-

A spike in the bank's noninterest income powered its better-than-expected net income and revenue in the second quarter.

July 16 -

Strong fee income growth and solid credit quality helped offset weak demand for credit as the San Francisco-based bank reported a 20% boost to earnings per share from a year ago.

July 15 -

The Pittsburgh-based company's earnings fell 4% in the third quarter from a year ago, although noninterest income climbed 11%.

October 15 -

-

Data as of Mar. 31, 2022. Dollars in thousands.

June 21 -

On Dec. 31, 2020. Dollars in thousands.

March 21 -

On Sep. 30, 2021. Dollars in thousands.

December 20 -

On June 30, 2021. Dollars in thousands.

September 20 -

Community banks, which rely more on the charges than their larger counterparts do, were instrumental in staving off new regulation during the Obama era. But much has changed since Democrats last held power in Washington.

July 27 -

On Mar. 31, 2021. Dollars in thousands.

June 21 -

Some institutions for more than a year have reduced or eliminated overdraft and funds transfer fees to help members hard hit by the economic downturn, but it's unclear how much longer they can keep coasting on other sources of noninterest income.

April 15 -

On Dec. 31, 2020. Dollars in thousands.

March 22 -

Noninterest income from Paycheck Protection loans and mortgage refinancings isn't enough to make up for shortfalls elsewhere, and growth prospects are hard to identify.

February 16 -

On Sep. 30, 2020. Dollars in thousands.

December 21 -

The company's insurance arm, which recently bought a Texas-based insurance tech firm, is on pace to complete five deals this quarter.

December 7 -

On June 30, 2020. Dollars in thousands.

September 28 -

On Mar. 31, 2020. Dollars in thousands.

June 29 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

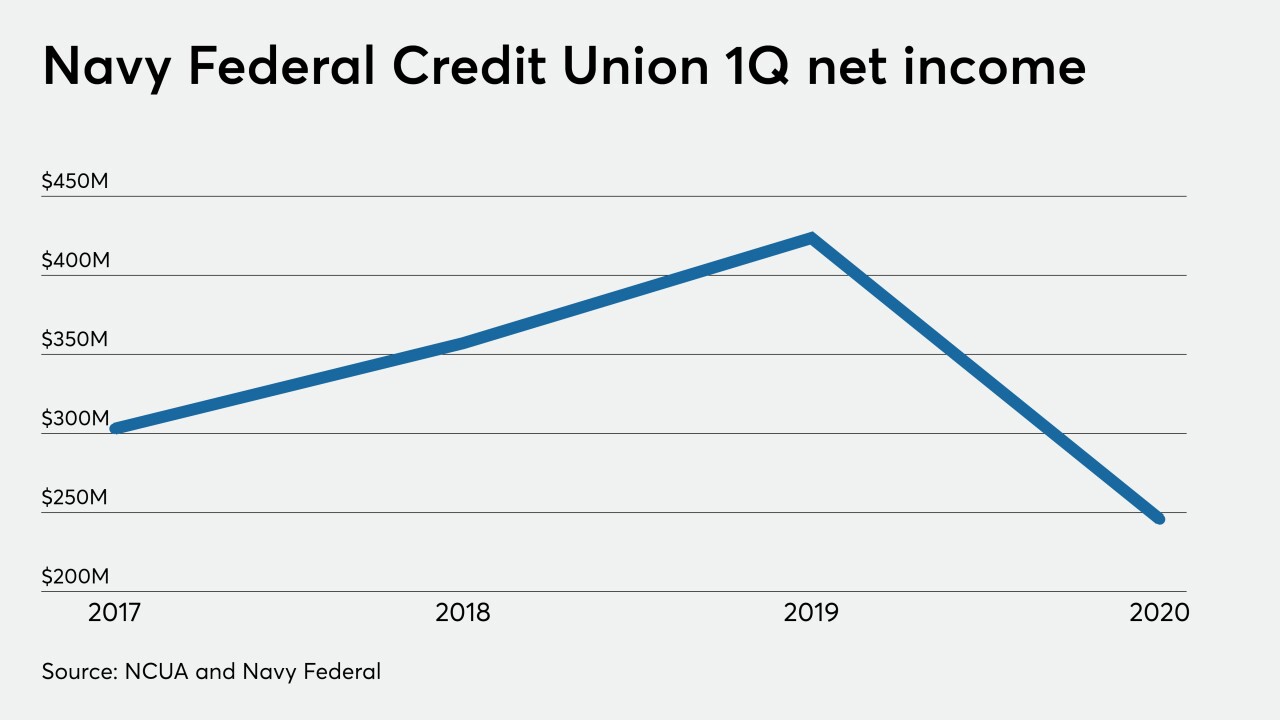

The largest credit union in the world increased its provision by 28% from a year earlier.

April 22 -

Margins will be squeezed after the Federal Reserve lowered interest rates earlier this month to counteract the economic fallout from the coronavirus.

March 25