-

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9 -

The success of some fintechs in getting bank charters this year only underscores how onerous the process remains for many others. That’s unlikely to change unless policymakers reconsider what it means to be a bank.

November 18 -

The e-commerce leader’s return to the drawing board alleviates immediate concerns about its banking plans. But the company intends to reapply, and it will be harder for the industry to persuade policymakers to block industrial loan companies more broadly.

August 26 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

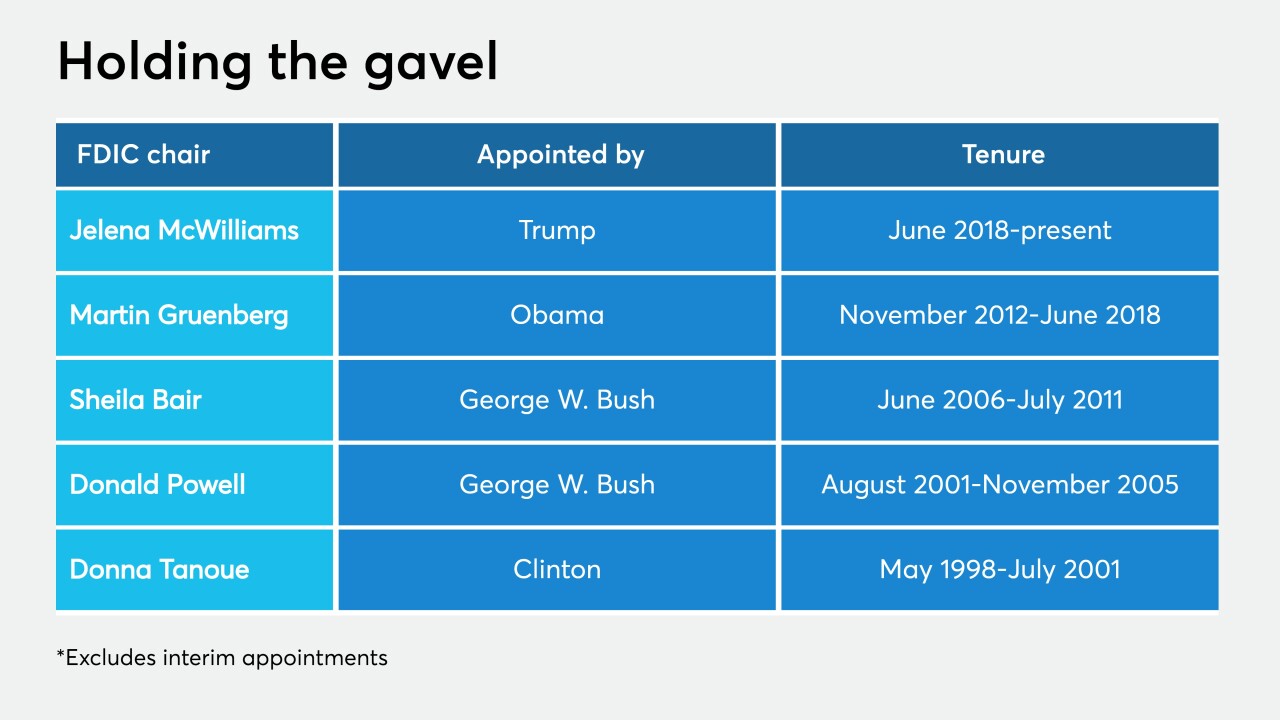

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

For too long, nonbanks have been allowed to form industrial loan companies to operate as banks without Fed oversight. This regulatory pass should not be given during a crisis.

July 31 Calvert Advisers LLC

Calvert Advisers LLC -

Two trade organizations and a consumer group urged lawmakers to establish a three-year moratorium to block the charter bids of companies that they said were attempting to skirt regulatory requirements.

July 29 -

New president of Promontory Interfinancial Network says recession will cause "hundreds" of nonbank disruptors to fail; lenders face dilemma over offering Main Street loans to noncustomers; PNC Financial expands, diversifies executive leadership team; and more from this week’s most-read stories.

July 11 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

Small banks have long led the campaign against industrial loan companies, arguing they can be used to violate the separation of banking and commerce. But now the industry’s heavyweights are also taking a hard line in response to an FDIC proposal that would give tech companies a smoother path into the lending business.

July 6 -

The investment firm is the latest nonbank to try to enter banking through a Utah-based ILC.

July 2 -

Three banking trade associations told the FDIC that Rakuten Bank America, even after revisions to its earlier application to the agency, would still violate the separation of banking and commerce as well as present consumer privacy concerns.

June 23 -

Recent steps that would help nonbank lenders enter the traditional banking system, like a proposal clarifying the industrial loan company charter, are needed but face strong opposition.

June 8 CCG Catalyst

CCG Catalyst -

Recent steps that would help nonbank lenders enter the traditional banking system, like a proposal clarifying the industrial loan company charter, are needed but face strong opposition.

June 3 CCG Catalyst

CCG Catalyst -

The Japanese e-commerce giant is taking another run at a U.S. banking charter after receiving feedback from the Federal Deposit Insurance Corp. about its initial application, which was withdrawn earlier this year.

May 29 -

The company's plan had drawn strong criticism from bankers about Rakuten's potentially controlling an industrial loan company while engaging in its nonfinancial businesses.

March 23 -

In signing off on deposit insurance for the payments giant and student loan servicer, the FDIC sanctioned the first new industrial loan companies in over a decade.

March 18 -

On the same day the Federal Deposit Insurance Corp. said it will soon rule on two applications, the agency also proposed benchmarks for all firms that want to own industrial loan companies.

March 17 -

GreatAmerica Financial in Iowa is looking to form a bank so it can offer more products to small and midsize companies.

March 12 -

A decision by regulators on how to move forward with the controversial charter could have broad implications for fintech firms that want to enter the banking system.

March 11