-

Arrested four times for blocking the entrance to Citigroup, a veteran climate protester wonders why more rank-and-file bankers don't make common cause with activists trying to prevent the funding of fossil fuel development.

July 22

-

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21 -

A law that took effect this week allows Florida consumers to ask state regulators to investigate why a financial institution canceled an account or rejected a loan application. The law, which applies to federally chartered banks, could lead to a legal battle over the limits of state powers.

July 4 -

The U.S. 30-year yield reached the highest level in a month on Monday amid predictions that a Trump presidency would lead to higher inflation.

July 3 -

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

New York Department of Financial Services' guidance advising banks and insurers to avoid doing business with the NRA was ruled as likely to be unconstitutional by the Supreme Court. Why is it still on the department's website?

June 21 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

The Honolulu bank is raising $165 million through depositary shares, a move that two observers said would help boost its below-average leverage ratio.

June 20 -

A new debit card, a panel discussion and a concert are among the ways banks are commemorating the end of slavery in the U.S.

June 19 -

The best way for banks to alleviate the effects of extreme weather events is to continue to do what they do best — lend.

June 18

-

-

The company's shareholders are ill-served by its large investments in fossil fuel projects that both damage the environment and present major financial risks.

June 14

-

The Boston-based custody bank will place deposits at Carver State Bank, Citizens Trust Bank and Ponce Bank as part of its broader effort to help reduce the wealth gap. State Street plans to place a total of $100 million of deposits at minority depository institutions this year.

June 11 -

WealthMeUp, an app that educates users on investing and other financial concepts, eventually wants to turn users' cash-back into investing dollars.

June 11 -

U.S. regulators need to do more to require banks to recognize the risks posed by climate change, and the damage that continuing to support fossil fuel extraction projects does to the environment.

June 7

-

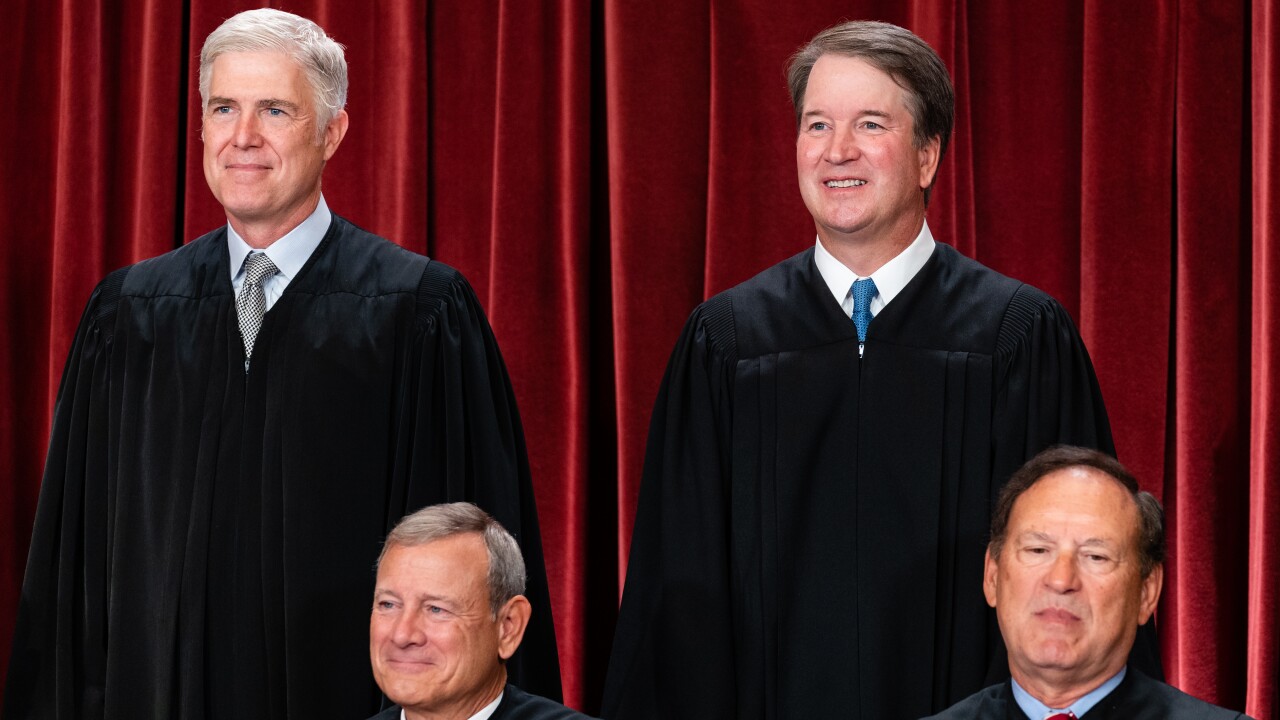

The National Rifle Association bagged a key victory in a case against a former top New York state official. The high court's ruling could make it harder for regulators to discourage financial institutions from doing business with specific industries.

June 3 -

Trading halts caused by an error affected 40 stocks Monday morning, including BMO Bank and Banco Santander-Chile.

June 3 -

The Securities and Exchange Commission, having already approved spot bitcoin ETFs, ought to follow through and grant the same approval to spot ethereum funds. Doing so would create a new surge of investment, with positive economic impacts.

May 16

-

Many banks got shares in the lucrative payments network when it went public in 2008. Some of them are now looking to sell in order to offset losses on their sales of underwater bonds.

May 9 -

A group of 24 institutional investors say a recent pledge by the British bank to restrict financing for companies that focus exclusively on fossil-fuel exploration and extraction doesn't go far enough.

May 9 -

A group of HSBC Holdings Plc investors wants the bank to set a funding target for renewable energy amid concerns its current green pledges are too vague.

May 3