-

The Silicon Valley partnership represents an extension of — but also a departure from — the consumer strategy that Goldman has been pursuing since the launch of its digital consumer bank, Marcus.

March 25 -

Prosecutors working for Special Counsel Robert Mueller raised the prospect that a $1 million loan to Paul Manafort in 2017 from an "opaque" Nevada company might have been a "sham transaction" in which no repayment was ever expected.

March 25 -

Agency concerned about the number of "risky" mortgages being approved; Brian Kelly, who runs The Points Guy website, can determine if a card succeeds or fails.

March 25 -

Banks and credit unions may be moving one step closer to federal legislation freeing them to serve legal pot businesses, but the path to enactment is still fraught with huge challenges.

March 24 -

The Democrats are asking the OCC and the CFPB to use their authority to remove Tim Sloan, who became CEO in 2016.

March 22 -

The bureau had already proposed removing the underwriting portion of the rule, but a judge in Texas has indefinitely delayed the other key component as well.

March 22 -

What the FIS-Worldpay deal means for banks; behind the OCC's public rebuke of Wells Fargo; ripple effect feared as Fed mulls lifetime bans for two bankers; and more from this week's most-read stories.

March 22 -

Alongside identity-document scanning and other ID verification, the two companies are offering real-time checks of lists of suspicious persons. The goal: keep money launderers out of the banking system.

March 22 -

Readers debate the odds of legislative reform to Fannie Mae and Freddie Mac, consider the growing problem of "friendly fraud," weigh ways to avoid reputation problems and more.

March 21 -

However, before we put all of our eggs in the blockchain basket, we need to examine whether the technology is ready to protect merchants from chargebacks and fraud, contends Suresh Dakshina, president of Chargeback Gurus.

March 21 Chargeback Gurus

Chargeback Gurus -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

Speaking at a press conference, Federal Reserve Chairman Jerome Powell said the bank’s risk management failures have required a dramatic overhaul of its processes.

March 20 -

With heightened scrutiny from regulators and the public for wrongdoing, financial institutions need to put more focus on preventing mistakes in the first place.

March 20 KYC Solutions Inc.

KYC Solutions Inc. -

Even as regulations are getting tougher, criminals are getting more sophisticated and creative, writes Ron Teicher, CEO of EverCompliant.

March 20 EverCompliant

EverCompliant -

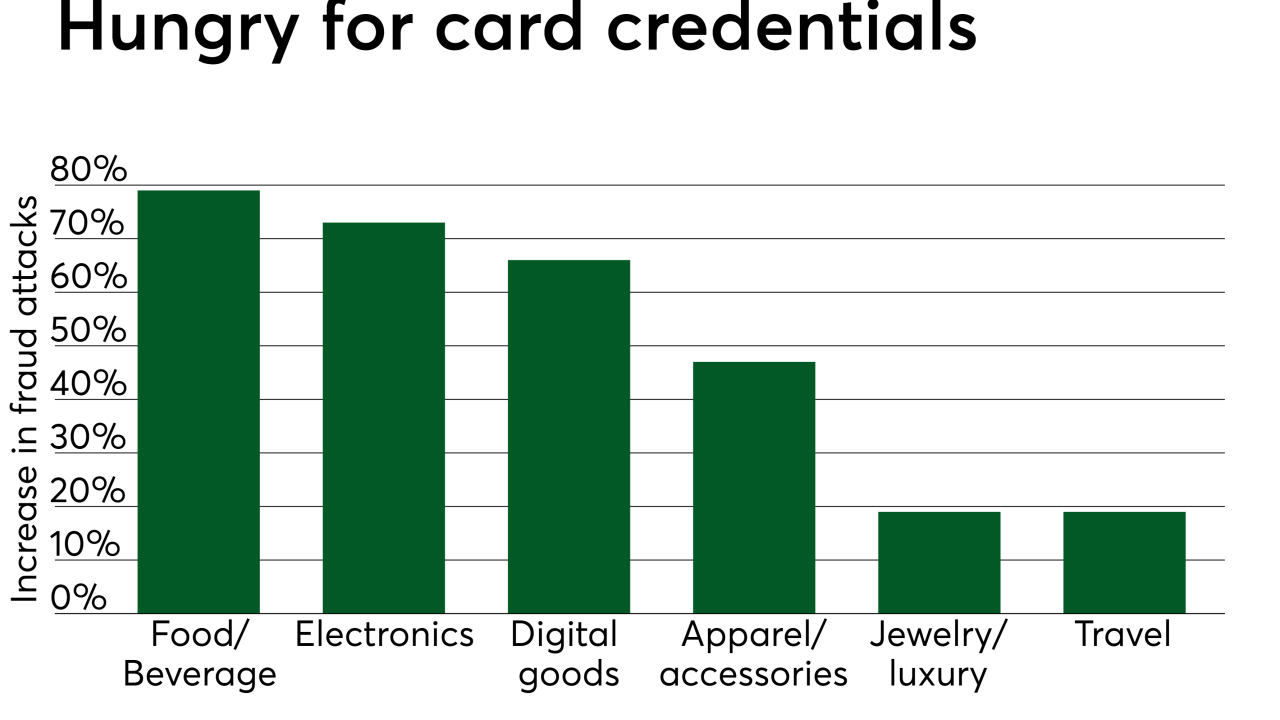

Fraud attacks against online food and beverage businesses in the U.S. increased by nearly 80 percent in the past year, as fraudsters have decided that dining establishments are the perfect places to test stolen card credentials.

March 20 -

The state's financial regulator says Fast Money Loan charged consumers interest rates and fees above the state's usury cap, and operated unlicensed storefronts.

March 19 -

Reports of improper charges by perpetrators who know the victim soared last year. Issuers and card networks are failing to tighten security, clearly label transactions and police chargebacks, critics say.

March 19 -

The online lending industry has turned to the courts, Congress and now federal banking agencies in an effort, thus far fruitless, to blunt the impact of a 2015 appeals court ruling.

March 18 -

A number of credit unions have faced lawsuits alleging their websites failed to meet the standards of the Americans with Disabilities Act.

March 18 -

Given the size of the deal — which includes about $9 billion of Worldpay’s debt on top of a $34 billion bid — the pressure’s on to build a global powerhouse that can counter other major fintech mergers announced in the past weeks. FIS must also emerge as a nimble rival to the startups that threaten the old order.

March 18