-

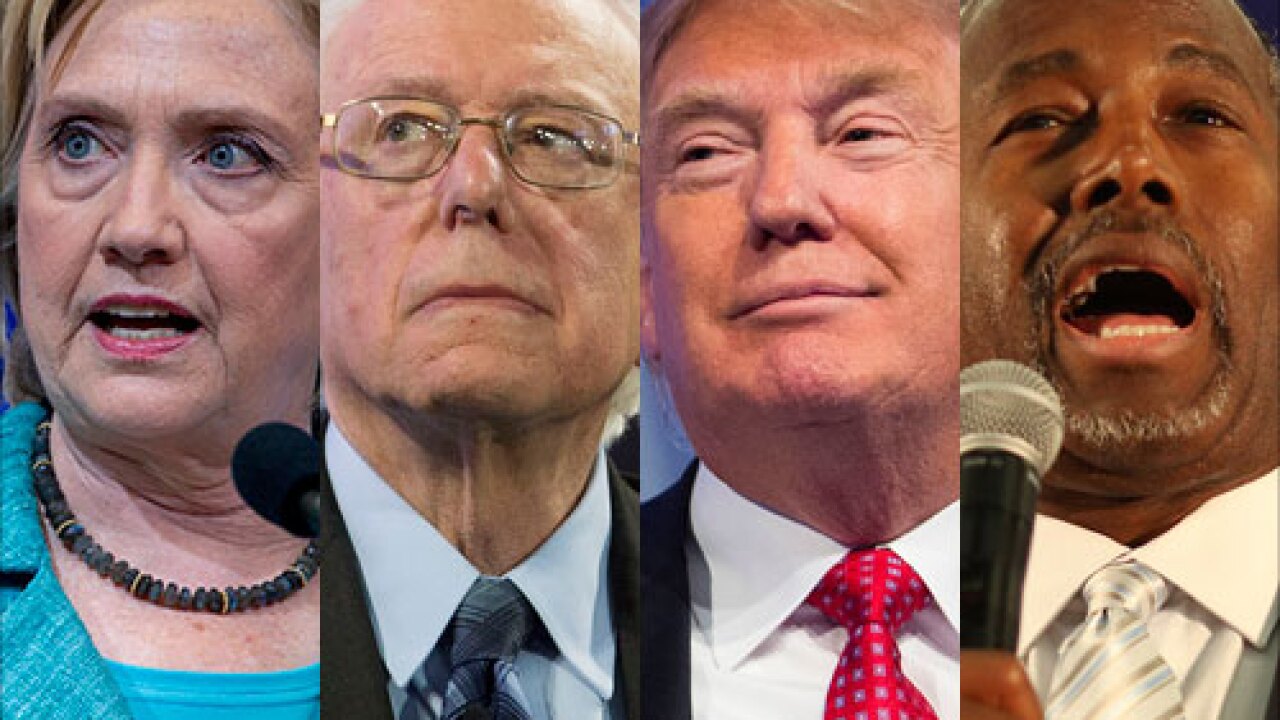

Democratic presidential front runner Hillary Clinton last week became the latest presidential candidate to outline her views on Wall Street reform, taking an incremental approach that tried to strike a balance between pleasing the liberal base while not taking a radical stance on issues. Following is how her plan compares with her competitors, both Republican and Democrat.

October 13 -

Democratic presidential front-runner Hillary Clintons first major speech on Wall Street reform Thursday is unlikely to persuade skeptics on the left that she is committed to going further than President Obama on the issue. Heres why.

October 8 -

The U.S. version of an international liquidity rule may include additional factors that make it harder to accurately compare between banks or examine the same institutions liquidity holdings over time, according to a paper issued Wednesday by the Office of Financial Research.

October 7 -

From "too big to fail" to Glass-Steagall, the two leaders of the postcrisis recovery hashed out the economic issues, while pitching Bernanke's new book.

October 7 -

The Federal Reserve Board said Monday that it would reopen its public comment period on Goldman Sachs' pending acquisition of roughly $16 billion in online deposits from GE Capital, citing a need for greater public examination of the deal.

October 5 -

WASHINGTON Senate Banking Committee Chairman Richard Shelby sent a letter to regulators this week raising concerns about the role of the Financial Stability Board in designating large banks as systemically risky and whether the international council has undue influence on U.S. policy.

September 30 -

Rules dealing with liquidity and other market-related items may be a better strategy for asset managers than higher capital requirements, said Federal Reserve Board Gov. Daniel Tarullo.

September 28 -

The only way to evaluate the appropriateness of Dodd-Frank's costs is to monitor the economic benefits that it creates. That's why the government needs to find a quantifiable way to measure the efficiency of its regulations.

September 23

-

Bank executives and outside experts finger technology as the area most in need of improvement when it comes to vetting financial institutions' ability to withstand the next bit economic shock.

September 21 -

Elizabeth Warren, D-Mass., and David Vitter, R-La., the lead sponsors of a bill to place more explicit limits on the Federal Reserve's emergency lending powers, say the bill is getting quashed by a full-court press from banking interests.

September 16 -

The window for moving financial services regulatory relief through Congress is rapidly closing, but there appears to be little hope that the partisan tensions that have stalled the process will ease in time.

September 16 -

Federal Deposit Insurance Corp. Vice Chairman Thomas Hoenig said favorable leverage-ratio treatment for certain derivatives would undermine postcrisis capital reforms.

September 16 -

Criminal charges don't scare big banks anymore. Perhaps the Justice Department's fresh commitment to threatening top executives with prosecution will keep them in line.

September 15

-

The North Carolina-based BB&T is far larger than any other bank regulated by the FDIC. It should be under the supervision of an agency with more experience overseeing large banks.

September 14

-

Gregory Baer, the head of regulatory policy for JPMorgan Chase, will be the next president of The Clearing House Association, the group announced Friday.

September 11 -

The Justice Department's announcement that it would target individual executives at banks and other companies that are being investigated for wrongdoing has sparked a debate about whether the move is actually substantive or instead just designed to boost the agency's public image.

September 10 -

With summer recess ending, banking agencies are about to embark on a busy policymaking schedule leading up to the end of the year.

September 8 -

The world's biggest banks may gain greater flexibility in meeting new crisis rules as the Financial Stability Board adjusts its total loss-absorbing capacity proposal to eliminate bias against decentralized lenders and opportunities for regulatory arbitrage.

September 8 -

IMGCAP(1)]

August 28 -

Nearly seven years after the financial crisis, the uncomfortable truth for the banking industry is that populist anger remains alive and well.

August 27