-

The 30-year fixed rate loan was down 26 basis points as investors reacted early in the week to the employment numbers, according to Freddie Mac.

August 8 -

The same creativity and flexibility that community development financial institutions bring to business lending ought to be applied to financing affordable housing.

August 7

-

-

High borrowing costs led to fewer mortgage originations in the second quarter, according to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit released Tuesday.

August 6 -

Bond traders now see a roughly 60% chance of an emergency quarter-point cut by the Federal Reserve within one week because of the market turmoil.

August 5 -

The 30-year fixed rate mortgage was at its lowest level since early February as the benchmark 10-year Treasury dropped under 4%.

August 1 -

The lender denied its software uses artificial intelligence in fighting a 'digital redlining' case.

July 31 -

Election speculation about policy change at Fannie Mae has boosted its stock slightly this year. It's also profitable, but there's much more to consider.

July 30 -

Changes to the regulatory regime surrounding the Federal Home Loan banks should be carefully calibrated so as to do no damage to their successful support for housing and the provision of liquidity to members.

July 30

-

The San Antonio-based bank is in the midst of a yearslong expansion effort spanning Houston, Dallas and Austin — all of which are fueling loan growth.

July 25 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

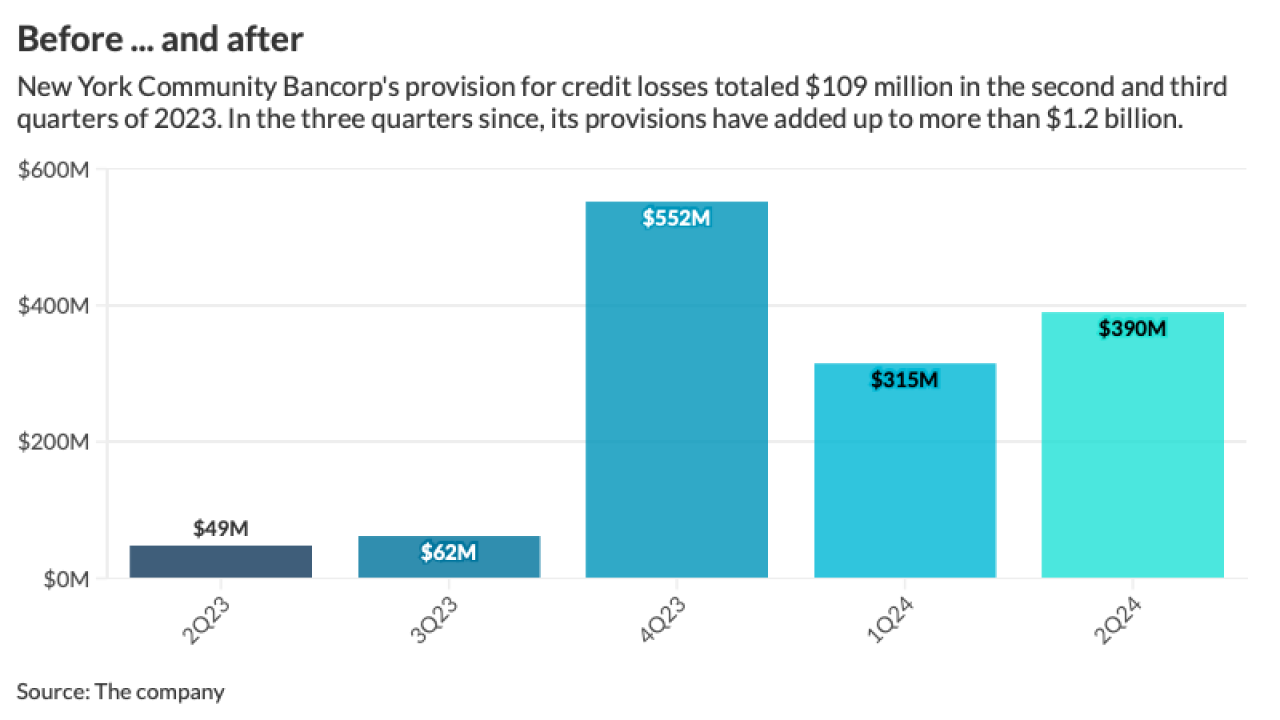

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The Department of Housing and Urban Development and the Nationwide Multistate Licensing System also reportedly had disruptions.

July 19 -

Even though the 30-year fixed rate mortgage is at its lowest level since mid-March, consumers are being cautious in returning to the market, Freddie Mac said.

July 18 -

The final rule governing the use of automated valuation models for home assessments is substantially similar to the initial proposal made last June.

July 17 -

With Americans suffering from high housing costs and declining supply, we cannot afford to watch a massive government-sponsored enterprise sit on billions in retained earnings.

July 12

-

As part of the three-year agreement, the group will fund a $1.22 million scholarship fund to recruit minorities into the appraisal profession.

July 11 -

Positive signs on jobs and inflation help drive the 10-year Treasury yield lower, and lead investors to forecast a short-term rate cut sooner than later, Freddie Mac said.

July 11 -

The top five community banks have combined first mortgage loans of more than $2.8 billion as of March 31, 2024.

July 11