-

Blockchain technology has the potential to change the healthcare industry, placing the patient, at the center of the system by providing added security, privacy and interoperability to health data and payments, writes Donika Kraeva, strategic communications manager for Dentacoin.

September 6 Dentacoin

Dentacoin -

Counter to the trend — pioneered by Amazon — of launching cashierless technology in small stores to keep traffic under control, the U.K. supermarket chain Sainsbury’s has launched a trial of cashierless mobile shopping in one of its busy London stores, Clapham North Station Local.

September 5 -

By transforming a traditional treasury into a cashless economy, cities will open the doors to wider and faster adoption of more complex smart city innovations, writes Sumeet Puri, senior vice president and global head of systems engineering at Solace.

September 5 Solace

Solace -

The World Wide Web Consortium (W3C) is sending a message to the payments industry that it might not be wise to wait on the card networks to solve the growing problem of mobile and online payments fraud.

September 4 -

As the pressure to monetize data in an omnichannel environment increases, so does the fear of misuse.

August 31 -

Amazon Go may be stealing the spotlight, but it is far from alone in the rush to revolutionize in-store checkout through the use of sensors, scanners, mobile devices and more.

August 31 -

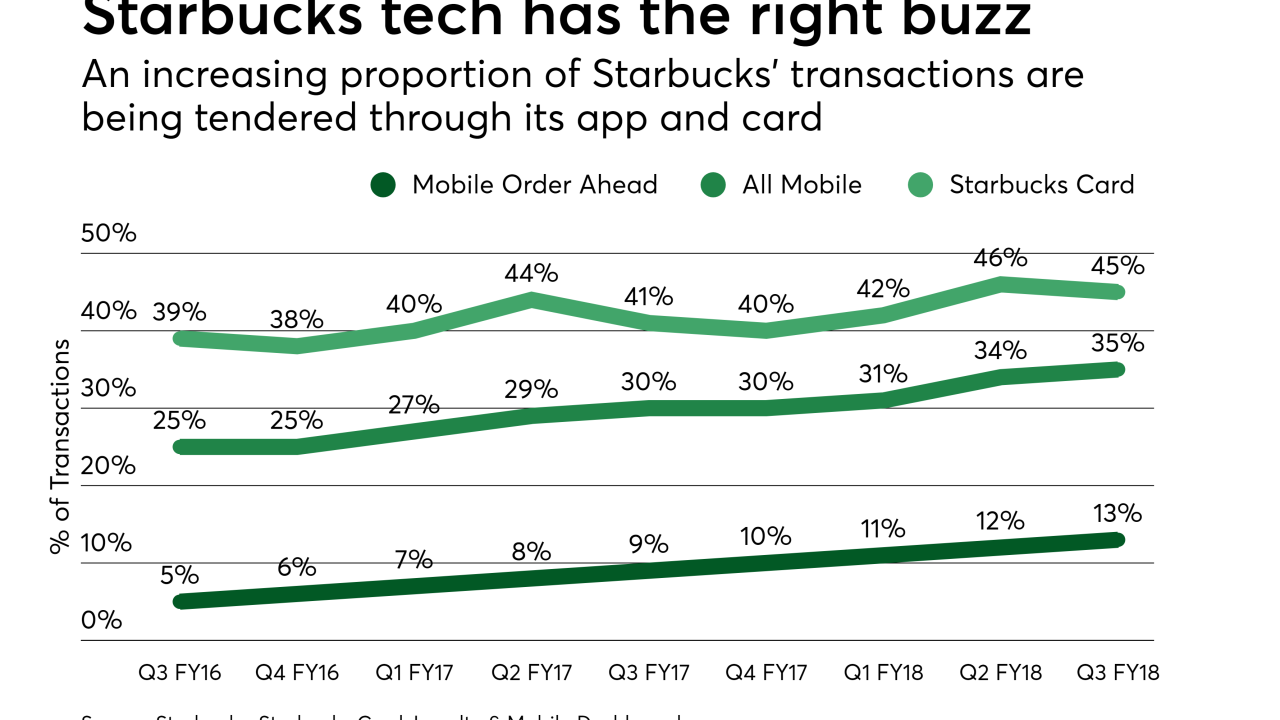

While the battle for the consumer’s coffee or tea beverage, both hot and cold, is increasingly moving in a mobile direction, the challenge remains as to whether Dunkin’s recent moves are enough for it to succeed against Starbucks.

August 31 -

David Mangum will be leaving his post as president and chief operating officer of Global Payments, an announcement that came on the same day it inked deals to retain other top execs, including CEO Jeff Sloan.

August 30 -

For the past year, select Google advertisers have had access to a potent new tool to track whether the ads they ran online led to a sale at a physical store in the U.S. That insight came thanks in part to a stockpile of Mastercard transactions that Google paid for.

August 30 -

The new optimism is fueled by rising standards of living, increases in smartphone usage and cheap data plans that are boosting internet penetration across the nation. Perhaps most important, India is the last big retail market still up for grabs, with an internet economy projected to double to $250 billion by 2020.

August 30