-

CUs in both states surpassed total asset milestones, but many business lines are growing at a slower pace than they were one year ago.

July 11 -

Membership continues to rise across the Wolverine State, though at a slower pace, but lending overall is on the decline.

July 1 -

Dallas Fed chief says lower interest rates may require stricter rules to ward off riskier lending; after financial crisis, debt backed by HELOCs disappeared.

June 25 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

Toronto-Dominion Bank is seeking to win back customers with home-equity loans — even as concerns grow over elevated consumer debt amid a slowing Canadian economy.

January 29 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

Rising wages and savings rates resulted in a decline in past-due payments in the second quarter, the American Bankers Association said in its quarterly report on delinquency trends in consumer lending.

October 4 -

Credit unions in the Silver and Golden states saw strong increases in growth and deposits during the first quarter of 2018.

July 18 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

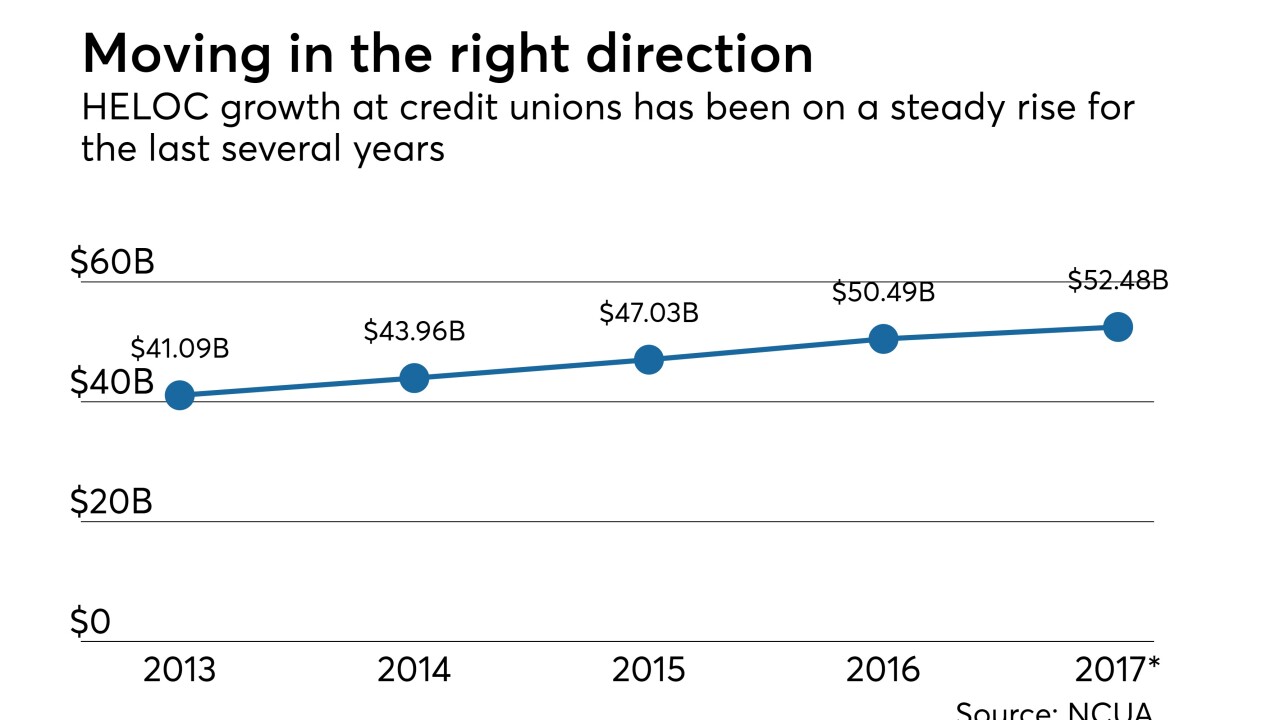

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but while some analysis shows they've been slow to borrow against this newfound wealth, credit union home equity lending was up significantly last year.

April 2 -

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing the risk for banks and credit unions.

January 2 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing banks’ risk.

December 26 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

One of the biggest challenges surrounding the ballot initiatives is voter turnout, which is often just 10 percent of registered voters in elections the year after a presidential contest.

October 27