-

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

Agriculture lenders expect more than a third of their borrowers to lose money this year, a development that could result in credit quality deterioration and impacts on banks' bottom lines.

November 14 -

Rep. Zach Nunn, R-Iowa, has won endorsements from key banking industry players this election year with his support for the ACRE Act. Here's why rural banking might be a winning issue in the toss-up race.

October 23 -

Lower commodity prices and decreases in government assistance are expected to push farm income lower this year and raise credit risk for banks.

March 25 -

To serve an increasingly online audience, POS Nation has acquired agriculture e-commerce platform GrazeCart, an example of vendors joining forces to adapt to shifts in the agriculture industry.

March 7 -

Bankers largely support expanding government-backed farm loan programs, and in general support continued funding for crop insurance. But politics is making swift passage of a traditionally uncontroversial bill challenging.

September 18 -

Credit unions generally struggle to make agricultural loans because the market is saturated by more experienced lenders. But they can develop the expertise — or acquire it through M&A.

July 13 -

In buying the $1.5 billion-asset County Bancorp, Nicolet would become the second-largest bank in Wisconsin and the state’s No. 1 dairy lender. It's the second bank acquisition deal Nicolet has announced this quarter.

June 22 -

Soybean, corn and wheat are trading at their highest levels since 2014, meaning farmers are more likely to catch up on loan payments and pursue expansions that require them to take out more loans.

February 25 -

The Amarillo company is buying First National Bank of Tahoka, continuing the industry’s consolidation in the state.

December 14 -

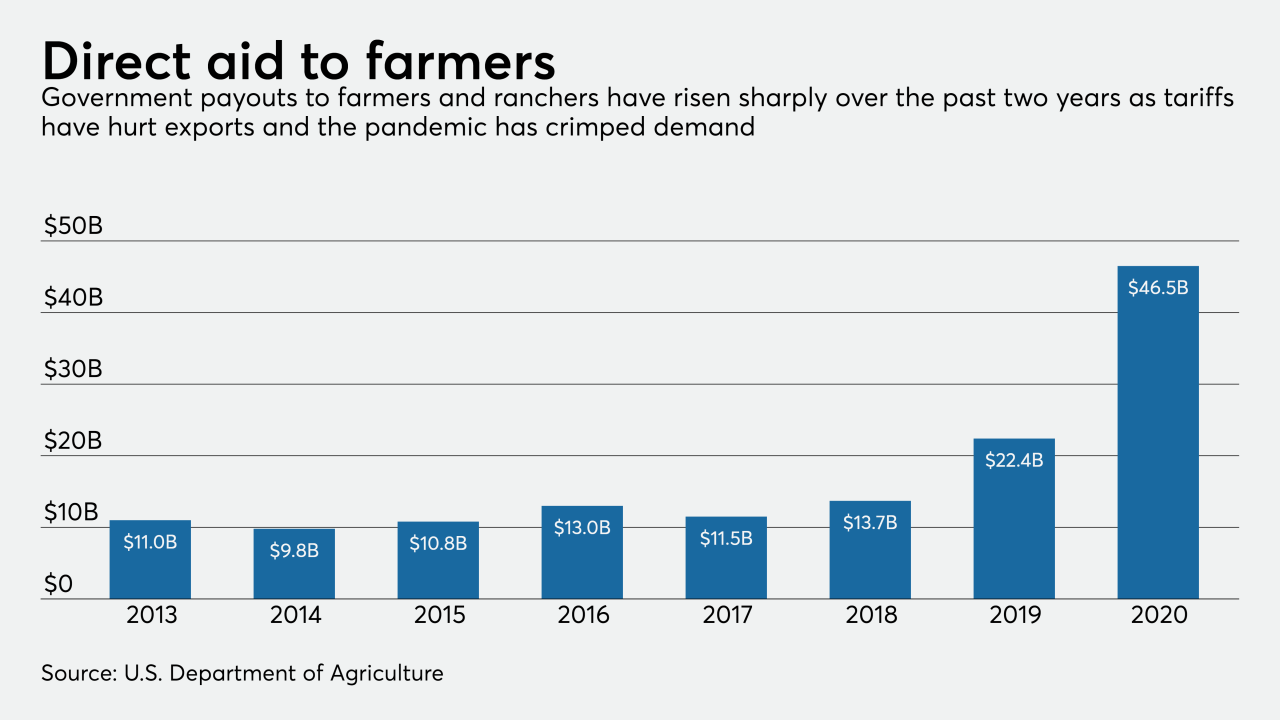

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

The Georgia lender has hired bankers away from Wells Fargo to build a new ag lending team that will look to capitalize on soaring lumber demand in its home state.

December 2 -

The global pandemic and stalled trade negotiations have discouraged farmers and ranchers from taking on more debt and made banks uneasy about extending more credit.

August 4 -

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

May 19 -

The payments landscape for U.K. farmers has long been fraught with inefficiencies at the best of times, particularly when it comes to the government’s processing of financial support payments. Now, with coronavirus wreaking havoc with administrative departments, farmers across the land are bearing the brunt of the crisis.

April 24 -

The pandemic could lead to a sharp rise in defaults and loan requests from farmers who have struggled with low prices and the impact of trade wars.

April 3 -

Lawmakers have also criticized the agency's decision to create qualifying standards for farmers and other small businesses.

February 20 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12