Navy Federal Credit Union in Vienna, Va., has released its first-quarter earnings, showing how deep the pain could be from the coronavirus for the industry.

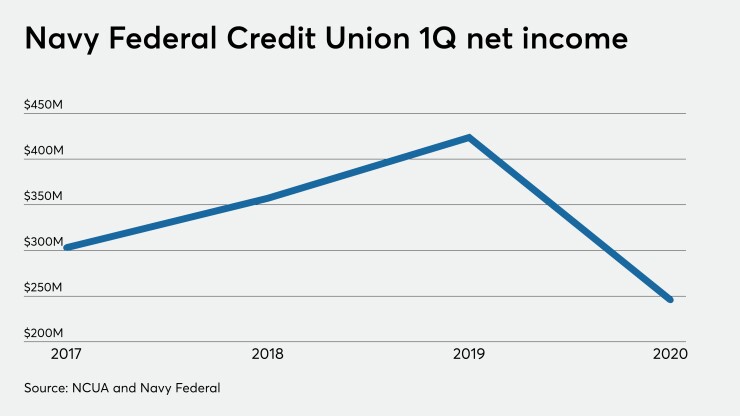

The $125.7 billion-asset institution said it earned $245.7 million during the first three months of 2020, down about 42% from a year earlier. The credit union posted its first-quarter earnings on its website, though its full call report is not yet available yet on the National Credit Union Administration website. Numbers from 2019 were pulled from NCUA call report data.

Publicly traded banks also have reported significantly lower income for the first quarter as they set aside more for provisions in anticipation of borrowers failing to repay loans. It’s expected that

The credit union did not include any commentary along with the results posted on its website.

Navy Federal’s total interest income was $1.6 billion, up about 11%, as total loans ticked up almost 15% to $86.2 billion. Its noninterest income increased by roughly 6% to $473.9 million.

Operating expenses totaled $886.3 million, up almost 11% from noninterest expenses reported in the first quarter of 2019.