-

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

A big funding source for the Paycheck Protection Program is set to expire on March 31. Its demise would pinch nonbanks that are originating and buying loans, especially if Congress continues the PPP beyond this month.

March 5 -

Harris Simmons of Zions Bancorp. warned that excess deposits could suppress loan demand and pose an inflation threat, while Darren King of M&T tried to reassure investors that deposits will be less volatile than some fear once the economy improves.

February 11 -

Comerica, Citizens Financial and other companies are buying up securities, paying off high-cost borrowing and trying to develop specialty lending niches. But loan growth remains weak, and the likelihood of extreme volatility in deposits makes it hard to plan ahead.

January 29 -

Deposits are soaring while loan demand lags and mortgage-backed securities offer weak returns. So the Alabama company has parked loads of cash at the Fed in hopes the economy will pick up steam before profit margins suffer.

January 22 -

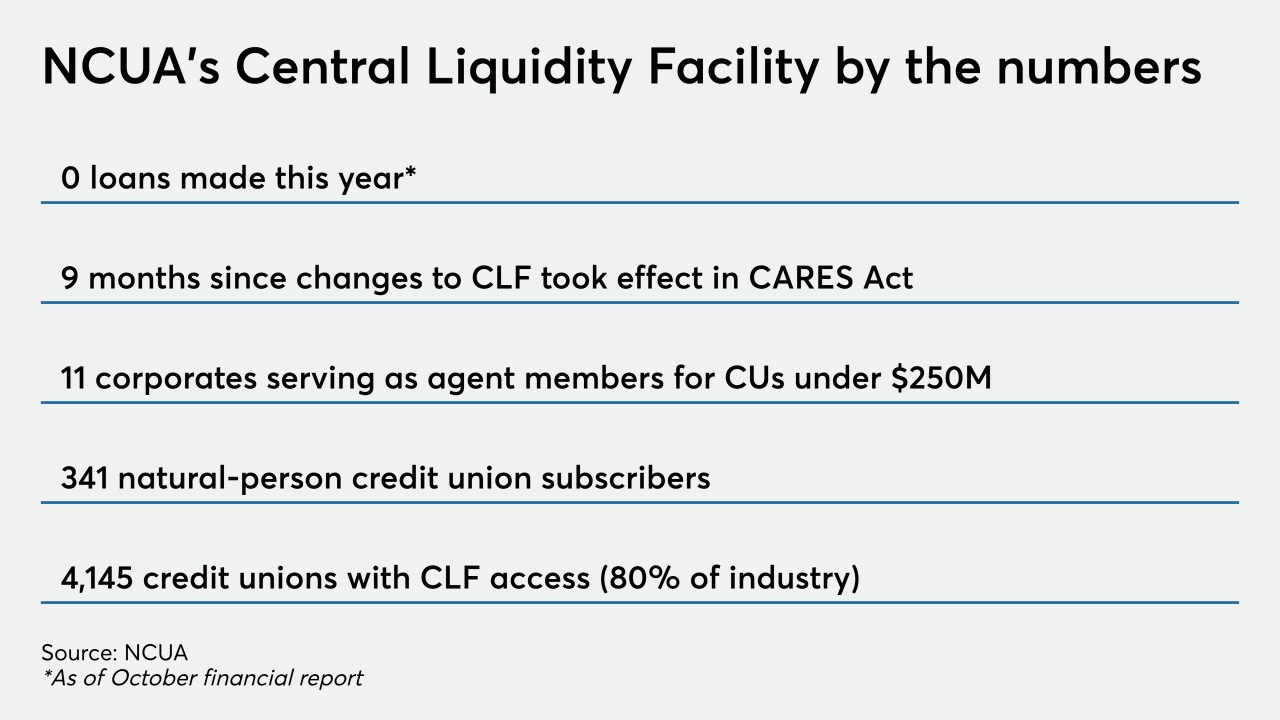

Provisions implemented under the CARES Act that made it easier for institutions to utilize NCUA's Central Liquidity Facility have been extended for a year with the signing of Consolidated Appropriations Act.

December 28 -

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

The move comes a day after the Federal Reserve had balked at the Treasury Department's demand that it return funds meant for pandemic relief that have so far gone unused.

November 20 -

Democrats called the decision by Treasury Secretary Steve Mnuchin "misguided," arguing that it's too soon to shutter the Federal Reserve's emergency-lending programs. Republicans say the programs have run their course and should expire a the end of the year.

November 20 -

Global regulators are preparing to tighten restrictions on companies believed to have threatened the financial system at the height of pandemic-fueled volatility.

November 17