-

With little fanfare, President Trump officially nixed the rule prohibiting financial firms from including mandatory arbitration clauses.

November 1 -

As more startups turn to initial coin offerings to raise capital, financial institutions will seek reassurance that their blockchain and other fintech partners are aboveboard.

November 1 -

Eight leagues/associations now are part of class action response to massive hack, with two leagues – representing CUs in Nebraska, Arizona, Colorado and Wyoming – joining on Halloween.

November 1 -

Many standard procedures are possible as there are significant similarities in the information requirements across the globe, writes Zac Cohen, general manager for Trulioo.

November 1 Trulioo

Trulioo -

Political stalemates have convinced many executives that relief will only come when agency leaderships turn over.

October 31 -

Fraudsters deliberately target the holiday season, with more than half of annual fraud income taking place between September and December and chargeback rates increasing by up to 50% at peak shopping periods, writes Suresh Dakshina, president of Chargeback Gurus.

October 31 Chargeback Gurus

Chargeback Gurus -

American Banker reporter Kate Berry explains the Senate's vote on arbitration and what the CFPB might do next.

October 31 -

CFPB Director Richard Cordray sent a letter to President Trump Monday asking him to veto a Republican resolution to nullify the bureau's arbitration rule.

October 30 -

The OCC has terminated orders against three of Fulton's banks. The company and two other banks still have BSA-related orders.

October 30 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

President Trump is expected to announce his Fed chair nominee this week; three deals earned JPM's boss almost $100 million.

October 30 -

It's been a decent year for banks, especially given the industry's return on assets hit a 10-year high. But there are signs it might not last. With Halloween near, here is a look at some potentially frightening developments that could keep bankers up at night.

October 29 -

Investors Bancorp in Short Hills, N.J., chased deposits in the third quarter in a move that drove up interest expenses and lowered profits.

October 27 -

Barclays and the Justice Department, engaged in a legal battle over the suspected fraudulent sale of mortgage securities a decade ago, have revived discussions about reaching an out-of-court settlement, according to people with knowledge of the situation.

October 27 -

Small banks targeted a handful of GOP senators; bank may lose more than $450 million, mainly due to its Puerto Rico auto finance unit.

October 27 -

The stunning defeat of the Consumer Financial Protection Bureau's arbitration rule didn't have to happen, according to critics and former agency officials.

October 26 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 26 -

Readers weigh in on Amazon as a bank threat, claims that big banks are poor fintech partners, whether there are too many banks in the U.S. and more.

October 26 -

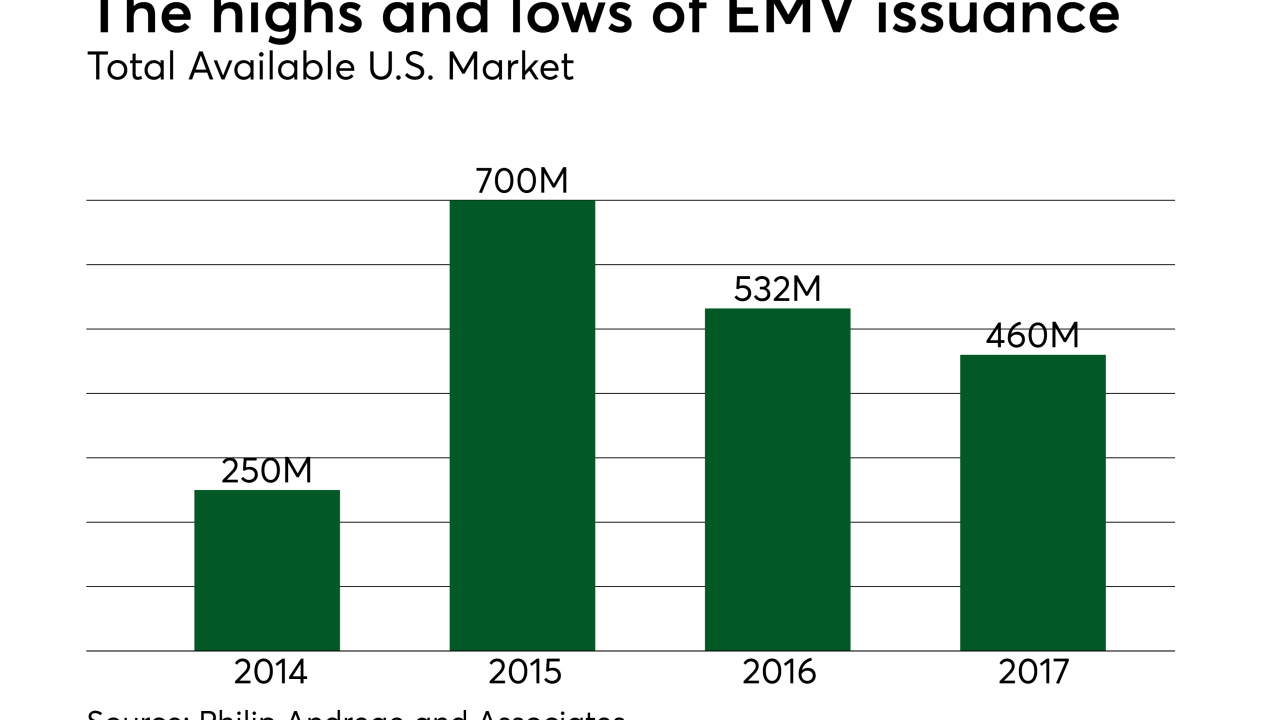

Now two years on from the U.S. EMV liability shift, chip cards are commonplace in American wallets. But the benefits of EMV cards — a longer five-year lifespan and a reduced need to reissue in the event of fraud — have muted the demand for new cards.

October 26 -

German bank says the $220 million settlement closes the book on its Libor-related misdeeds; reopening mandatory arbitration could backfire on banks.

October 26