-

Nonbank lender HomeBridge Financial Services has lifted the curtain on a new mortgage platform aimed at community banks and credit unions.

June 23 -

After publishing 1,888 pages detailing new mortgage disclosures, the Consumer Financial Protection Bureau's failure to file a required two-page form with Congress on time forced a delay of the rules' effective date.

June 19 -

In what would be the first comprehensive rewrite of its member business lending regulation since 2003, the NCUA Board unanimously approved a proposed series of changes that would make it markedly easier for CUs to lend to businesses.

June 18 -

After months of refusing industry and legislative calls to delay combining the requirements of two mortgage disclosure laws, the Consumer Financial Protection Bureau announced a two-month delay.

June 18 -

Six banks including JPMorgan Chase and Wells Fargo have been placed under further business restrictions after the Office of the Comptroller of the Currency determined they had yet to fully meet regulatory orders related to the independent foreclosure review which began in 2011.

June 17 -

Department of Housing and Urban Development Secretary Julian Castro touted the Federal Housing Administration's recent improvement on Thursday, saying it was on a trajectory to hit its statutory capital minimum and had recently seen a "significant uptick in refinancings."

June 12 -

The $65 million-asset ADP Federal Credit Union in Roseland, N.J., and the $28 million-asset Members Credit Union in Cos Cob, Conn., both have implemented the GrooveCar Direct product.

June 11 -

The Spanish-language TV channel Univision has launched a new online small-business lending platform.

June 11 -

More than a dozen housing groups joined with the credit union trade association to urge lawmakers to pass legislation that would grant lenders a formal grace period for implementing new disclosure forms later this summer, arguing that the industry needs greater certainty than the Consumer Financial Protection Bureau has so far provided.

June 10 -

Nearly a year after they first announced their intention to combine, the Home Loan Banks of Des Moines and Seattle completed last week the first voluntary merger in the system's history.

June 10 -

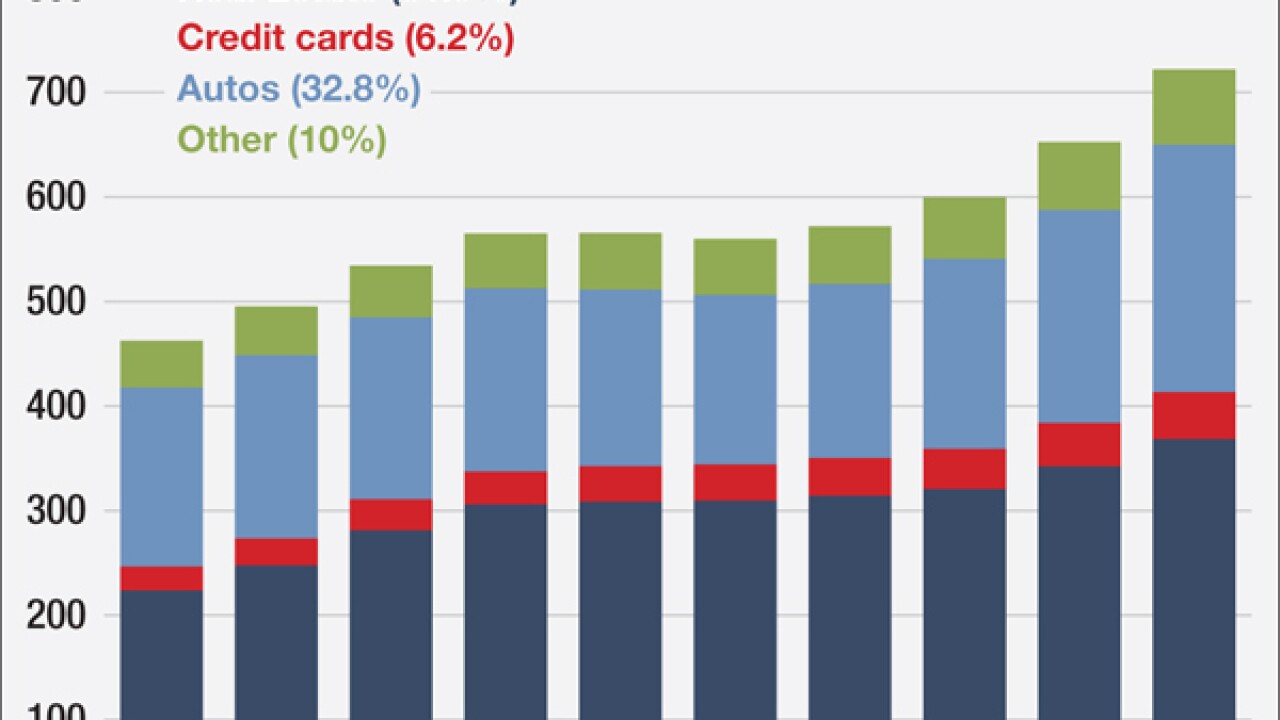

Demand for automobile loans has soared to new levels, Equifax said in a Thursday report. Meanwhile, delinquencies of 60 days or more have hit their lowest point in nearly a decade.

June 5 -

ElecTel Cooperative FCU here celebrated National Donut Day Friday with a "Hot Loans Now" promotion for personal loans that pulled in more than $560,000. Rates started at 1.99% for one year, 2.99% for two years and 3.99% for three years, and the credit union did not put a cap on how much members are eligible for.

June 5 -

The Nevada Credit Union League said it helped support and defeat several bills in the Nevada legislature that would have affected credit unions in the Silver State.

June 5 -

WASHINGTON Rep. Edward Royce, R-Calif., a long-time friend to credit unions, urged fellow House members Wednesday to support a Senate proposal that would make significant reforms to Fannie Mae and Freddie Mac.

June 4 -

The rate of small business loan approvals have remained largely stagnant and at historically low rates over the past year at credit unions, while such rates have been gradually edging upwards at the big banks, according to the Biz2Credit Small Business Lending Index, a monthly analysis by Biz2Credit.

June 4 -

It's no grace period, but the Consumer Financial Protection Bureau is working placate lender fears of hasty enforcement of its new integrated disclosure rules.

June 3 -

ALEXANDRIA, Va. Credit union income sources shifted from investments back to loans during Q1, according to a new report from NCUA, with loans up by nearly 11% year-over-year.

June 2 -

VENTURA, Calif. Ventura County Credit Union announced that it has been named a "preferred lender" by the U.S. Small Business Administration (SBA).

June 2 -

WASHINGTON The Supreme Court issued a ruling Monday that said second mortgage liens cannot be voided in bankruptcy, even when the first lien is underwater.

June 2 -

The merger of the Federal Home Loan Banks in Des Moines and Seattle became official on Monday, shrinking the overall number of banks in the system to 11.

June 1