-

The New York megabank benefited duing the second quarter from strong revenue growth in its giant credit card business, which helped overcome headwinds in wealth management and investment banking. But executives indicated that the script could soon flip.

July 14 -

The private-equity firm plans to focus on innovation and acquisitions when it takes a controlling stake of the payments processor.

July 14 -

Higher interest rates and larger card balances set the stage for an 11% jump in revenue from U.S. personal banking in the second quarter. That blunted the impact of a 78% surge in write-offs tied to consumer loans.

July 14 -

A federal judge ruled that the Ripple Labs token is a security when sold to institutional investors but not the general public, a long-awaited decision that was widely hailed as a victory for the crypto industry over the SEC.

July 13 -

The business is deposit-taking and offers revolving credit cards as well as loans for small-ticket items. The potential sale could serve as a benchmark for other lenders considering selling their own consumer finance businesses.

July 13 -

American Express is turning to some unusual allies in its quest to gain popularity overseas: shoe-repair shops and bargain stores.

July 13 -

Venture capitalists are increasingly keen on firms that can guide merchants through a maze of emerging processing options.

July 13 -

This week in global news, Lisbon takes contactless payments to the subway; U.K. politicians say AML actions rules are politically motivated; and more.

July 12 -

Accrue Savings' merchant-specific savings accounts, originally pitched as a way for consumers to fund major furniture and jewelry purchases, is finding a new market with vacationers.

July 12 -

Guy Harris and Eric Hoffman joined the company's leadership team to help it manage an industrywide spike in suspect payments.

July 11 -

Adjusted for inflation, consumer spending has largely stalled after surging at the start of the year. Delinquency rates, meanwhile, are ticking up.

July 10 -

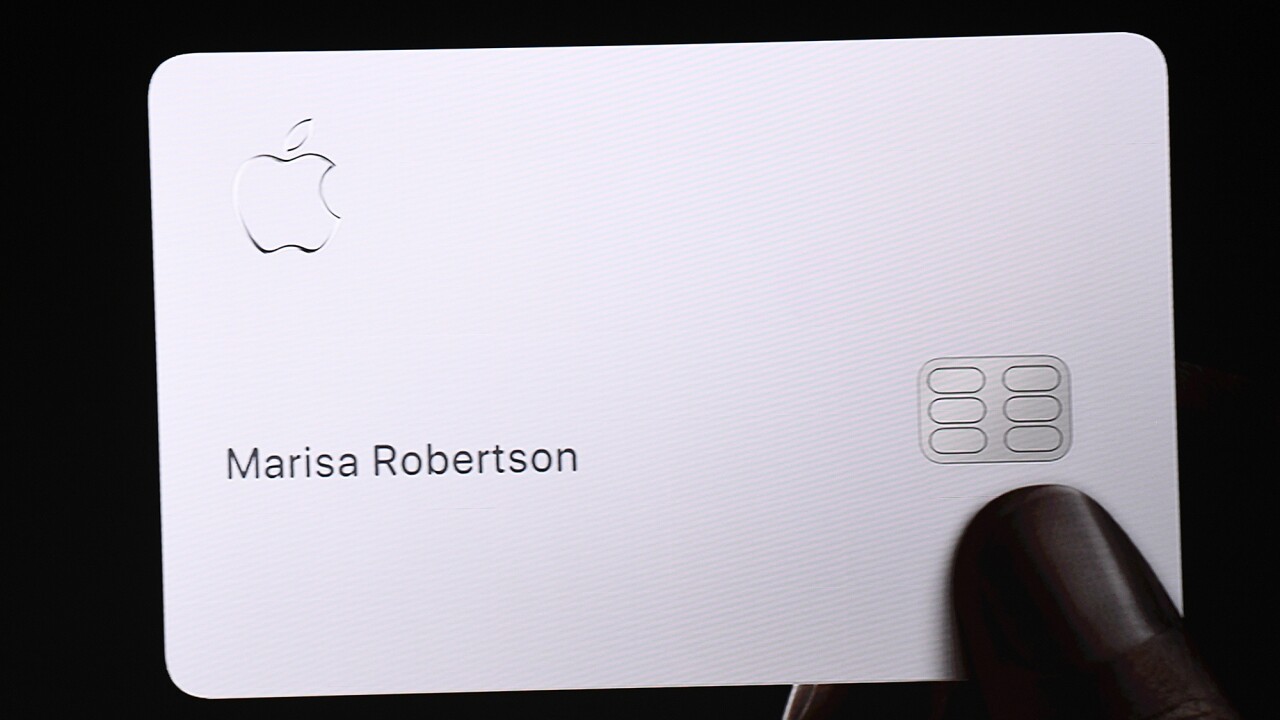

The tech giant wanted to put the consumer first. This meant its banking partner was always second — and taking on more risk than most card issuers at a time of economic volatility.

July 10 -

JPMorgan Chase and Goldman Sachs are leading the financing, which will involve the private equity firm taking a 55% stake in the payments processor, while FIS retains the remainder.

July 10 -

Organized criminals exploited the issue for several months in early 2022 before the company fixed the problem, according to the newspaper.

July 9 -

The Consumer Financial Protection Bureau, the Treasury Department and the Department of Health and Human Services released a request for comment on medical debt financing products. At the same time, the White House said that the agencies will explore whether efforts to sign up customers are breaking the law.

July 7 -

The sanctions were in response to violations of laws and regulations in areas including financial consumer protection, payment and settlement business and anti-money laundering obligation in the past years, according to China's central bank.

July 7 -

The bank is offering earned wage access, a product that can reduce overdrafts and employee retention, but which may someday run afoul of regulators.

July 7 -

A digital version of the British pound may feature a way to verify the holder's age and citizenship status, potentially smoothing the purchase of alcohol and tobacco and transactions with government agencies.

July 7 -

The payment processor Worldpay was originally supposed to be publicly traded. By taking the unit private and retaining a stake, FIS can remain competitive n merchant services.

July 6 -

Some of the world's largest banks found that digital dollars could be an effective way to improve domestic and cross-border payments, according to a unit of the Federal Reserve Bank of New York.

July 6