M&A

M&A

-

The Pennsylvania company will pay $80 million for the parent of USNY Bank.

January 9 -

Clients will have an active role in testing new products and services at the regional giant formed by the merger of BB&T and SunTrust, says Chairman and CEO Kelly King.

January 7 -

The company, which has agreed to buy Marquis Bancorp, could use some of the proceeds to fund growth and pay off a line of credit.

January 7 -

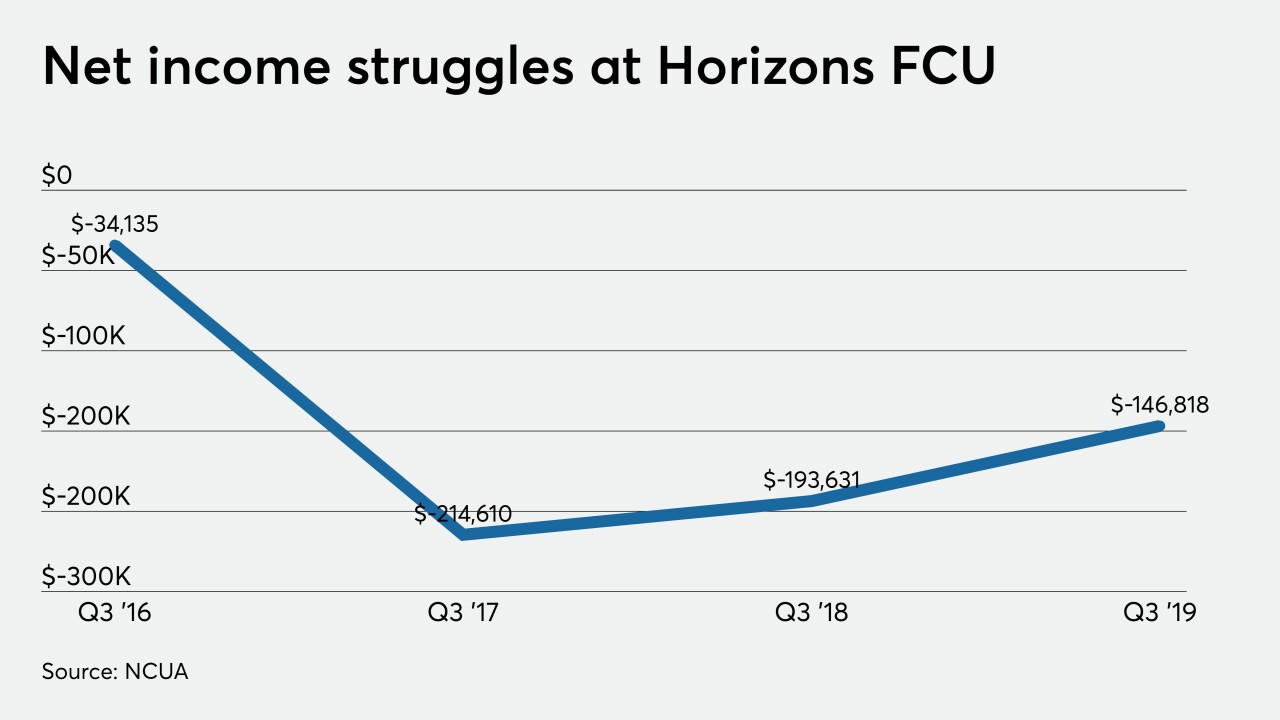

After struggling with profitability, Horizons FCU has been approved to join Premier Members Credit Union later this year.

January 7 -

The company will pay $29 million for a bank located northwest of Grand Rapids.

January 6 -

Some analysts warn the loosening of bank regulations may be hiding risks; watchdogs are demanding proof that financial institutions are ready for 2021.

January 6 -

Though there were several high-profile mergers of equals among bigger banks, deal activity rose only slightly, and the vast majority of transactions involved the smallest of institutions. Here's an overview of those trends and others that stood out in bank dealmaking last year.

January 5 -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

January 2 -

Steuben Trust received two bites from potential MOE partners, but the New York bank’s lightly traded stock and many other challenges forced a sale to a much larger rival instead.

January 2 -

The merger of BB&T and SunTrust, the largest bank deal in over a decade, dominated news throughout the year; New York investigated the wage access app Earnin, which critics claimed was actually a stealth payday lender; Libor is going dark in 2021, and some banks aren’t ready; and more from this year’s most-read stories.

December 31