-

Regions Financial in Birmingham, Ala., has lowered its forecast for annual loan growth, citing weak demand for commercial loans.

September 14 -

Banks will report quarterly results in about a month, and big-bank chiefs cautioned that lending is sluggish because businesses have little desire to take on more debt amid economic and political uncertainty.

September 13 -

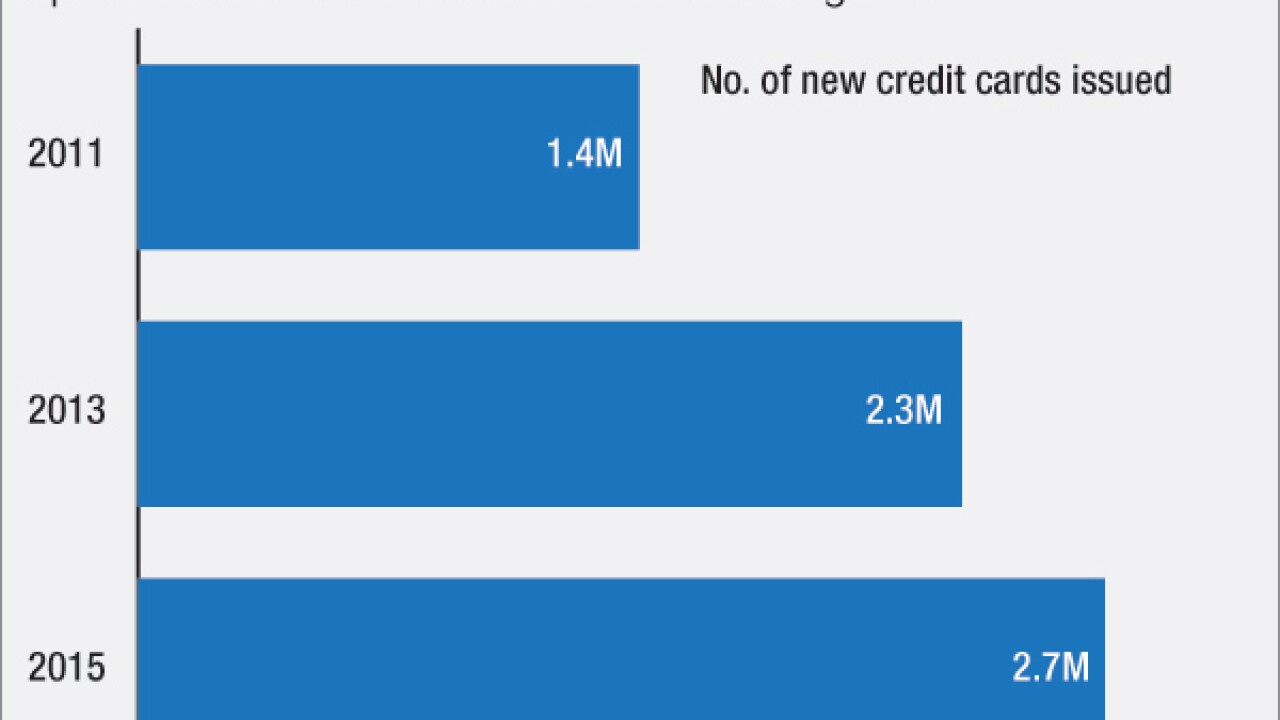

New credit card accounts at JPMorgan Chase have grown by double digits thanks partly to its embrace of borrowers with lower FICO scores, but it sought to reassure investors that credit quality has suffered only slightly.

September 12 -

While troubling factors such as higher risk profiles may be behind the recent lending boom, the industry could also just be returning to the historical average for loan growth following the "Great Panic" of 2008-2010.

September 12

-

The revelation Thursday that Wells Fargo employees were opening accounts for customers without their consent is sparking doubt about the accuracy of the reported growth in the credit card business. The scandal also casts in a harsh new light on Wells strategy of building a large credit card operation through its branch network.

September 9 -

The Financial Accounting Standards Board's accounting rules for credit risk have good intentions, but a likely amplification of the ups and downs of the credit market was probably not one of them.

September 9 Milepost Capital Management

Milepost Capital Management -

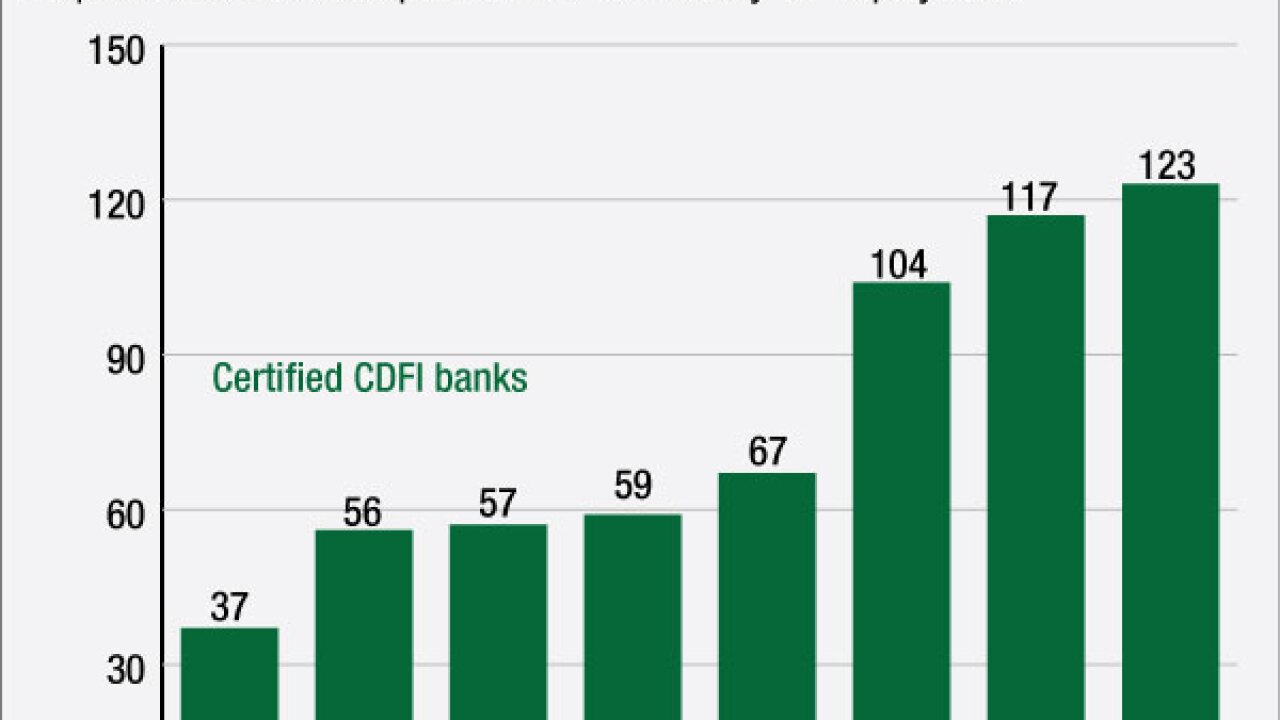

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

The Federal Deposit Insurance Corp.s recent statements encouraging new bank applications are promising, but some barriers to new charters may remain inside the FDIC and we are still waiting for the first de novo of 2016.

September 6 American Bankers Association

American Bankers Association -

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

With even community banks getting hit by ransomware attacks, there's a long list of cybersecurity practices that bankers can expect their supervisors to scrutinize during upcoming exams.

September 1