-

Regulators should consider online lending and a list of what loans qualify for CRA credit in any revamp of the outdated law.

October 7

-

The mortgage industry has put more emphasis on organizing data in a digital manner and presenting it in an easily digestible format.

September 18 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

New unit will work with foreign governments; standards too soft on those without conventional paychecks.

August 29 -

The Federal Housing Administration updated its lender certification proposal originally issued this past May, as it looks to ease industry concerns on False Claims Act enforcement.

August 15 -

The Department of Housing and Urban Development will remove some barriers to government-insured condominium lending next month, including a post-crisis measure housing industry groups have long complained about.

August 14 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 28 Kabbage Inc.

Kabbage Inc. -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 25 Kabbage Inc.

Kabbage Inc. -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

The conventional market recaptured a lot of the first-time homebuyers it lost during the financial crisis, but service members instead have increasingly stuck with loans insured by the Department of Veterans Affairs.

March 1 -

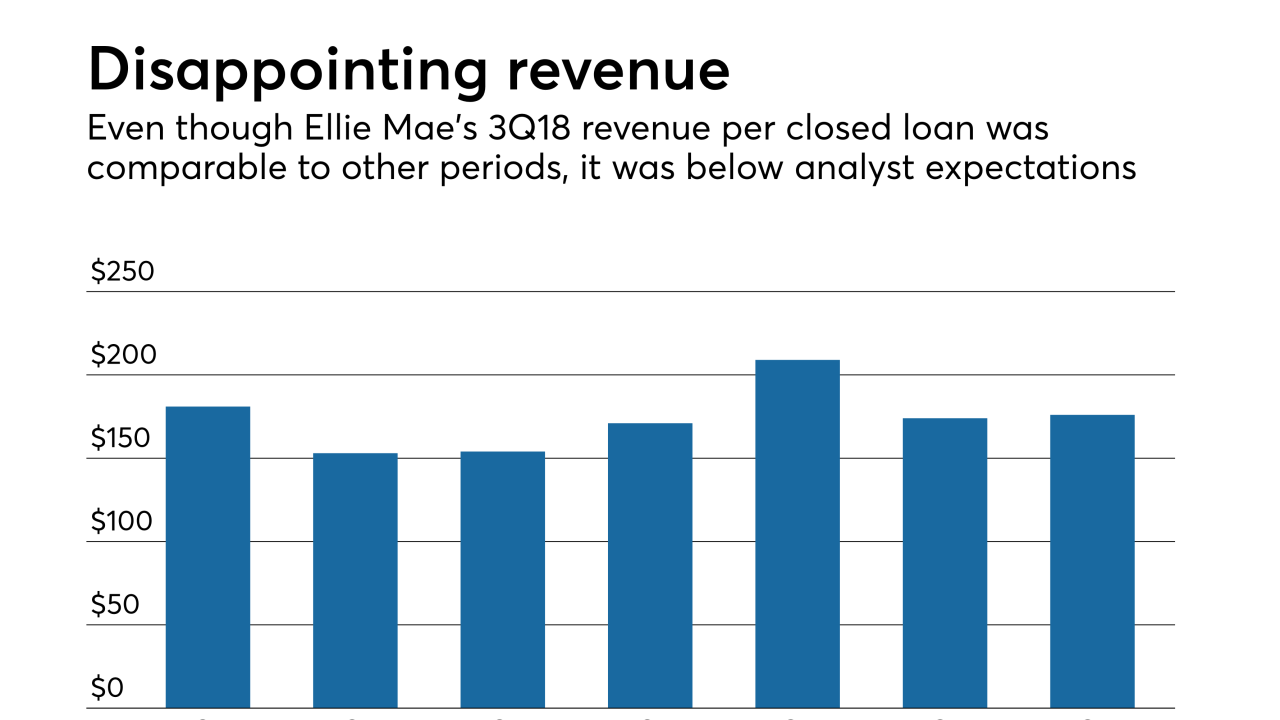

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

A top official at the Office of the Superintendent of Financial Institutions defended tougher underwriting rules blamed recently for a slump in the nation’s housing market, but left open the possibility that regulations could ease if conditions change.

February 5 -

The bloc said the company artificially raised interchange fees in Europe; weather changes that increase flood risks may mean defaults on mortgages.

January 23 -

Borrowers and financial institutions may be feeling the strain from reduced operations at the FHA and IRS, which has suspended the release of certain income documentation during the budget impasse.

January 4 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24