-

Shopping and paying for goods with a smartphone or tablet has been a staple of modern consumerism for years, but mobile wallet adoption is just at its early stages, writes Lisa Stanton, president of InAuth.

August 3 Monitise

Monitise -

Mobile ATMs are generally more secure than card-based machines, but still require more security than more traditional digital transactions, writes Sam Shawki, founder and CEO of MagicCube.

June 20 MagicCube

MagicCube -

Biometric scans provide security and convenience, but still carry risk that requires additional technology, writes ValuePenguin analyst Robert Harrow.

June 1 Value Penguin

Value Penguin -

Attacks like the WannaCry ransomware require issuers to educate staff and shore up technology defenses, writes Bob Antia, cheif security officer of Unitrends.

May 31 Unitrends

Unitrends -

Readers weigh in on a proposal for encouraging small bank installment loans, a firm that uses AI to reduce false alarms, what security improvements are needed for sharing customer data, and more.

May 26 -

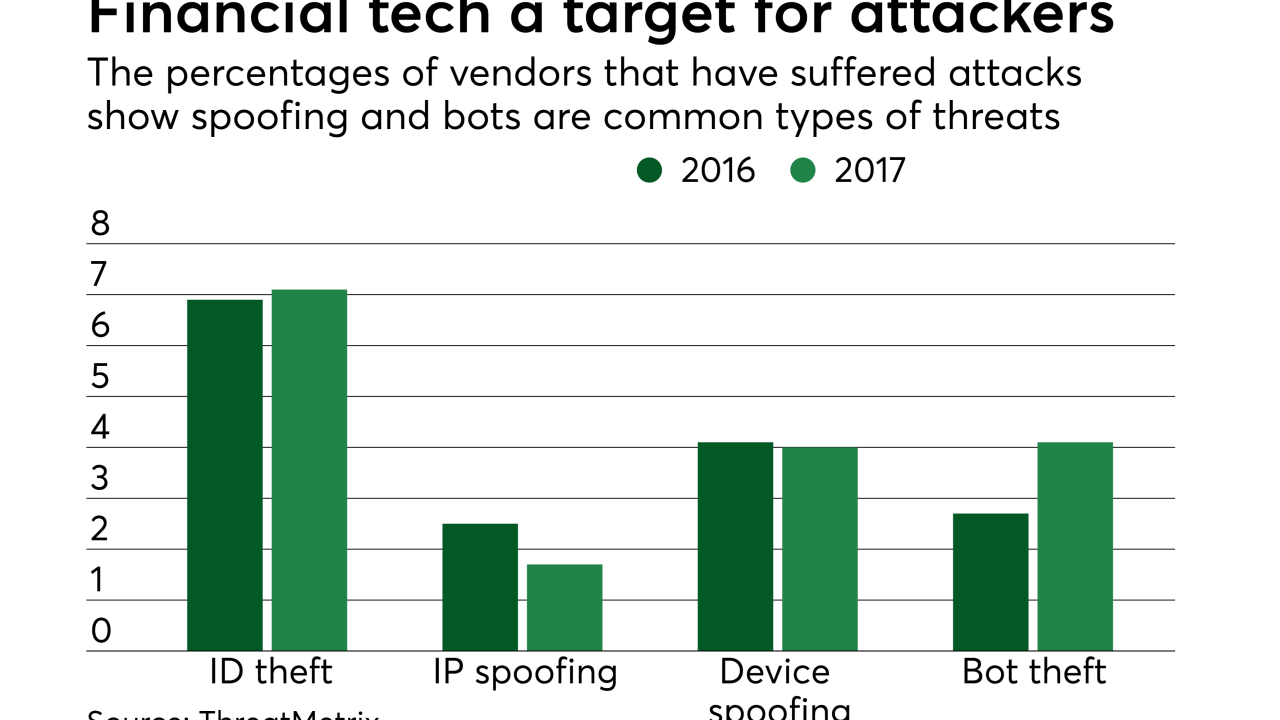

As volume grows, fraud and security risk will expand as well. Merchants and issuers can't afford to avoid the extra work to secure the channel.

May 25 InAuth

InAuth -

Better information security will remain the foundation of success as the financial services industry moves quickly to engage new business models.

May 23 ISACA Scottish chapter

ISACA Scottish chapter -

Mobile apps are becoming the playground and hiding place for cyberattacks and the criminals who orchestrate them.

May 9 -

Using mobile apps to control payment cards has become a popular security option among issuers.

May 8 -

As the smartphones become ATM cards, a new set of security risks emerges. Thorough ID protection is necessary to keep no-card ATMs secure.

April 25 iovation

iovation