-

The new service was designed to lower costs for community banks while adding security features and providing customers with access to Venmo and other peer-to-peer payment systems.

January 25 -

American Express predicts travel will account for just 20% of its spending for the foreseeable future, compared with 30% before the pandemic, as younger consumers spend more on merchandise.

January 25 -

The announcement marks JPMorgan’s first deal in 2022, on the heels of its most prolific year for buying and taking stakes in smaller firms since at least the financial crisis.

January 25 -

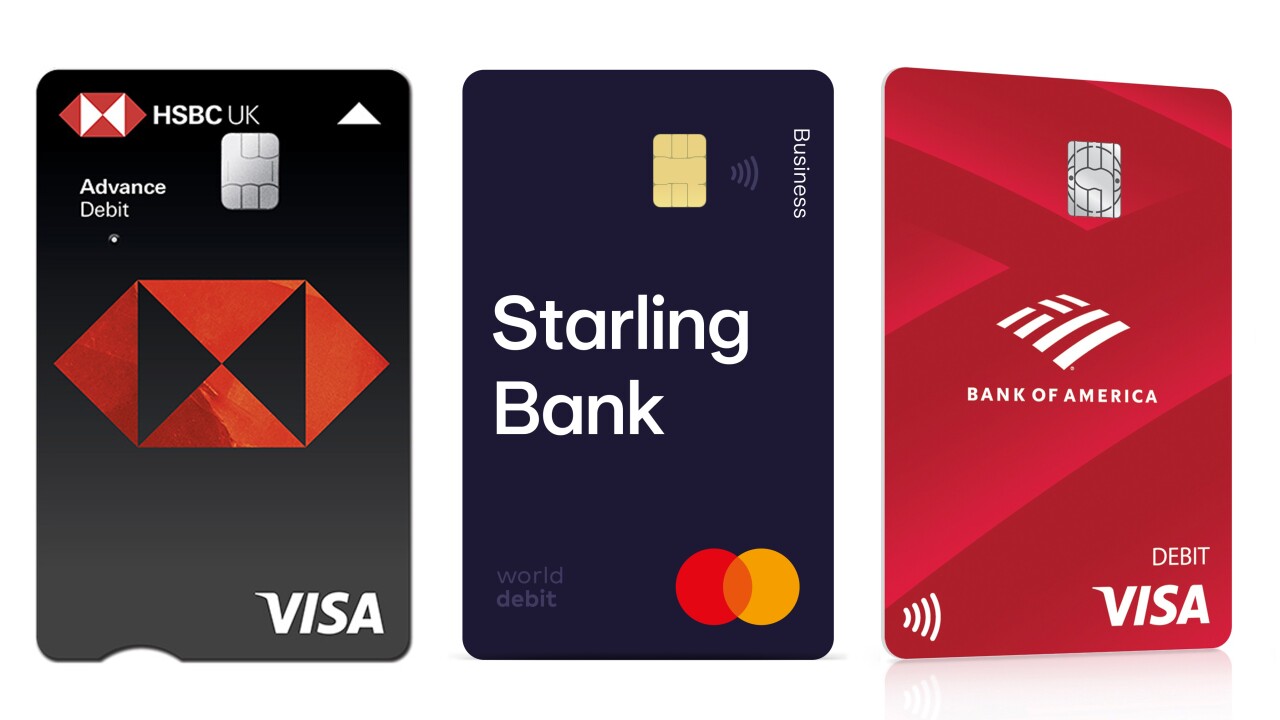

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

A new service speeds payments by using artificial intelligence to predict which buyers are most likely to pay.

January 21 -

Though the retailer's threat to drop Visa in the U.K. appears to have subsided, companies like Clik2pay, Affirm and Curve have seized on an opportunity to advance account-to-account transactions, buy now/pay later and cryptocurrency.

January 21 -

A long-awaited report from the Federal Reserve is a historic step toward the possible development of a central bank digital currency. But the Fed emphasized it would not create one without a clear directive from Congress and the White House.

January 20 -

The issuer says it can offer installment loans without jeopardizing the kind of growth in credit card volume that it reported for the fourth quarter.

January 20 -

JPMorgan Chase will introduce a credit card with Instacart this year, the first foray into grocery for the country’s largest co-brand credit card issuer.

January 20 -

Google has hired former PayPal executive Arnold Goldberg to run its payments division and set a new course for the business after it scrapped a push into banking.

January 19 -

Valuations for payment technology companies skyrocketed over the past year, pushed by a wave of public listings and record venture capital investments. Some potential acquirers are waiting for prices to cool.

January 19 -

A coalition of trade associations representing some of the world's largest retailers called on U.S. antitrust regulators to examine the fees charged by credit card companies after Amazon.com threatened to ban Visa cards in the U.K.

January 19 -

-

It has also taken a stake in Rêv Worldwide, developer of the bank's cross-border traveler account that supports currencies including the U.S. dollar, the euro and the Mexican peso.

January 18 -

Amazon.com Inc. has made a last-minute reversal to its plan to ban the use of Visa Inc.’s credit cards issued in the U.K.

January 18 -

The automaker plans to overhaul its online car-shopping portal, while also developing an in-car system for purchasing fuel, parking and other goods and services.

January 17 -

Citi will conduct a search for David Chubak's replacement as head of the retail services business, which provides private-label and co-brand credit cards for merchants including Macy’s and Best Buy.

January 14 -

UniCC is the the largest dark web vendor of stolen credit cards, with $358 million in purchases made through the market since 2013 using cryptocurrencies, according to a blockchain forensics firm.

January 13 -

The card brands are pursuing partnerships with banks, government agencies and merchants, with a goal of building networks and services to accommodate the rise of central bank digital currencies.

January 13 -

The startup PointCard's new charge card ignores applicants' credit scores, instead weighing their cryptocurrency holdings and other investments to determine ability to repay.

January 12