-

Tech sprints that bring regulators together with bank officials, data scientists and software companies originated in the U.K. and have crossed the pond into the U.S.

February 11 -

The payments company is working with nonprofit organizations, law enforcement authorities, victims and others to make it harder for the criminals behind the modern slave trade to move money.

February 6 -

The payments company is working with nonprofit organizations, law enforcement authorities, victims and others to make it harder for the criminals behind the modern slave trade to move money.

February 5 -

The U.S. banking system risks being left behind by the European Union and the United Kingdom when it comes to open banking.

February 3 Regions Bank

Regions Bank -

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

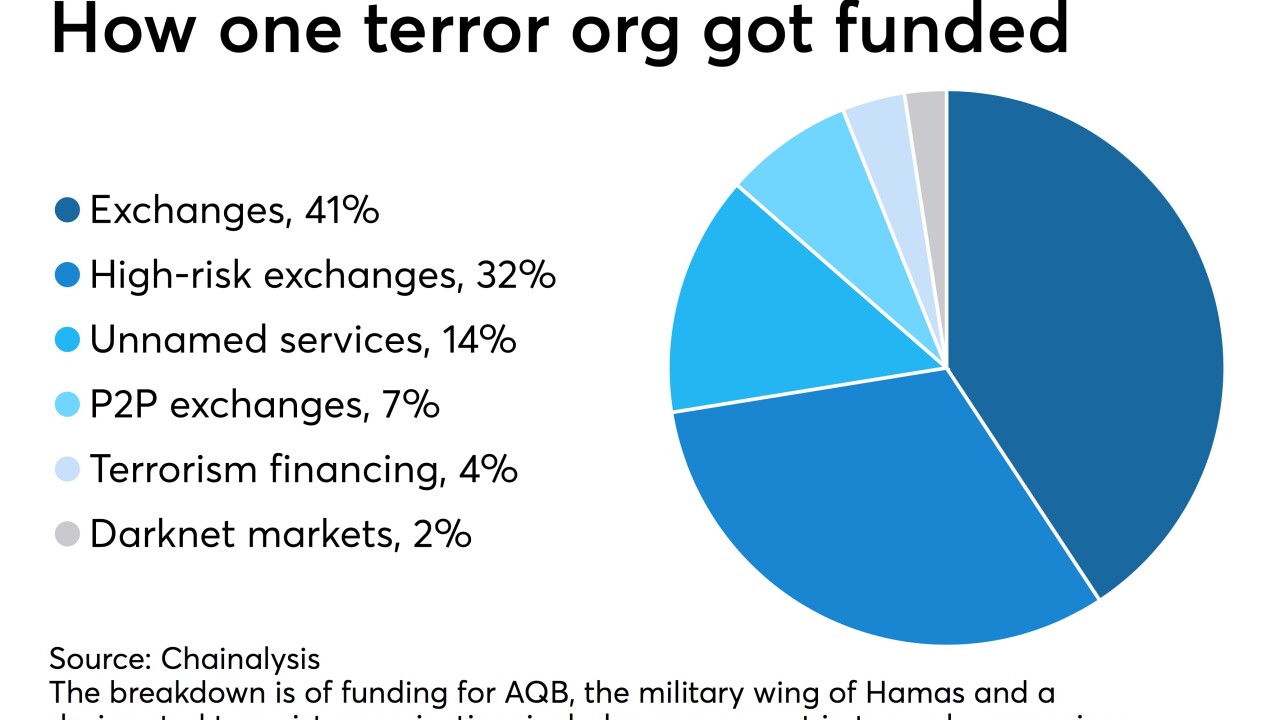

Terrorism financing schemes using cryptocurrencies are growing in sophistication, according to researcher Chainalysis, which helps law enforcement track digital-coin transactions.

January 17 -

Open banking and identity services are both still evolving to meet the needs of the new digital economy. These communities will need to connect at the hip to prevent fraud, avoid identity theft and to deter other financial crimes, like money laundering.

January 14 Regions Bank

Regions Bank -

A North Carolina group is trying to take regulators' cue to work together. A successful effort could encourage others to follow its lead.

January 12 -

Travelex unable to deliver cash to major banks following a New Year’s Eve cyberattack; Rep. Katie Porter says the bank is undermining purpose of its punishment.

January 10 -

Cybersecurity, AML compliance and consumer protections top the credit union regulator's list.

January 8 -

Granting a third party access to a bank's systems in exchange for more advanced technology can help prevent fraud, but it can also attract cyberattacks.

January 6 Regions Bank

Regions Bank -

The window to change beneficial-ownership rules or pass other measures will be narrow, but some legislative efforts from 2019 will carry over and House Democrats will resume inquiries of certain industry CEOs and Trump-appointed regulators.

January 1 -

The Senate Banking Committee chairman said he opposed a House bill that would give financial institutions legal cover to serve cannabis businesses.

December 18 -

Regulators said the living wills of six banks — not Goldman or JPM — need tweaking; the investment values the global business travel unit at $5 billion.

December 18 -

Fintechs want access to customers’ financial data, but banks are resisting, on security concerns; Deutsche Bank may cut bonus pool 20% after 14% drop last year.

December 16 -

The regulatory action from the Federal Reserve was one of two U.S. Bank received for its dealings with a payday lender who was later convicted of fraud.

December 12 -

JPMorgan Chase & Co.’s blockchain-based information network for payments is drawing the greatest interest in Japan, a country long blamed for weak measures against money laundering.

December 10 -

The leader of a new Compliance and Payments Task Force dives into how it will address emerging issues of counterterrorism financing in the digital age.

December 10 FinClusive

FinClusive -

The bank may extend advisory service to clients with as little as $5,000 to invest; trading of the cryptocurrency has plunged.

December 9 -

Issuers have started adding metal to their credit cards; banks have been “slow” to add diversity in executive ranks, filings suggest.

December 6