-

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

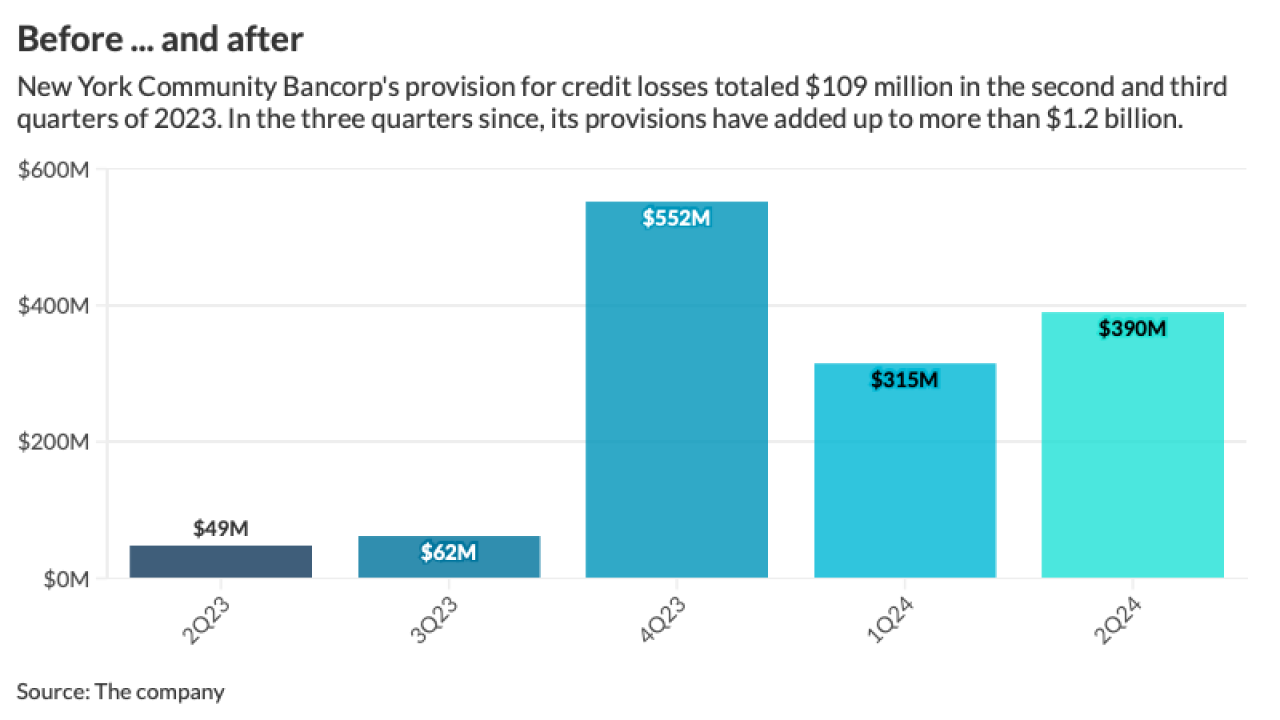

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The Department of Housing and Urban Development and the Nationwide Multistate Licensing System also reportedly had disruptions.

July 19 -

Even though the 30-year fixed rate mortgage is at its lowest level since mid-March, consumers are being cautious in returning to the market, Freddie Mac said.

July 18 -

The final rule governing the use of automated valuation models for home assessments is substantially similar to the initial proposal made last June.

July 17 -

With Americans suffering from high housing costs and declining supply, we cannot afford to watch a massive government-sponsored enterprise sit on billions in retained earnings.

July 12

-

As part of the three-year agreement, the group will fund a $1.22 million scholarship fund to recruit minorities into the appraisal profession.

July 11 -

Positive signs on jobs and inflation help drive the 10-year Treasury yield lower, and lead investors to forecast a short-term rate cut sooner than later, Freddie Mac said.

July 11 -

The top five community banks have combined first mortgage loans of more than $2.8 billion as of March 31, 2024.

July 11 -

The Consumer Financial Protection Bureau has proposed requiring that mortgage servicers exhaust all efforts at assisting struggling borrowers before moving ahead with a foreclosure.

July 10 -

The bank acquired these business purpose non-qualified mortgage loans originated by Civic Financial Services in the PacWest Bancorp deal.

July 5 -

The plan from the Heritage Foundation, a group the first Trump administration was largely in line with, would shutter CFPB, break up HUD and raise FHA premiums.

June 27 -

But economists seem to differ on what the latest movement in mortgage rates means for the summer home sales business.

June 27 -

The Federal Housing Finance Agency wants feedback on how the Federal Home Loan banks can improve their affordable housing programs, including efficiencies in the application process.

June 20 -

Markets appeared to welcome signs of future rate relief, with the latest Freddie Mac average falling for the fifth time in six weeks.

June 13 -

-

-

-

The 30-year fixed-rate mortgage average dropped back below the 7% level as investors reacted positively to news the economy is slowing, Freddie Mac said.

June 6