-

Businesses trying to meet a surge in demand for consumer goods are knocking on community banks' doors to finance expansions.

October 25 -

New enlistees typically lack credit histories, so the $1.2 billion-asset lender is using other transaction data to underwrite loans. It's a common practice among large banks and fintechs but rare for a community bank.

October 18 -

Using data aggregation subsidiary Finicity, the card network will allow its bank and credit union partners to offer installment loans directly to consumers, who can repay from checking and savings accounts.

September 28 -

Google has tied up with an Indian small lender to offer time deposits to users of its payments wallet, extending its presence in the nation’s lucrative digital banking space.

September 1 -

The partnership pits the buy now/pay later company against the e-commerce company's issuer partners, JPMorgan Chase and Synchrony Financial, and adds to the fintech's allure as an alternative to payment cards.

August 31 -

As more banks and fintechs offer installment loans at the point of sale, CO-OP Financial Services and PSCU are designing products to allow credit unions to compete in this market as well.

August 30 -

Shareholders in the troubled Mexican nonbank lender Credito Real will vote on proposals to sell the company’s U.S. operations at a meeting on Sept. 10.

August 27 -

The Canadian economy’s comeback in recent months, even as COVID-19 lingers, fueled strong domestic lending results at the country’s banks during the third quarter.

August 26 -

The banks reported fiscal third-quarter results that topped analysts’ estimates on gains in domestic personal and business loans as well as continued strength in the Canadian housing market.

August 24 -

Year to date Mar. 31, 2021. Dollars in thousands.

August 16 -

Upgrade, a lending startup that counts former LendingClub executive Renaud Laplanche as a co-founder, raised $105 million in a funding round that values the company at more than $3.3 billion.

August 11 -

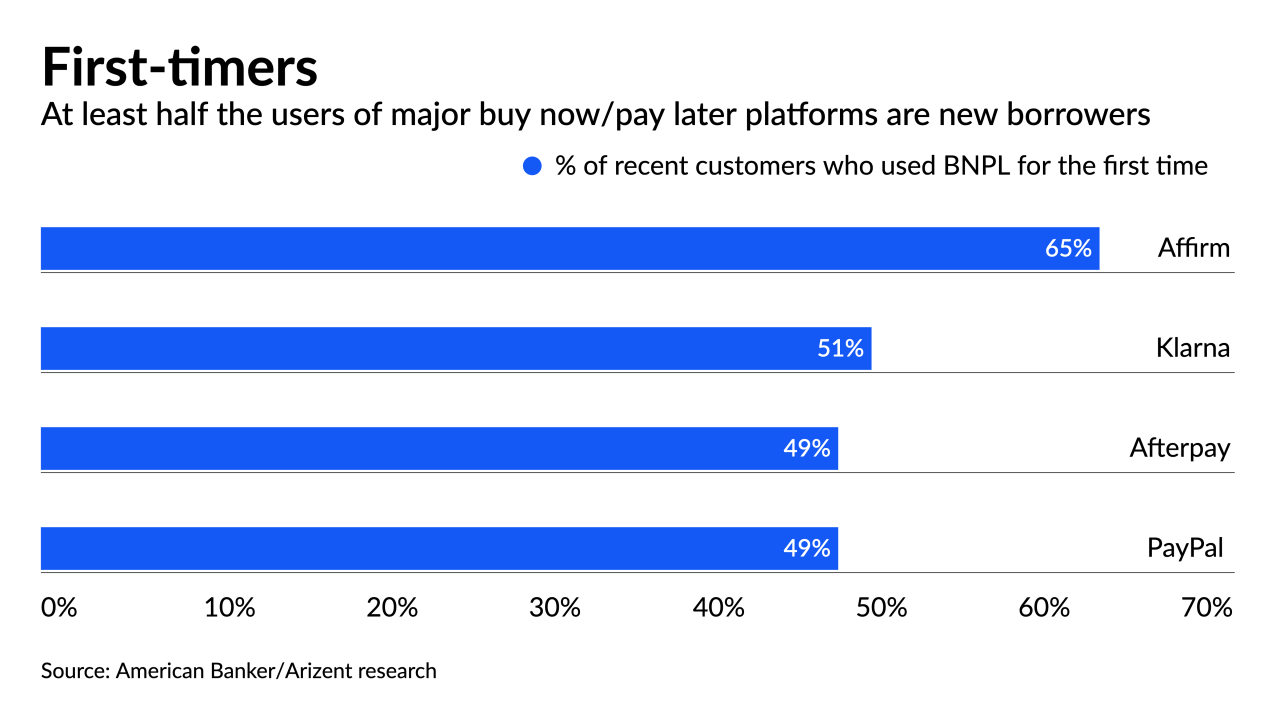

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9 -

Apple and Affirm's PayBright are planning to launch a buy now/pay later program for Apple device purchases in Canada, stepping up the iPhone maker’s ambitions to offer more financial services.

August 4 -

The $29 billion purchase of the Australian installment lender would bring larger retail relationships, as well as a fast-growing product that has appeal to both consumers and merchants.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Wintrust has developed a specialty financing insurance premium payments for companies and individuals while PacWest and Signature Bank are meeting strong demand for loans to venture funds that invest in technology firms.

July 27 -

On Mar. 31, 2021. Dollars in thousands.

July 26 -

The European Union’s planned Green Asset Ratio, intended to reveal how much a bank lends to climate-friendly companies and projects, will offer a distorted picture of reality, according to a Bloomberg survey of some 20 major European banks.

July 20 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

The tech giant is entering a heavily competitive market led by large companies like PayPal and hot startups like Affirm and Afterpay.

July 16