpaid federal workers could borrow to tide themselves over during the government shutdown rather than call in sick to earn a paycheck elsewhere.

January 24 -

Industry groups and lawmakers have joined bankers in insisting the agency develop a plan to resolve the paperwork problem before the partial government shutdown ends.

January 23 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

For thousands of government employees, credit card bills are coming due for travel and other expenses they incurred before the shutdown.

January 22 -

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

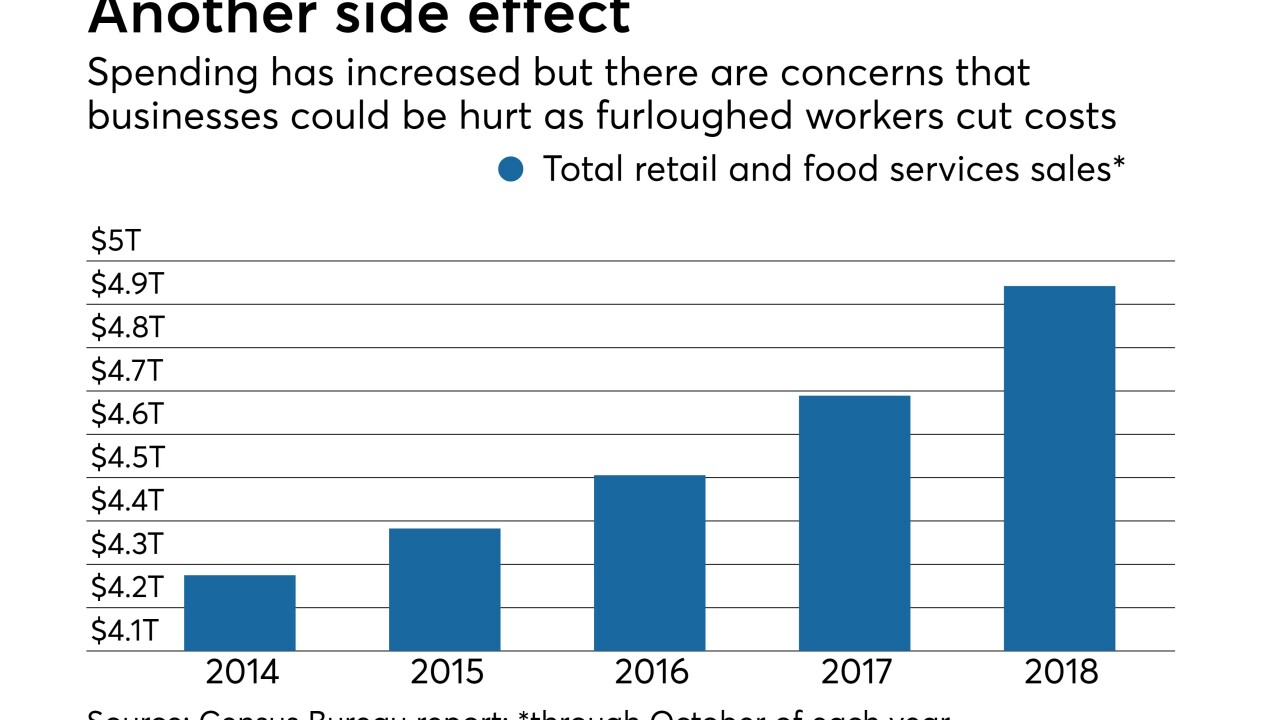

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17