-

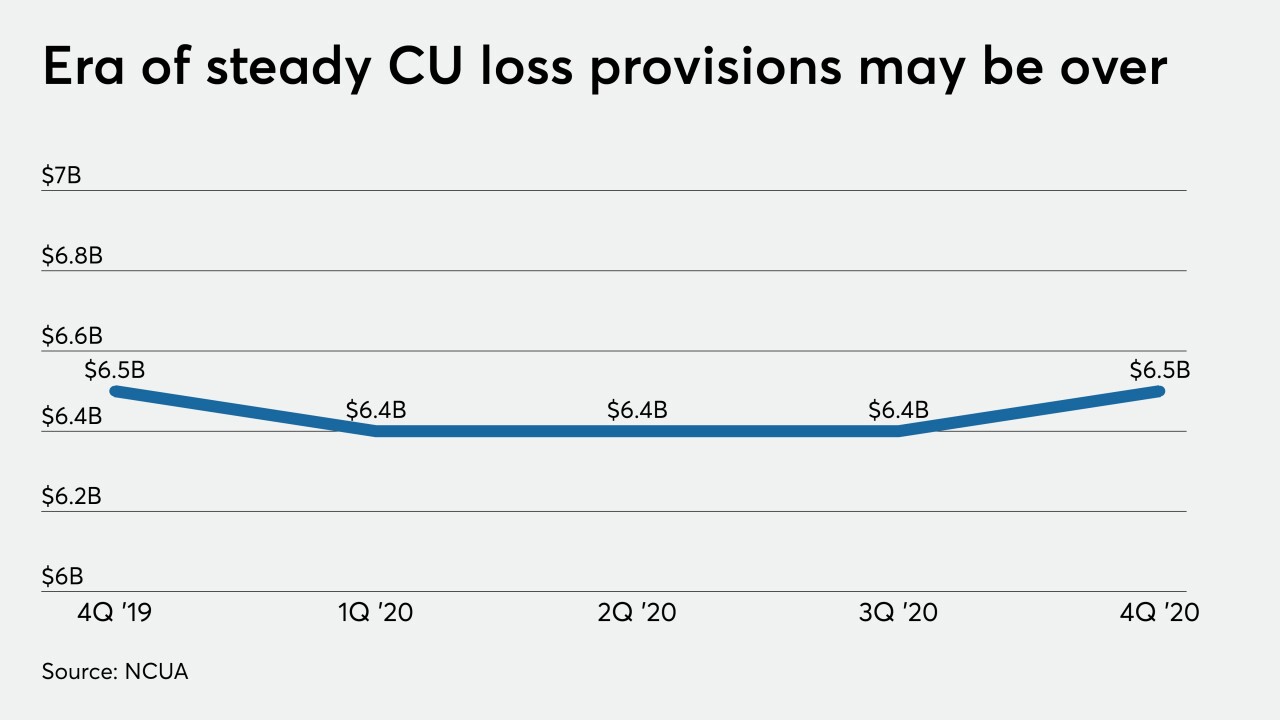

Lenders are throwing money at buyers with stable jobs while making it harder for weak borrowers to get loans; $50 billion in loss provisions may not be enough and could stifle lending.

May 4 -

The millions of dollars earned from Paycheck Protection Program transactions will help cover rising provision costs tied to the new CECL accounting standard and coronavirus shocks to loan books.

April 30 -

Rodney Hood, chairman of the National Credit Union Administration, told the Financial Accounting Standards Board that complying with the Current Expected Credit Losses standard could adversely impact the industry's net worth.

April 30 -

The two lenders are being more aggressive than other European banks in putting a price on the economic devastation caused by the coronavirus outbreak.

April 28 -

Banks would have drowned if lawmakers hadn't delayed the new accounting standard during the coronavirus pandemic.

April 24 -

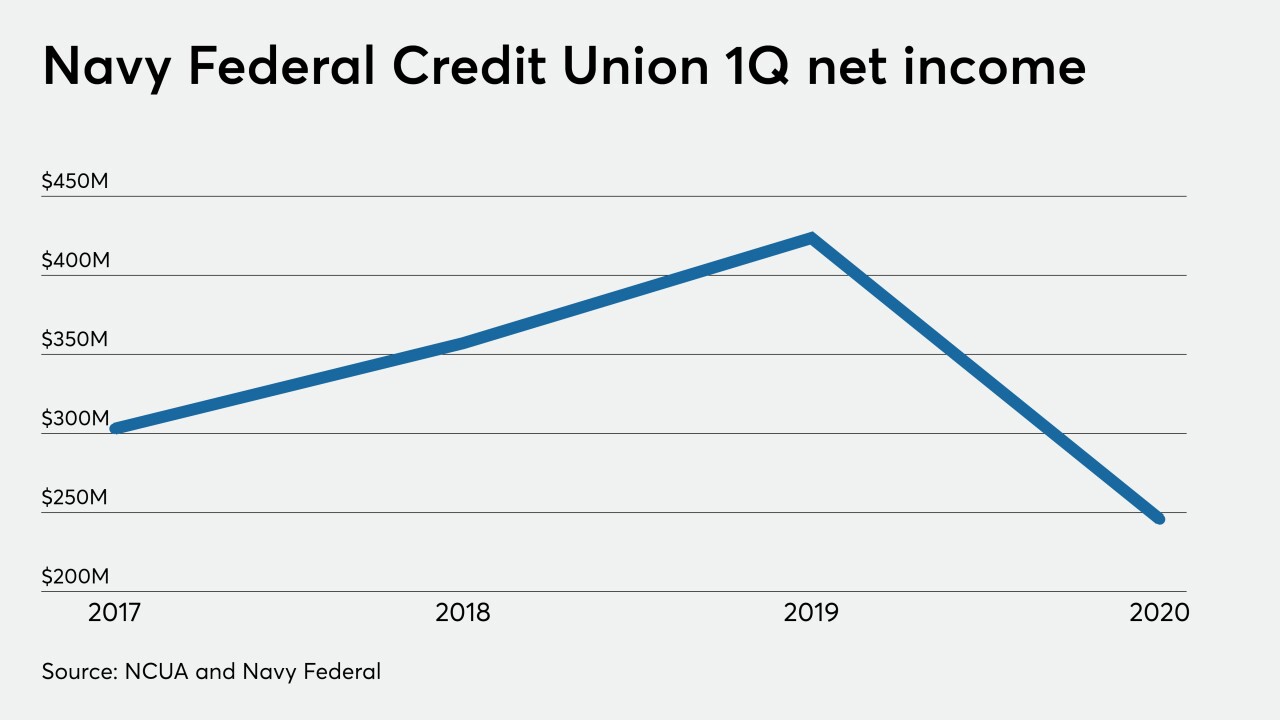

The largest credit union in the world increased its provision by 28% from a year earlier.

April 22 -

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

April 14 -

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

The country's top six banks were sideswiped by rising provisions for soured loans and slumping capital markets.

December 5