-

Corporations have tapped more than $124 billion in lines in the past three weeks; rating agency says virus “could wipe out a full year of U.S. banking profits.”

March 26 -

Some banks have closed branches or restricted access and bank tech resources are being overwhelmed; bank pays a record SKr4 billion ($400 million) for issues.

March 20 -

Financial institutions’ legislative agenda was already a low priority in Congress. Lawmakers’ efforts to stabilize the economy have shifted attention even farther away from bills that would benefit the industry.

March 16 -

Bankers express confidence despite coronavirus concerns, while consumers ponder cash needs; U.K. will hold off unloading its 62% stake in bank.

March 12 -

The Treasury secretary’s recent Senate testimony coming down on cryptocurrencies is misguided. Regulations should require building better blockchain technology at the banks.

March 9 Polyient Labs

Polyient Labs -

The company said it expects to enter into the order with the FDIC and its state regulator later this month.

March 5 -

Banks make emergency preparations as HSBC deals with confirmed case; the changes simplify regulations without posing additional systemic risks, the Fed says.

March 5 -

The disease could lead to less lending business and more loan defaults; Sergio Ermotti will join the insurance company as chairman in 2021.

March 3 -

The Treasury secretary’s recent Senate testimony coming down on cryptocurrencies is misguided. Regulations should require building better blockchain technology at the banks.

March 2 Polyient Labs

Polyient Labs -

The Supreme Court will hear arguments on the agency’s structure; the company, desperate after losing Costco’s business, allegedly pressured and misled applicants.

March 2 -

To appease regulators, challenger banks looking to service crypto businesses can implement effective AML controls and systems, says Fenergo's Rachel Woolley.

February 14 Fenergo

Fenergo -

The three cease and desist orders and one written agreement had cited separate concerns at JPMorgan Chase, Discover, Deutsche Bank and RBS.

February 13 -

Tech sprints that bring regulators together with bank officials, data scientists and software companies originated in the U.K. and have crossed the pond into the U.S.

February 11 -

The payments company is working with nonprofit organizations, law enforcement authorities, victims and others to make it harder for the criminals behind the modern slave trade to move money.

February 6 -

The payments company is working with nonprofit organizations, law enforcement authorities, victims and others to make it harder for the criminals behind the modern slave trade to move money.

February 5 -

The U.S. banking system risks being left behind by the European Union and the United Kingdom when it comes to open banking.

February 3 Regions Bank

Regions Bank -

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

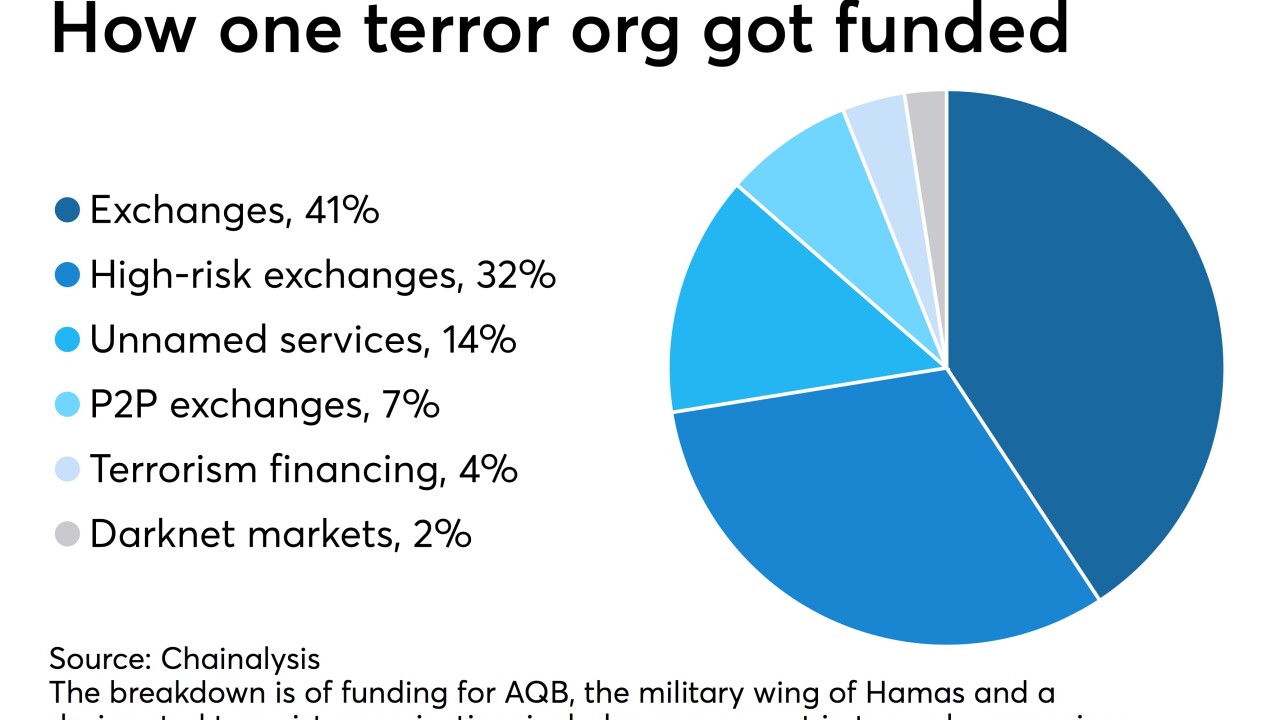

Terrorism financing schemes using cryptocurrencies are growing in sophistication, according to researcher Chainalysis, which helps law enforcement track digital-coin transactions.

January 17 -

Open banking and identity services are both still evolving to meet the needs of the new digital economy. These communities will need to connect at the hip to prevent fraud, avoid identity theft and to deter other financial crimes, like money laundering.

January 14 Regions Bank

Regions Bank -

A North Carolina group is trying to take regulators' cue to work together. A successful effort could encourage others to follow its lead.

January 12