-

The comptroller of the currency will be replaced by his COO, Brian P. Brooks, on an acting basis; CEO James Gorman says the economy needs to be on steadier ground first.

May 22 -

British banks are confronting the European import of subzero interest rates that could damage profits already weakened by the coronavirus pandemic as the Brexit divorce rumbles toward its rocky end.

May 21 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13 -

A negative Federal Reserve policy rate is still improbable, but if it were to happen it could be a net benefit, according to a note from JPMorgan Chase.

May 13 -

The move is the first time the bank has provided services to digital currency players; the Washington Post and four other heavy hitters want details on PPP and small business disaster loan programs.

May 13 -

The group that worked with the Fed to devise an alternative rate to Libor rejects criticism that the index favors megabanks.

May 11 Alternative Reference Rates Committee

Alternative Reference Rates Committee -

Banks that relied on loan growth to outperform peers in 2019 will need to focus more on core deposits and expense control this year. Check out our annual ranking of the top 200 publicly traded community banks.

May 6 -

Some megabanks are pushing New York lawmakers to add a legal safe harbor if lenders use the new Secured Overnight Financing Rate. Smaller banks would have little choice but to take that option.

May 4 Signature Bank of New York

Signature Bank of New York -

Economists also expect the Fed's balance sheet to more than $10 trillion as policymakers look to lift the country from a recession brought on by the coronavirus pandemic.

April 24 -

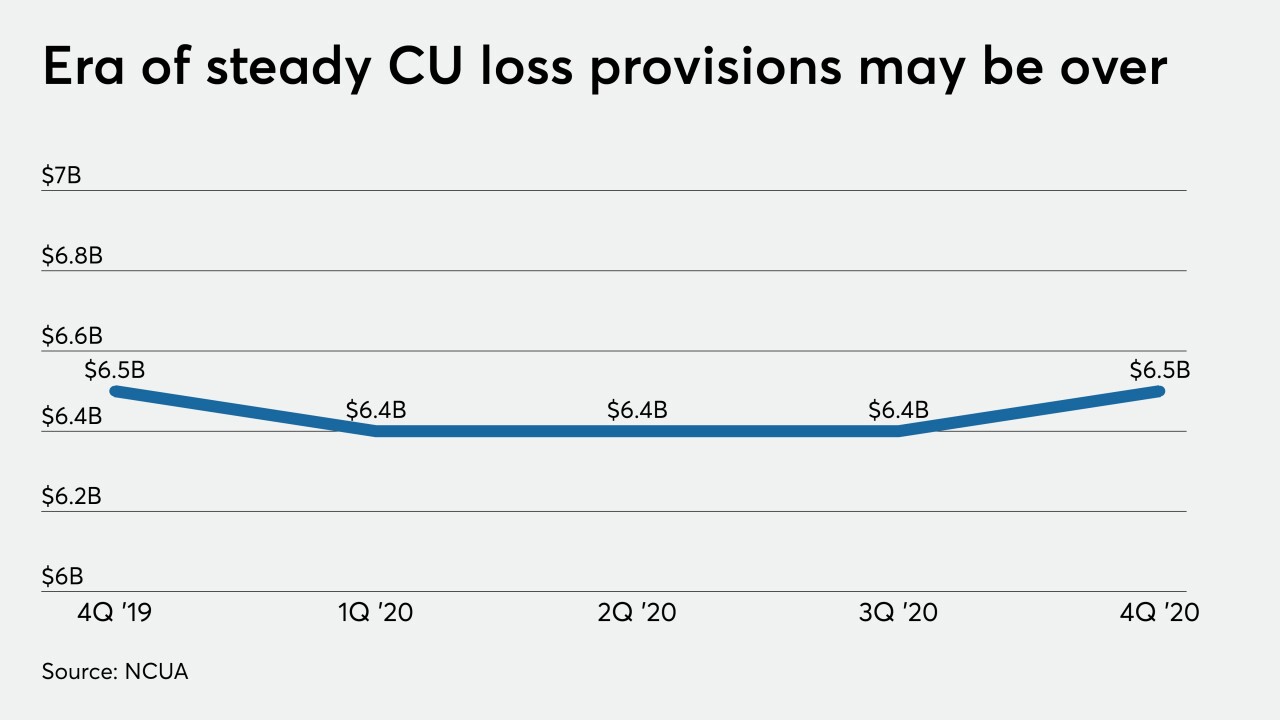

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20