-

Fraudsters are licking their chops at the prospect of businesses and financial services extending remote working because of the coronavirus pandemic.

May 22 -

Cybyer criminals have become more aggressive as employees are working from home. Credit unions should take these steps to ensure they block those efforts.

May 13 NetSPI

NetSPI -

As phishing and other attacks mount, a personal ID number can act as a second authentication factor, says LogRhythm Labs' James Carder.

April 16 LogRhythm Labs

LogRhythm Labs -

Many credit union employees are currently working from home to slow the spread of COVID-19 but this can invite more attacks from cyber criminals.

April 15 -

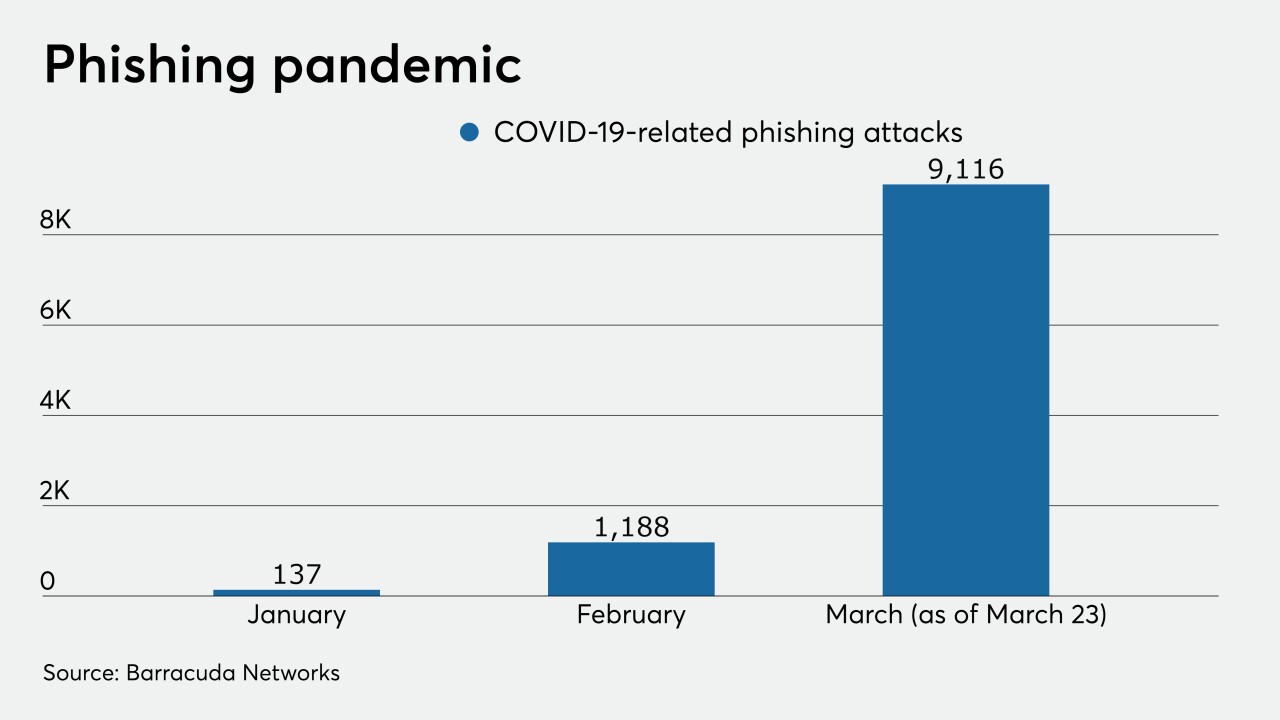

Hacker emails disguised as pleas for aid have surged in the past month, and they're targeting bank employees and the many others working from home.

March 30 -

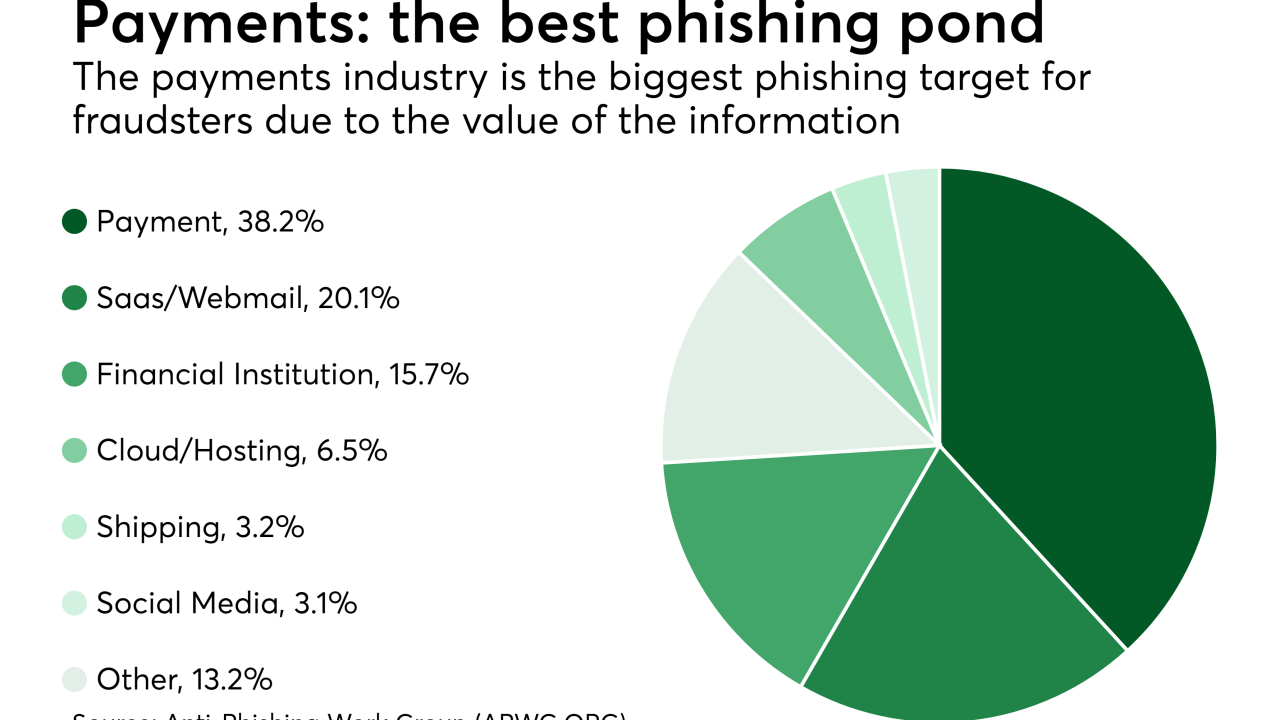

Card fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

March 30 -

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.

March 11 -

Traditional phishing attacks on email are easier for most users to spot, causing crooks to migrate to new venues, argues The ai Corporation's James Crawshaw.

January 6 The ai Corporation

The ai Corporation -

Detecting virtual bad actors means paying more careful attention to the digital interactions and touch points within your business, and how users interact with you through apps, websites or customer service centers, writes Accertify's Andrew Mortland.

October 16 Accertify

Accertify -

Cybercriminals have become extremely adept at crafting emails that are indistinguishable from legitimate emails, says Valimail's Peter Goldstein.

October 10

-

Some companies believe that their employees will know the difference between legitimate versus spoofed emails. While this might be true some of the time, even one mistake can be costly, writes David Barnhardt, executive vice president of product at Giact.

April 16 GIACT Systems

GIACT Systems -

Crooks are going after automated tax communications, text and streaming video. Here's what payment companies should do to educate their consumers, according to Robert Fodor, chief data scientist and vice president of fraud for Interac.

April 8

-

The days of odd emails are gone. Phishing has become a complex big business for crooks, according to Rafael Lourenco, an executive vice president at ClearSale.

March 14 ClearSale

ClearSale -

Today phishing scams have become so elaborate that they can take a variety of forms, including a phony job interview.

February 7 -

Midsize banks have much smaller security budgets, less mature security programs and less robust controls than their bigger counterparts, writes Leigh-Anne Galloway, cybersecurity resilience lead at Positive Technologies.

January 24 Positive Technologies

Positive Technologies -

Hackers pretending to screen a Chilean ATM network staffer for a new job instead slipped malware onto his work computer, leading to a broader attack.

January 18 -

CBTX said an unauthorized person obtained personal information for about 7,800 customers.

December 21 -

Web attacks spike around the holidays, creating a higher risk for malware, phishing and other crime, according to Ryan Wilk, vice president of customer success for NuData Security, a Mastercard company.

December 21 NuData Security

NuData Security -

Rich Baich, Wells Fargo's security chief and newly appointed security advisor to the White House, shares attack types he’s worried about and top defenses.

December 18 -

Phishing is a serious and growing problem in the financial services and payments industries, creating pressure to come up with advanced detection techniques, according to Adrien Gendre, chief solutions architect for Vade Secure.

November 29 Vade Secure

Vade Secure