-

The nation’s largest mortgage lender plans to use a new partnership with the financial technology company AutoFi to sell more cars to its home loan customers.

May 5 -

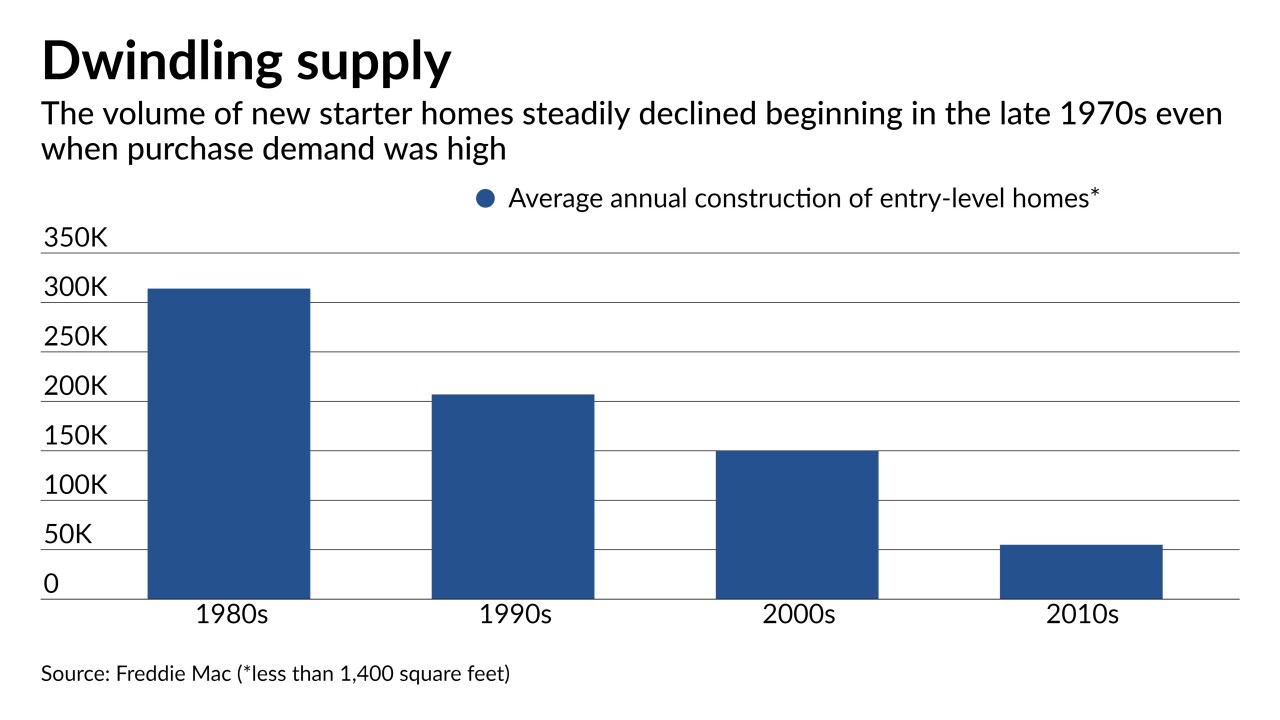

Reviving a long-dormant loan guarantee program could go a long way toward restocking the supply of starter homes and helping households of modest means create wealth.

May 4 University Bank

University Bank -

On Dec. 31, 2020. Dollars in thousands.

May 3 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

It would be available to homeowners making 80% or less of their area’s median income who weren't eligible to tap into low rates last year.

April 28 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

The lender will expand certain mortgage products, like its HomeRun program, which requires lower down payments and removes mortgage-insurance requirements for lower-income borrowers.

April 26 -

Deposits keep flooding in, mortgage lending shows signs of cooling, and bankers can’t agree on when commercial lending will rebound. Here’s what we learned from first-quarter results.

April 25 -

The Consumer Financial Protection Bureau disputes a district court ruling that misconduct claims against the company were already covered by a previous settlement.

April 22 -

The Dallas company agreed to sell MSRs tied to $14 billion of mortgages to PHH Mortgage.

April 21 -

The quarter-to-quarter increases bested expectations, suggesting that large banks are regaining market share in mortgage lending

April 21 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

April 20 -

If passed, the Affordable Housing Credit Improvement Act introduced last week could spur development of 2 million rental units for low- and moderate-income households over the next decade.

April 20 Enterprise Housing Credit Investments LLC

Enterprise Housing Credit Investments LLC -

The Michigan lender agreed in 2012 to pay $133 million to resolve civil fraud charges tied to government-backed mortgages. But the deal with the Justice Department came with a catch that eventually allowed Flagstar to pay far less.

April 15 -

Loan growth and wealth management revenue drove a 53% increase in the San Francisco bank's profit from a year earlier.

April 14