-

Popular TV shows about house fixers and flippers have sparked consumer interest in remodeling, creating an opportunity for lenders to build a specialty in renovation loans while traditional mortgage lending is weak.

February 4 -

Ginnie Mae has restricted loanDepot's ability to securitize Veterans Affairs mortgages because of apparent churning of recent originations.

January 30 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Student loan debt — now at $1.5 trillion in the U.S. — is arguably the greatest pain point for consumers in their 20s and 30s. To court that demographic, banks are increasingly offering help with refinancing and repayment.

December 20 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

As the Federal Housing Administration prepares to release its annual actuarial report this month, the industry is questioning how the reverse mortgage program fits into the agency's future.

November 2 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

To help close deals, there are steps online lenders can take to establish a quick and personal connection with real estate agents.

September 18 -

Loan officers whose habits are attuned to the refi market need to improve their relationship game to make it in this business, NBKC Bank's Dan Stevens told attendees at Digital Mortgage 2018.

September 17 -

Wells Fargo & Co. is cutting 638 mortgage employees as the nation’s largest home lender contends with a slowdown in the business.

August 24 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 9 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but while some analysis shows they've been slow to borrow against this newfound wealth, credit union home equity lending was up significantly last year.

April 2 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

As interest rates go up, volume expected to drop to its lowest level since 2000; thieves can make cash machines release money “like winning slot machines.”

January 29 -

The credit union encouraged members to save on interest by converting loans they took out elsewhere to Educators Credit Union loans.

January 10 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

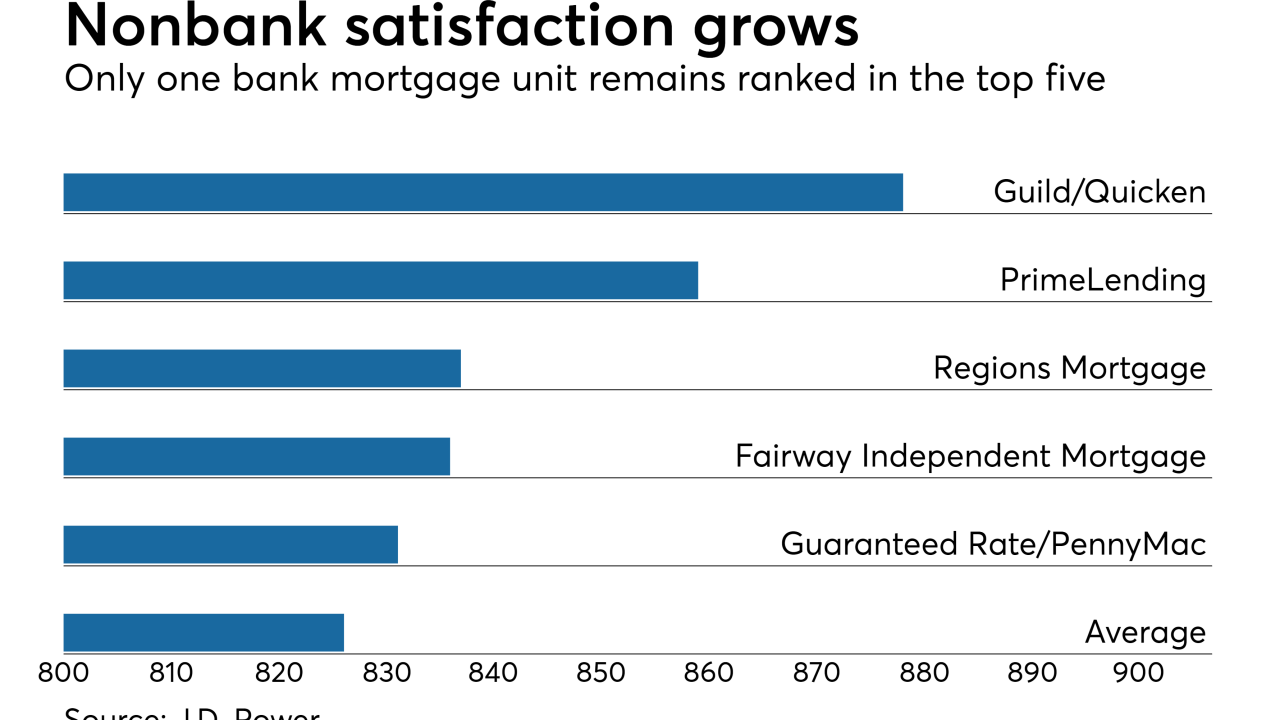

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9 -

More FHA homeowners than expected are refinancing out of the program and into conventional mortgages, despite an increase in mortgage rates over the past year.

November 7 -

Taking a data-driven approach to marketing not only helped pump up originations -- it also helped save members money.

October 26