-

Donald Trump was sworn in Friday, but banking industry executives have spent the last two months envisioning a vastly different political, economic and regulatory climate. The dominant question in coming months will be how realistic those expectations are.

January 20 -

In a candid, in-depth exit interview, Ted Tozer discusses Ginnie Mae's growth during his seven years at the agency's helm, the need for comprehensive housing finance reform, big banks' retreat from mortgages, counterparty risk management and more.

January 18 -

Rising interest rates typically cause lenders to relax underwriting guidelines. The incoming administration promises to deregulate. Sounds like a combustible mix, but there's ample room to loosen credit without returning to the practices that caused the crisis.

January 18 -

And the next HUD chief might eventually rescind it altogether.

January 18 -

As president of the secondary marketing agency, Tozer has helped the mortgage market to continue functioning and keep up with changes following the financial crisis.

January 13 -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits.

January 12 -

HUD Secretary-designate Ben Carson is all but certain to get confirmed to his post—unless he makes a major mistake during his confirmation hearing.

January 11 -

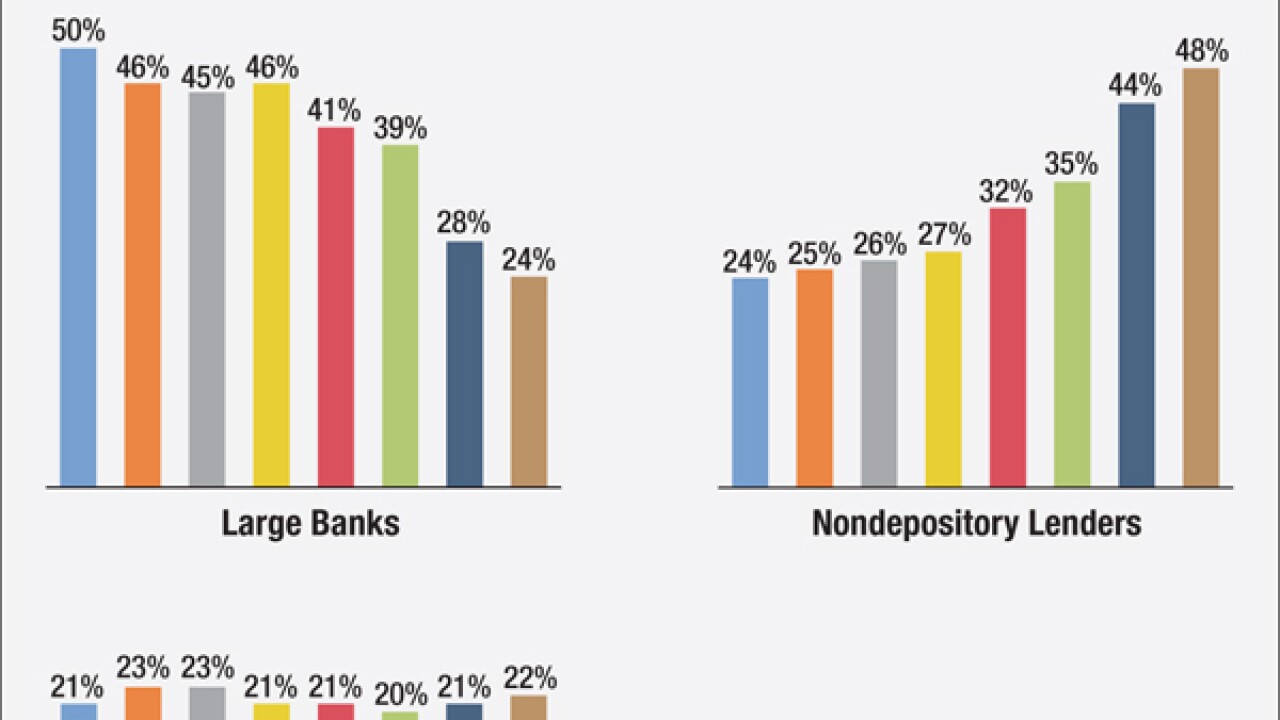

Nondepository lenders are beating their bank competitors when it comes to both digital innovation and market share in the mortgage industry. As interest rates rise, banks will need to move toward electronic closings and adopt other innovations if they want to stay competitive.

January 10

-

WASHINGTON The Senate Banking Committee is scheduled to hold a hearing Jan. 12 on the nomination of Dr. Ben Carson as secretary of the Department of Housing and Urban Development.

January 5 -

Loan modification activity has fallen dramatically at national banks over the past year, according to a report released Wednesday by the Office of the Comptroller of the Currency.

January 4 -

The Rural Housing Service is expanding its manufactured housing loan guarantee program to include more refinancings of used or existing manufactured homes.

December 30 -

WASHINGTON The Federal Housing Finance Agency is making it easier for Federal Home Loan banks to expand the kinds of collateral they can accept for advances.

December 29 -

The Department of Justice has agreed to a settlement with a pair of Cincinnati banks accused of redlining African-American neighborhoods in four cities in Ohio and Indiana.

December 28 -

It's unclear how the new political environment will affect the platform's viability or how investors will view the securities issued on it. The next year could determine the project's success and role reshaping the secondary mortgage market.

December 27 -

Congress wants to put federal flood program on sounder financial footing, encourage the development of private flood insurance market and stop the insanity of rebuilding properties subject to repetitive flooding.

December 23 -

The case against Fannie Mae and Freddie Mac is stronger than the argument for their survival.

December 23 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

Treasury sweep agreement set to deplete Fannie and Freddie's capital reserves by the end of 2017.

December 23 -

Andrew Jetter is stepping down as the chief executive of the Federal Home Loan Bank of Topeka after serving as the president and the CEO for 14 years.

December 21 -

Ginnie Mae has revised the wording of the acknowledgment agreements necessary to finance mortgage servicing rights. It sought to resolve a concern warehouse lenders had in the event issuers become troubled.

December 21 -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20