-

M&T, PNC, SunTrust and other regionals reported strong fee growth thanks to inroads they have made in investment banking, wealth management and other areas. It couldn't have come at a better time for them.

July 17 -

The combination of swelling deposits and weak loan growth continues to be a tough problem for regional banks. U.S. Bancorp's Richard Davis thinks higher loan growth is just around the corner to solve the problem, but PNC's Bill Demchak fears deposits could flee faster than lending will ramp up.

July 15 -

Wells Fargo executives received a host of questions Tuesday about the effect of rising interest rates on its deposits and other risk factors, but they said they cannot let uncertainty restrain their short-term actions and think some predictions about rates especially on Treasuries may be wrong.

July 14

Enjoy it while it lasts.

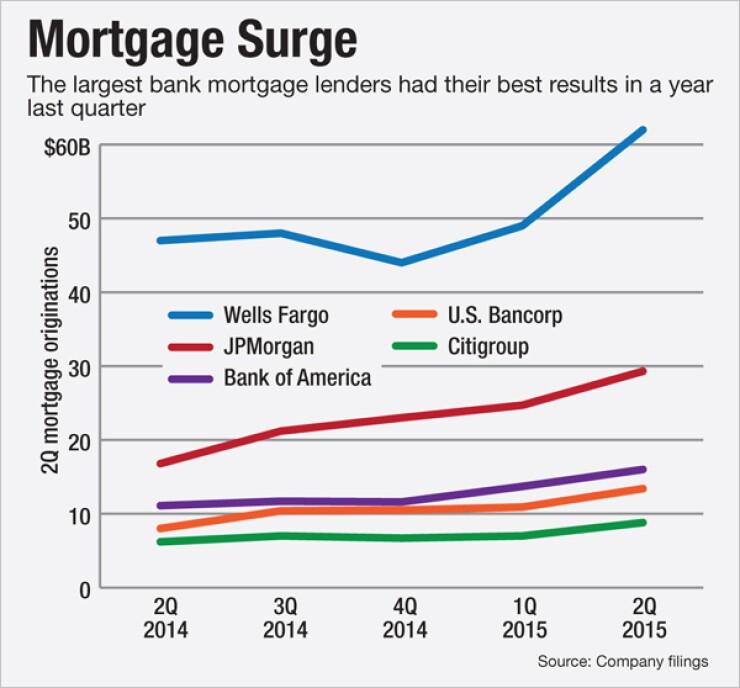

Home lending surged at most large and regional banks in the second quarter, with home purchases overtaking refinances as the housing rebound gained even more solid footing.

"The second quarter was a big quarter for everybody," said Simon Tahan, director of mortgage banking at the $23.6 billion-asset Webster Financial in Waterbury, Conn. "We're starting to see consumer confidence and the economy turning nicely, home construction is going up, income growth is coming and employment is good."

However, many bankers cautioned that lending volume will probably slow in the second half as interest rates rise and force refinancings to drop.

"As rates have moved up, and I look forward to [the third quarter], I would probably think about refi activity continuing to decline," SunTrust Banks' chief financial officer, Aleem Gillani, told analysts.Other challenges lie ahead, too, including heightening competition from nonbanks, heavier servicing costs and conflicting underwriting pressures.

Below are six key takeaways from banks' second-quarter results.

1) The high growth totals made it a quarter to remember.

All of the big banks saw double-digit increases in loan volume, thanks to new business and the fact that results a year ago were severely depressed.

Wells Fargo, the largest home lender and the industry's bellwether, said loan volume jumped 32% in the second quarter to $62 billion, compared with a year earlier. Originations rose

Among regional banks, lending volume rose

2) Yet refinancings fell and are expected to keep dropping.

Mortgage rates are still low by historic standards but have risen by nearly 40 basis points in the last two months, causing refinance applications to plummet 30%, according to the Mortgage Bankers Association.

The expectation is that refinance activity will continue to decline in the second half as rates rise. Home purchase applications grew steadily in the quarter but have not been that spectacular. Refinances rose to 51% of total mortgage applications for the week ended July 15, with mortgage rates unchanged at 4.2%, the MBA found.

Gain on sale margins, the best measure of banks' mortgage performance, took a hit from higher rates and, for some lenders, from higher costs for loans purchased from correspondent lenders. Gain on sale margins averaged 2% at large and regional banks, down from 3.5% in mid-2012, according to Brian Foran, a partner at Autonomous Research in New York.

3) Nonbanks are becoming an even bigger threat.

Nonbank mortgage lenders continue to steal market share across the board from banks with the exception of Wells Fargo, which gained 0.4% market share in retail originations, said Chris Gamiatoni, a partner at Autonomous.

Nonbanks' share of mortgage originations reached its highest point at 55.5% in the quarter, he said. Since late 2012, large banks' share of mortgage originations has been cut in half, while nonbanks' share has more than doubled.

"Nonbank lenders have become more aggressive, and they are back in the business because the opportunity is there," said Tahan at Webster Financial. "This year we saw a good number of nonbanks that have gotten back into the business and are starting to take market share from the bigger banks."

Independent mortgage lenders have been far more receptive to expand credit to borrowers particularly those with lower credit scores and the minimum 3.5% down payment required for Federal Housing Administration loans.

While large banks' share of FHA lending slipped to 25.67% in June, nonbanks' share of FHA-backed home purchase loans climbed to 66.2%, said Edward Pinto, a resident fellow and co-director of the International Center on Housing Risk at the American Enterprise Institute. In November 2012, those numbers were virtually the reverse 27.4% and 65.4%.

Pinto has tracked the shift in market share from banks to nonbanks. He found that six banks are no longer among the top 25 Federal Housing Administration lenders, while 10 nonbanks have jumped into the rankings.

Still, independent mortgage lenders have quietly built their home purchase business since the downturn, and many specialize in lending to first-time homebuyers, so it makes sense that they have gained market share. Independent mortgage bankers

4) Servicing costs are still high by historical standards.

Few chief executives were as vexed about mortgage servicing costs in the second quarter as Richard Davis of U.S. Bancorp, who told analysts last week that higher costs "inspire" the bank to stick with higher-quality customers.

"The cost of servicing is remarkably higher now than it ever was," Davis said. "There is no relief on that at all."

He went on to explain that if there is a customer with a credit score that shows some risk that the bank would have to give a loan modification, "I am probably not going to do it anymore because the cost of handling that customer in the modification period and phase is expensive, and it is rife with compliance risk and mistakes."

"When you start getting into that lesser quality customer," Davis continued, "the cost of servicing goes way up and we have been feeling that because we have been dealing with all these issues we've had to go back and remedy but we are not going to do it going forward."

Servicing costs have been rising for the past seven years and are now started to decline slightly. Overall servicing costs have fallen to $237 a loan this year after hitting a peak of $301 in 2014, according to the MBA. Servicing a defaulted loan cost an estimated $2,357 in 2014 compared with just $134 for a performing loan, according to the MBA and Stratmor Group.

5) Jumbo loans stayed on the rise, but their underwriting will get stricter because of new regulations.

Many banks including JPMorgan emphasized the increase in the second quarter in jumbo loans, which can range from $417,000 to $625,500 in high-cost areas. Jumbo lending is at an eight-year high and made up 14.7% of all home purchases in April, the most recent data available, according to CoreLogic.

"Jumbo continues to do quite well," said Sam Khater, the deputy chief economist at CoreLogic.

Khater discovered a noticeable drop in the share of jumbo loans to borrowers with high debt loads. The CFPB's ability-to-repay rule has a hard requirement that borrowers must have a debt-to-income ratio of 43% or less in order to qualify for a qualified, or safe, mortgage.

"Banks' willingness to make those loans has declined so the rule has led to its intended outcome, which is to limit the amount of indebtedness in the market," Khater said.

Webster Financial is a good example of a bank targeting the jumbo market with a specific strategy of lending to the so-called "mass affluent," borrower, Tahan said. The bank originated $540 million in mortgages in the second quarter, a 191% increase from a year earlier, and up 75% from the first quarter. Roughly 65% of its volume came from jumbo loans, he said.

"The reason why we look at jumbo is it's not just a mortgage business, it's a relationship," Tahan said. "Today we have over seven products and services with each mortgage transaction it's pretty close to Wells [Fargo]."

6) To sustain the momentum, banks may have to lower credit score and other standards on regular mortgages.

One unintended by-product of the low rate environment may be tighter lending standards, said Khater. When rates drop and lenders are inundated with refinance applications, they tend to focus on the low-hanging fruit, which happens to be the best borrowers with the highest credit scores, he said.

"Low rates may have contributed to the tight underwriting environment," Khater said.

As rates rise, lenders may actually loosen underwriting requirements, particularly credit scores, if volume drops too dramatically.

Finally, another unusual statistic: loans of less than $100,000 have hit a 15-year low, making up just 13% of all mortgage volume in April, CoreLogic found. Low balance loans are a particular challenge for lenders because they more easily bump up against the 3% cap on points and fees.