-

Upgrade, a lending startup that counts former LendingClub executive Renaud Laplanche as a co-founder, raised $105 million in a funding round that values the company at more than $3.3 billion.

August 11 -

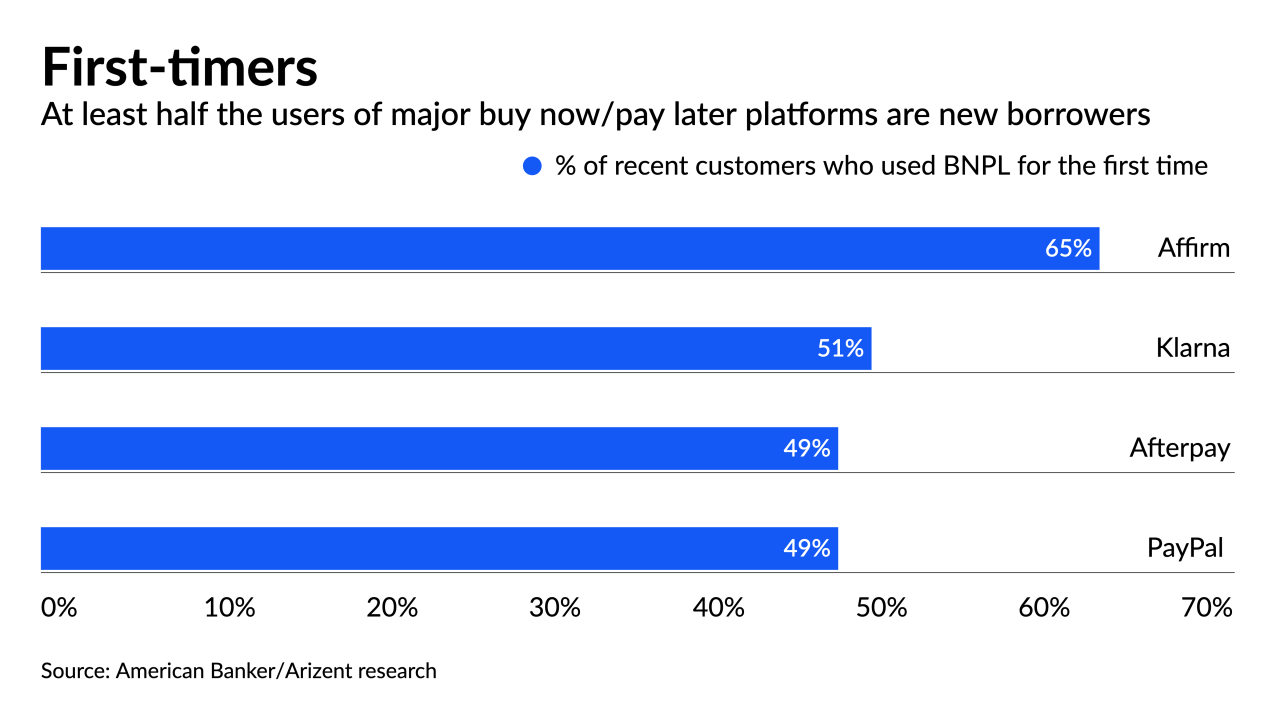

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9 -

Apple and Affirm's PayBright are planning to launch a buy now/pay later program for Apple device purchases in Canada, stepping up the iPhone maker’s ambitions to offer more financial services.

August 4 -

The $29 billion purchase of the Australian installment lender would bring larger retail relationships, as well as a fast-growing product that has appeal to both consumers and merchants.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Wintrust has developed a specialty financing insurance premium payments for companies and individuals while PacWest and Signature Bank are meeting strong demand for loans to venture funds that invest in technology firms.

July 27 -

On Mar. 31, 2021. Dollars in thousands.

July 26 -

The European Union’s planned Green Asset Ratio, intended to reveal how much a bank lends to climate-friendly companies and projects, will offer a distorted picture of reality, according to a Bloomberg survey of some 20 major European banks.

July 20 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

The tech giant is entering a heavily competitive market led by large companies like PayPal and hot startups like Affirm and Afterpay.

July 16 -

Blend Labs, a lending platform for financial companies, raised $360 million in an initial public offering price at the top of a marketed range.

July 16 -

Wells Fargo’s average loans tumbled in the second quarter as consumers and businesses, buoyed by pandemic stimulus programs, refrained from more borrowing.

July 14 -

Apple Inc. is working on a new service that will let consumers pay for any Apple Pay purchase in installments over time, rivaling the buy now/pay later offerings popularized by services from Affirm Holdings Inc. and PayPal Holdings Inc.

July 13 -

The Fed’s decision to extend a key liquidity program keeps the prospect of additional Paycheck Protection Program loans alive through July 31.

July 1 -

Banks such as Santa Cruz County Bank are now trading shares over the counter to capitalize on investors' bullish outlook for small lenders.

July 1 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Unchained Capital, a Bitcoin-based custody-service provider and lender, has raised $25 million in funding, valuing the company at $125 million.

June 4 -

Bank of Montreal’s fiscal second-quarter earnings beat estimates as the waning COVID-19 crisis allowed the lender to set aside less for souring loans and gave a lift to the company’s personal and commercial banking businesses.

May 26 -

The private-label card issuer says that, as merchants reopen, now is the time to realize the benefits of its 2020 acquisition of the buy now/pay later company Bread.

May 26