-

The Federal Housing Finance Agency is expected to issue a proposal soon that would require Fannie Mae and Freddie Mac to purchase manufactured housing loans from lenders.

August 13 -

Homeownership is out of reach for too many Americans. The next president could change that with a few simple policies aimed at encouraging private capital to invest in residential mortgages.

August 13

-

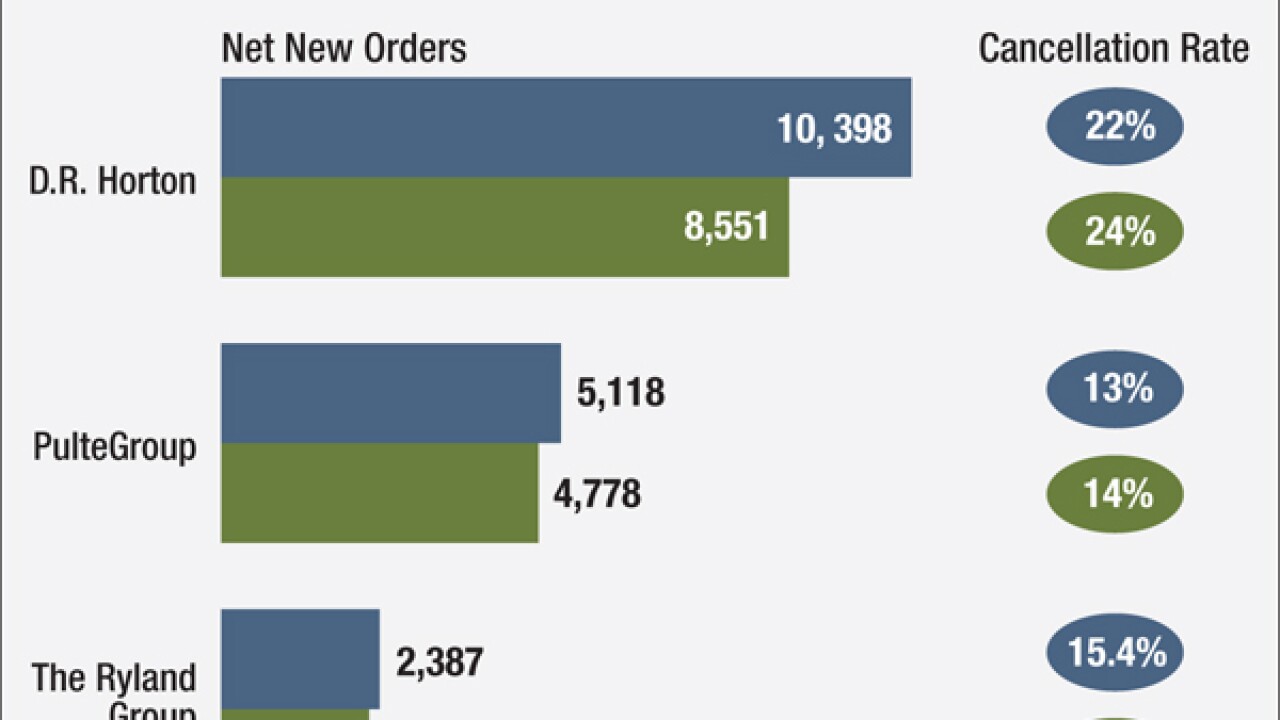

Consumers' growing confidence about their ability to qualify for a mortgage is generating more foot traffic, sales orders and loan volume for some of the nation's largest homebuilders.

August 12 -

Ocwen Financial's internal review group is "independent," and the Atlanta servicer is in compliance with the national mortgage settlement, settlement monitor Joseph A. Smith said Tuesday.

August 11 -

A federal judge has overturned a New York City law that would have required banks to make new disclosures regarding their investments in local communities.

August 10 -

The New York Bankers Association is challenging the legality of a local law that is designed to cajole banks into making larger investments in poorer communities. The outcome could be an important precedent in relation to similar laws in other cities.

August 6 -

Despite being introduced to the market with great fanfare, Fannie Mae's 3% down payment mortgage offering has yet to gain much traction with lenders and consumers.

August 6 -

M&T Bank said it's in discussions with U.S. officials to settle an investigation into the lender's origination and sale of federally insured home loans.

August 6 -

The Consumer Financial Protection Bureau has ramped up its push for the mortgage industry to switch to an electronic closing process after results from a pilot program showed consumers favored it over in-person mortgage closing.

August 5 -

Prospective borrowers for single-family homes will be required to make a minimum down payment of 15% of the purchase price, down from 20%. The borrower must have a minimum FICO score of 680, down from 740.

August 5 -

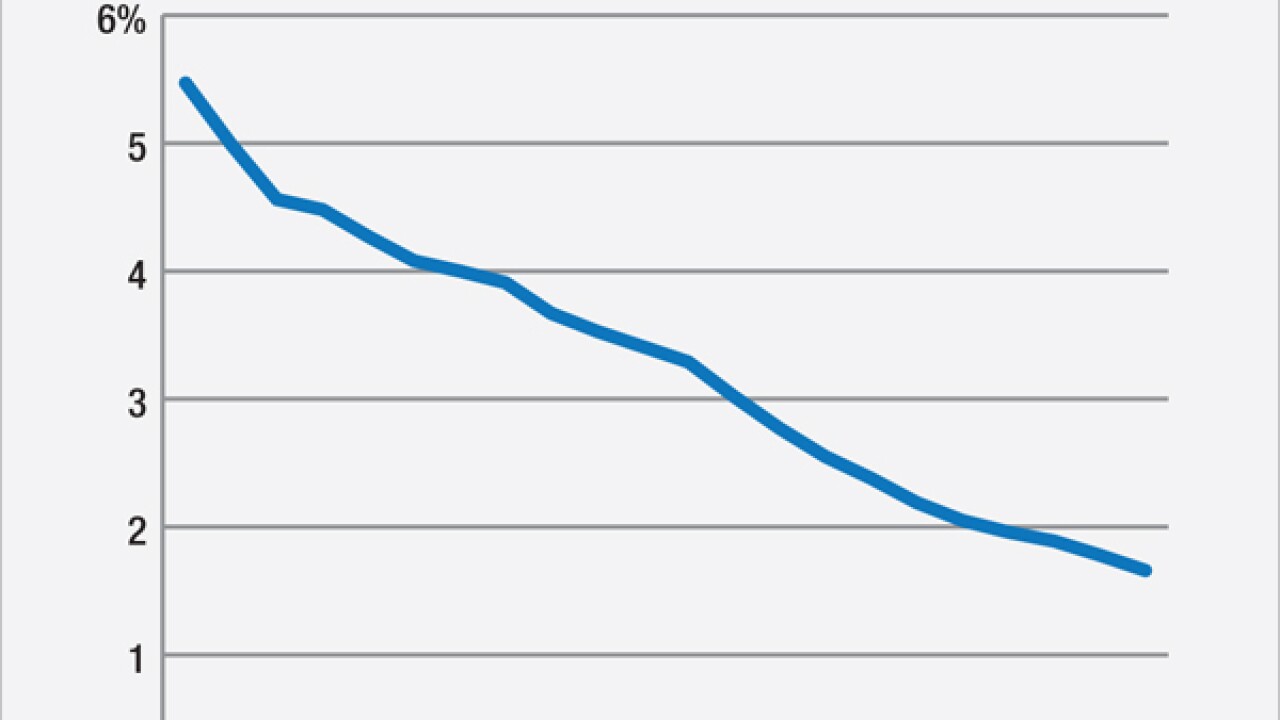

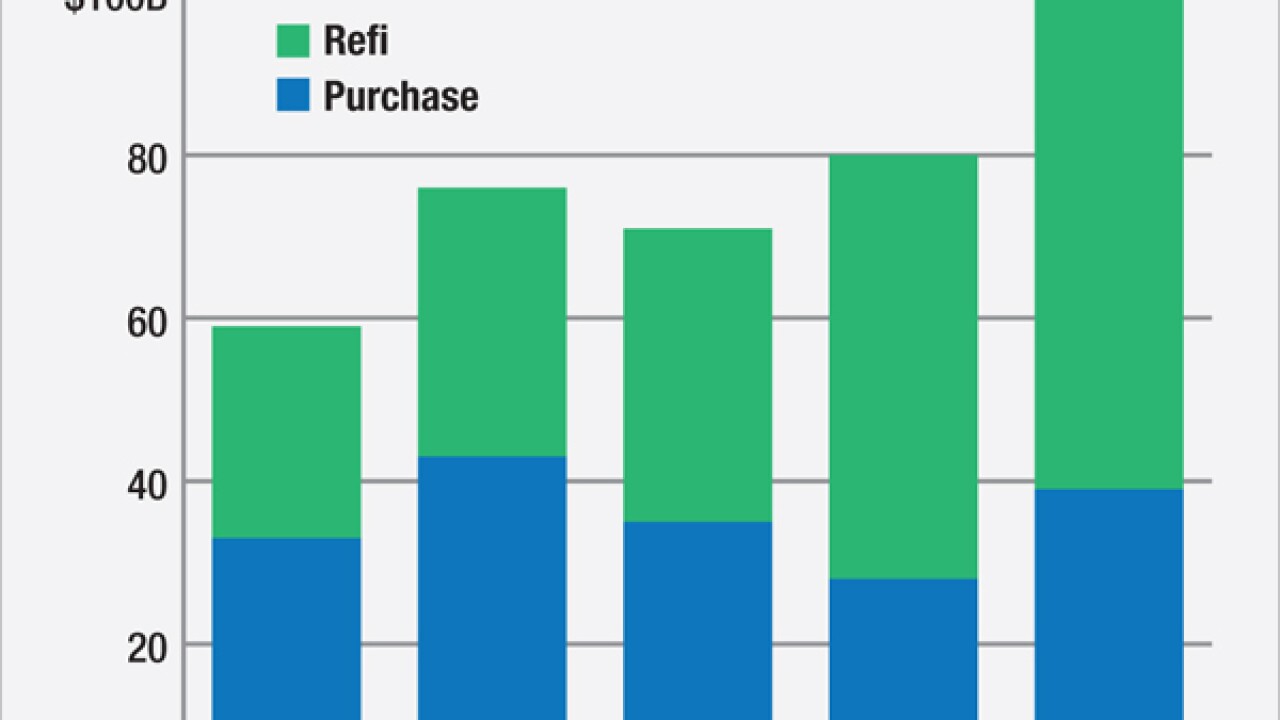

Freddie Mac's second-quarter single-family funding was the strongest it's been in a year, positioning the company to supplant the coming drop in refinancing with purchase mortgages.

August 4 -

Lawmakers included a measure that will impose new mortgage reporting requirements on banks and servicers as part of a short-term highway funding bill passed this week by both chambers of Congress.

July 31 -

Home Affordable Modification Program denial rates are still high, but the Treasury Department and top mortgage servicers contend that the numbers have improved.

July 30 -

The Federal Housing Administration is expected to rebuff a government watchdog report that blasted down payment assistance programs. The report has raised concerns that mortgage lenders would have to indemnify FHA for past loans, and that housing finance agencies would have the programs restructured.

July 30 -

Former Texas Gov. Rick Perry laid out a sweeping financial reform agenda on Wednesday, suggesting he would force the biggest banks to hold even more capital or reinstitute elements of the Glass-Steagall Act.

July 29 -

The Special Inspector General for the Troubled Asset Relief Program is renewing calls for further investigation of servicers it claims may be denying too many Home Affordable Modification Program applications.

July 29 -

The House Financial Services Committee tackled several key bills including ones targeting Operation Choke Point, executive compensation at Fannie Mae and Freddie Mac, small banks' exam cycle, and changes or delays to several actions by the Consumer Financial Protection Bureau.

July 28 -

The Mortgage Bankers Association on Wednesday said the housing market recovery has shifted to "a higher gear," and it raised its forecasts for total originations and home purchases for this year and 2016.

July 22 -

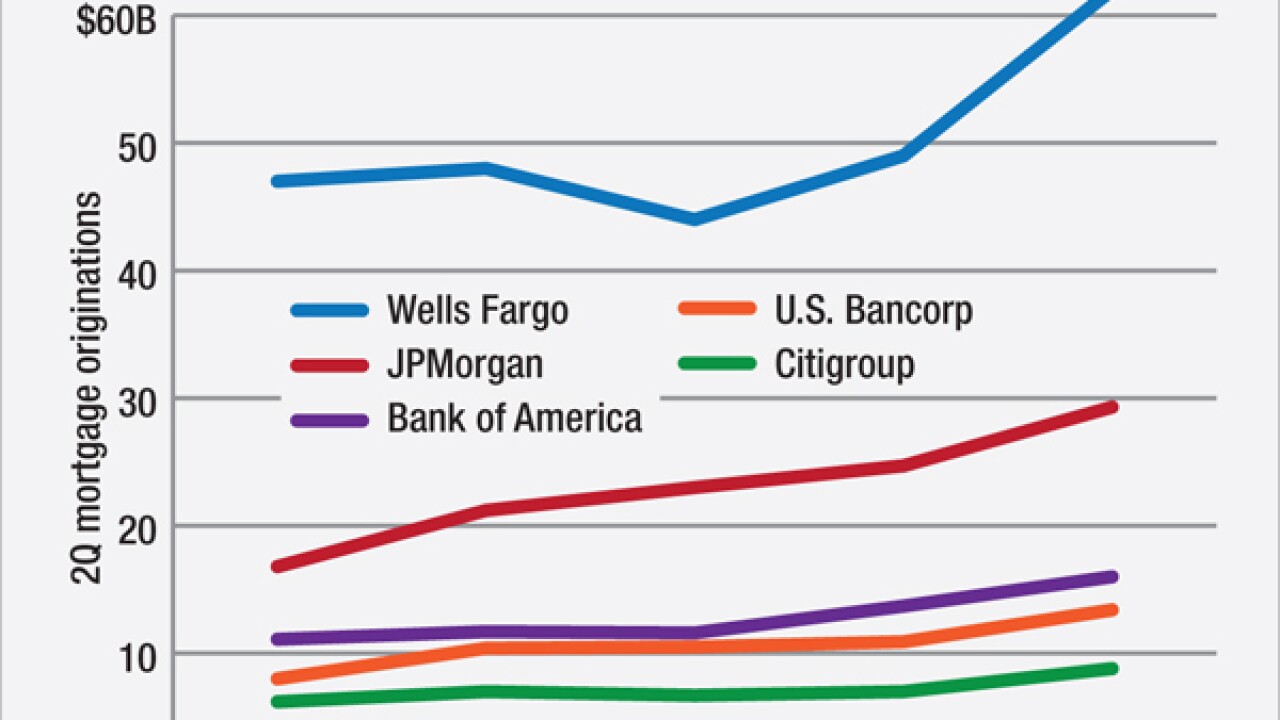

Bankers were pleased with the dramatic leap in home lending last quarter, but they cautioned that volume will slow in the second half as rate increases curb refinancings, nonbanks provide stiffer competition, servicing costs remain high and underwriting standards change.

July 22 -

Federal judges have dismissed two lawsuits that accused Wells Fargo of reverse-redlining in Los Angeles and Cook County, Ill., Reuters reported.

July 20