-

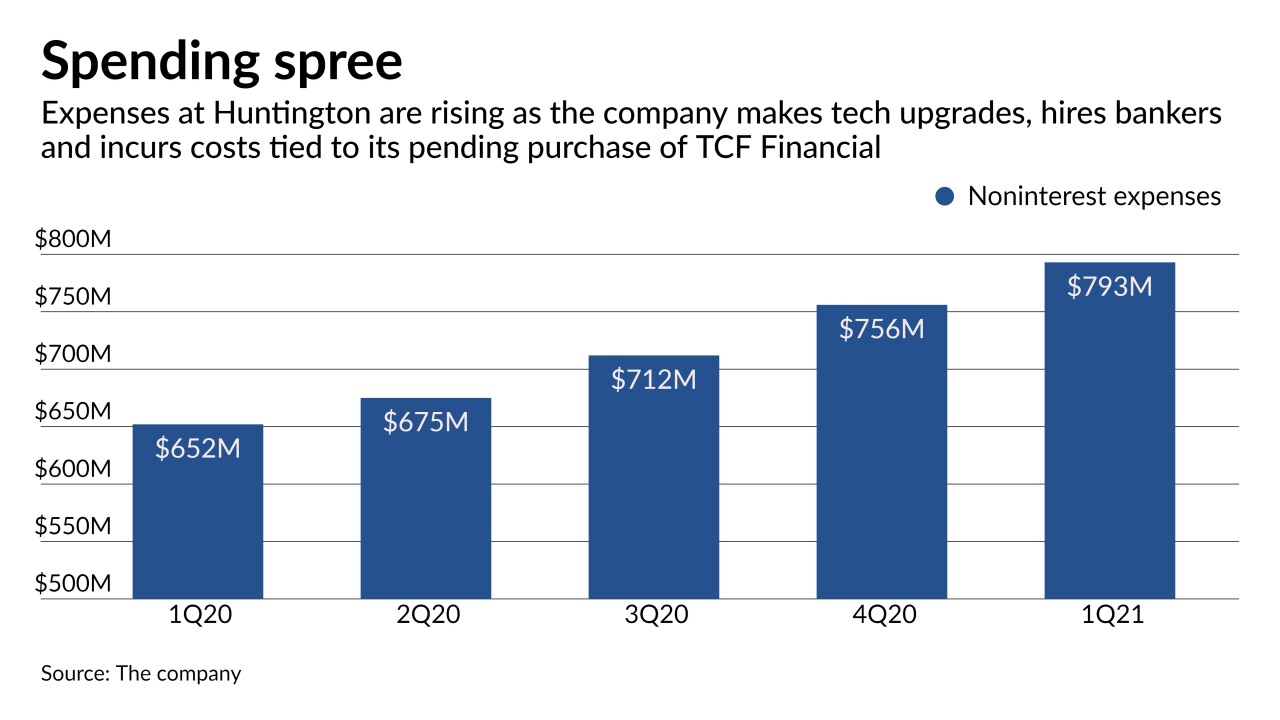

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

April 22 -

The Tennessee company says it has been pitching specialty finance products inherited from Iberiabank to its own clients.

April 21 -

The San Antonio company will no longer charge fees on transactions of $100 or less that take checking account balances into negative territory, as long as the customer has a $500 monthly direct deposit set up.

April 15 -

Loan growth and wealth management revenue drove a 53% increase in the San Francisco bank's profit from a year earlier.

April 14 -

The Mississippi company has never done a deal this large. But buying Houston-based Cadence would take it into high-growth markets and reduce both companies' concentrations in sectors such as energy, dining and hospitality.

April 12 -

Valley National wanted to become more customer friendly, while Washington Federal needed more commercial clients. The leaders of those companies recently discussed the tough decisions they made to bring about much-needed change.

April 9 -

The Michigan company recently paid $70 million to close the books on a matter dating to the last financial crisis.

March 31 -

The economy is poised to rebound, meaning loan demand and hiring will pick up, some observers say. Others argue that banks have plenty of reasons to cut jobs given industry consolidation, the growth of digital banking and expectations that low interest rates will persist.

March 29 -

Fees from forgiven Paycheck Protection Program loans are providing a short-term lift, but balance sheets are shrinking and it isn't clear what will drive future growth.

March 21 -

The Indiana company said the move reflects a need to cut costs and customers' increased preference for digital channels.

March 15 -

The Honolulu company said the "non-public, fact-finding inquiry" by the Securities and Exchange Commission focuses on its calculations for earnings per share.

March 15 -

HoldCo Asset Management, which gains two board seats from a standstill agreement, had expressed disappointment that the Boston company hired a CEO instead of pursuing a sale.

March 8 -

The California company said the issue involves a line of credit it funded earlier this year and that it is working with law enforcement authorities on the matter.

February 26 -

M&T had long coveted the Connecticut regional but couldn't make a deal work. Their merger is the latest example of regional banks joining forces to compete in an industry undergoing rapid transformation.

February 22 -

The investments, part of a post-merger effort to wring out more profits, include new commercial and mortgage lending platforms.

January 21 -

Sandy Spring Bancorp also plans to shrink its network as more customers move to digital channels.

January 21 -

Robert Kafafian says he's hearing more MOE chatter now than at any time in his decades-long career as a consultant. He cited smaller banks' need to cut costs, improve tech offerings and compete with bigger lenders.

January 13 -

The company, which reported a large third-quarter loss in October, plans to sell or shutter a quarter of its locations.

January 6 -

The New Canaan, Conn., company said it will record a pretax expense of $3.9 million in the fourth quarter related to branch and office closings, severance payments and the end of a vendor contract.

December 31 -

One engineered a big M&A deal, another struggled with his bank's credit issues and another abruptly resigned. Here are their stories and more.

December 23