-

Post-crisis regulations were not only costly but may have undermined executive accountability by turning CEOs into compliance managers instead of drivers of business decisions.

November 30 Nossaman LLP

Nossaman LLP -

The Federal Deposit Insurance Corp.'s third-quarter earnings report was stacked with good news: record earnings and lending, fewer troubled loans and higher interest and noninterest income. Yet there was one statistic that is likely to fuel more calls for help from Washington.

November 29 -

Hopes are high among bankers that soon-to-be President Donald Trump and the new Congress will quickly lower the corporate tax rate. But a tax overhaul might benefit community banks and small regionals more than larger banks, especially those reliant on tax strategies that might be less meaningful in a new system.

November 23 -

Fifth Third Bancorp in Cincinnati will record a gain of $9 million during the fourth quarter after selling shares in the payment processor Vantiv.

November 22 -

Banks should focus on strategies to ensure their sales incentives programs actually help drive profits. Otherwise, their rewards programs are at risk of adding zero benefit to their bottom line.

November 18 New York Institute of Technology � Accounting and Business School

New York Institute of Technology � Accounting and Business School -

Carter Bank in Virginia had been enjoying record profit until it was ordered to beef up Bank Secrecy Act compliance. The institution is the latest community bank to take a hit from enhanced oversight.

November 17 -

The Farm Service Agency and the Small Business Administration seem to be taking longer to approve guarantees for loans to facilities that house livestock, creating another headache for bankers.

November 16 -

If there is one thing credit unions and banks can agree on with regard to the National Credit Union Administration's latest effort to revamp its field-of-membership rules it is this: a lawsuit is brewing.

November 14 -

Midland States Bancorp in Effingham, Ill., has launched an efficiency push after a period of expansion that reached another milestone Thursday.

November 10 -

Bankers can't start spending their tax cuts under the Trump administration yet because there are so many X factors including what exactly the new president would seek to steer through Congress. But they sure have fun thinking about what they'd do with the billions of dollars in savings that are possible.

November 10 -

Green Dot reported net income of $2 million in the third quarter as the prepaid card issuer sought to overcome the revenue it lost by discontinuing one of its most popular products.

November 9 -

Santander Consumer Holdings USA in Dallas on Wednesday reported lower quarterly profits due to ongoing issues associated with its discontinued personal loan business.

November 9 -

The only tactic for survival is brutal honesty. So let's accept the very real risk of disappearing and do the heavy lifting required to persevere.

November 9 Liberty Bank

Liberty Bank -

Seacoast Banking Corp. of Florida recently announced another bank deal just months after its biggest shareholder complained of subpar performance. The bank insists it is sticking to a long-term plan to build value.

November 8 -

Deposits at big banks have swelled as corporations shifted funds around in anticipation of new money market rules. But industry experts describe the influx as a temporary blip that will serve mainly to provide yet another drag on margins in the fourth quarter.

November 7 -

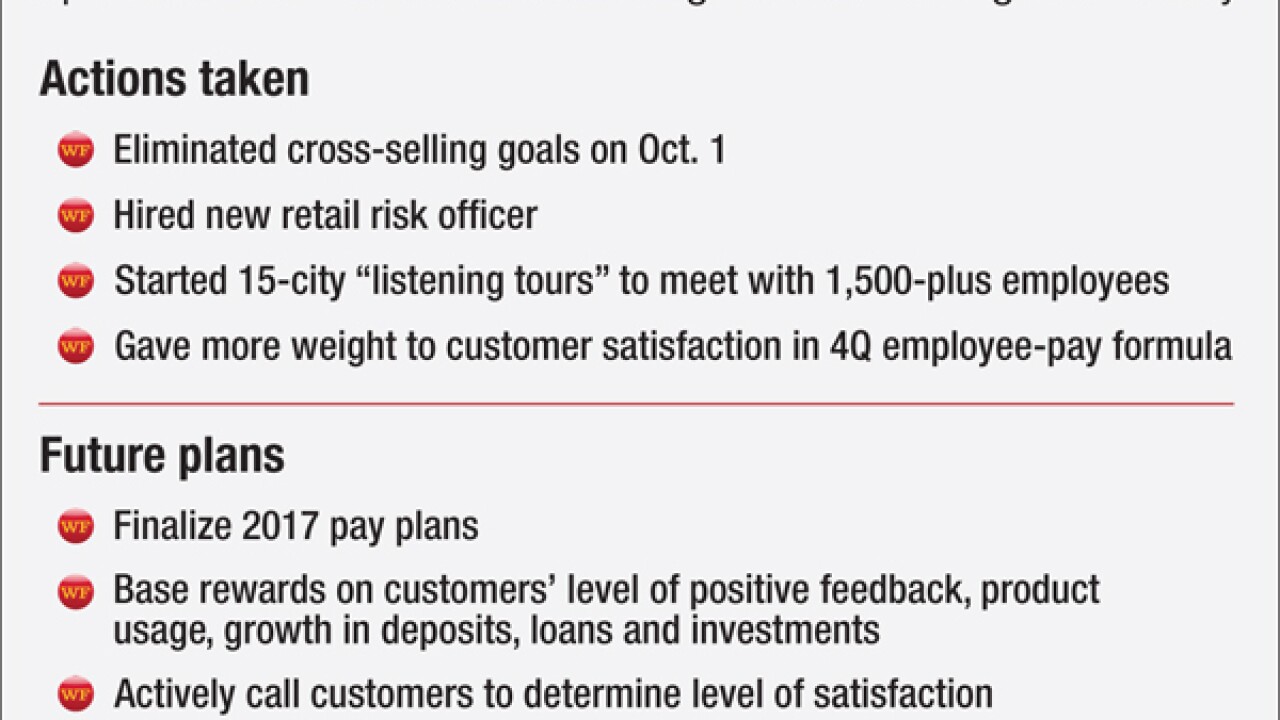

In her first major presentation as Wells Fargo's head of retail banking, Mary Mack took on the doubters, making the case for why she is the best fit to lead the embattled retail unit. She laid out plans to revamp compensation and internal culture.

November 3 -

OnDeck Capital reported its fourth consecutive quarterly loss on Thursday as investors bought fewer loans and the firm was forced to make costly adjustments to its business.

November 3 -

Two top executives said the scandal-plagued bank has managed to minimize the financial damage and can continue to grow amid some reforms. Yet they acknowledged that the full toll has yet to be realized, and the company announced it had significantly raised its estimated legal exposure.

November 3 -

If modified, the cybersecurity standards in New York State are a step in the right direction to protect banks and consumers.

November 2 Tanium

Tanium - Indiana

Acquisition costs ate into third-quarter profit at Old National Bancorp in Evansville, Ind.

October 31