-

A sharp increase in credit card account write-offs, a slowdown in consumer spending and heavy compliance costs triggered a 62% decline in fourth-quarter earnings.

January 18 -

The retail giants are testing the limits of what customers will allow a generative AI system to do before making a payment.

January 18 -

As merchants push the government for relief from funding consumer card perks, the card network is exploring how to replace cash with digital incentives.

January 17 -

Worldline and Google partner team up for cloud computing; Global Payments works with Commerz in Germany.

January 17 -

American Express has built platforms to help smaller brands quickly bring credit cards to market and for B2B software companies to embed virtual cards.

January 16 -

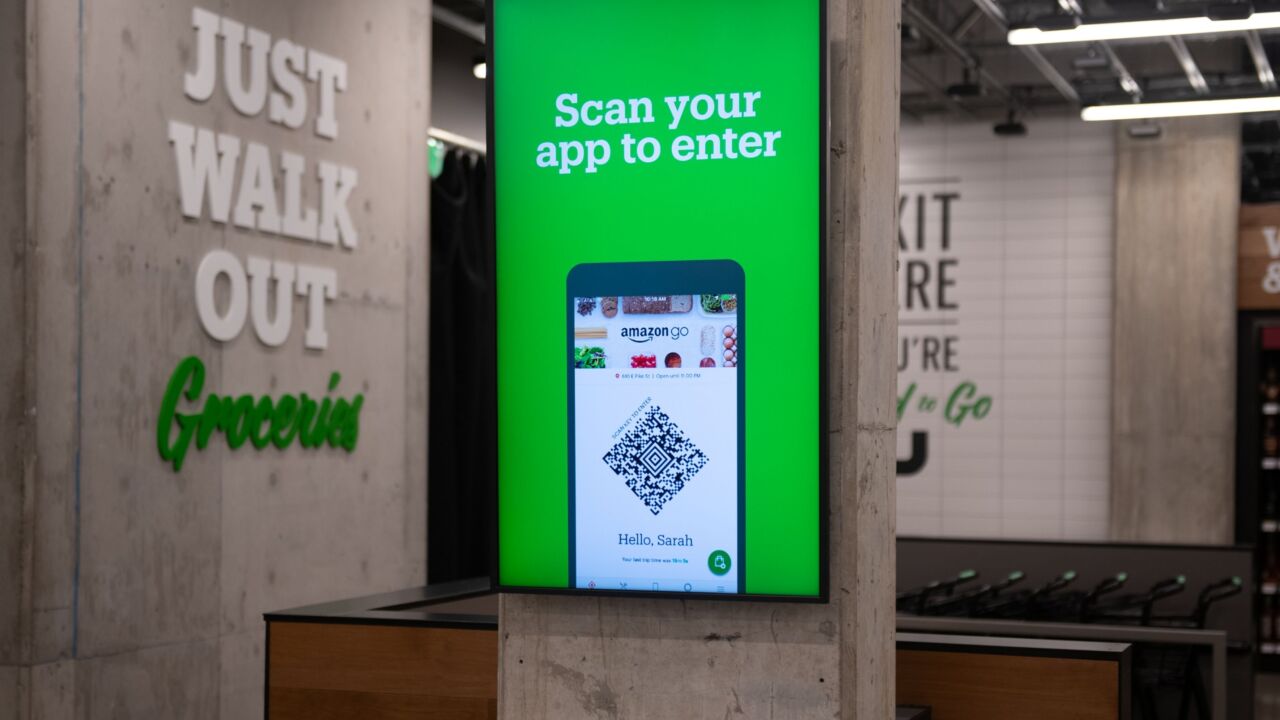

When the e-commerce giant designs and revises new store models like Just Walk Out, it faces a challenge: How do you train technology that requires real-world data that doesn't yet exist?

January 16 -

Payments fraud is the most expensive kind, at $450B; anti-financial-crime execs are the most worried about real-time payments, a survey from Nasdaq and Oliver Wyman found.

January 16 -

Companies such as SeatGeek, a ticketing provider that requires its employees to do a lot of travel, find that artificial intelligence can help manage a large amount of data tied to travel and expenses.

January 15 -

The technology company's move in Georgia could widen its processing relationships with merchants, but the company insists it won't become a traditional financial institution.

January 13 -

Tech company Circle files for an IPO; Amazon wants to extend its Just Walk Out technology to hospitals; Pacific Financial expands in suburban Oregon; and more in the weekly banking news roundup.

January 12 -

The card network is creating a generative AI-powered chatbot to give small-business owners personalized assistance, emphasizing 'inclusive' resources and mentorship for minority entrepreneurs.

January 12 -

Like a ratchet, price controls in the payments industry move only one way, destroying value and reducing incentives for innovation.

January 11

-

The card networks are expanding their development of accelerators for women and minority-owned businesses, improving these entrepreneurs' access to venture capital.

January 11 -

In comments submitted to the Consumer Financial Protection Bureau concerning its "large participant" rule governing Big Tech in payments, many commenters outlined procedural concerns, suggesting there may be grounds for litigation when the rule is finalized.

January 10 -

In addition to Ant's possible deal to buy MultiSafepay and Adyen's work with Straumur, Visa has partnered with TECH5 on government ID and Mastercard is expanding its virtual-card network through Rawbank.

January 10 -

From Mastercard partnering with banks and third parties in new open-banking relationships to PayPal stepping into the cryptocurrency payments market by launching its own stablecoin, payments firms are taking on new opportunities.

January 10 -

A potential antitrust lawsuit may open iPhones to outside payment apps. But any bank that seeks to profit from the Department of Justice's moves will face a host of other challenges.

January 10 -

Scrambling to generate revenue, the social media app sees P2P payments as the easiest way to offer its vast base of enrolled consumers other financial services.

January 9 -

The Federal Reserve would seem to offer a compelling alternative to the bank-backed RTP network, but some credit unions — which typically see bank systems as competitive threats — are making more nuanced choices.

January 8 -

In the news this week: A consumer group filed a complaint against Starbucks over its mobile app and reloadable gift cards, Apple Pay added a new payment tech firm, The Clearing House hired Amanda Stewart as its new marketing chief, and more.

January 5