Small business banking

Small business banking

-

The former Georgia senator and entrepreneur, who promised to combat red tape and fraud in her confirmation hearing, takes office following a 52-45 vote.

February 19 -

-

While companies trust banks and typically maintain their core relationship with small businesses, the industry's dominant position is hardly set in stone, according to a survey by American Banker.

October 11 -

The workforce management platform and payment company launched a card to pay corporate expenses, an option that the country's large banks have mostly avoided.

September 26 -

Only two de novo banks have opened in 2024, while more than 100 launched annually prior to the 2008 financial crisis. Experts don't agree on how to solve the problem.

September 18 -

Banks should embrace Kamala Harris' effort to drive sustainable, equitable economic growth. Doing so will open them up to underserved communities where they can build customer loyalty among a population primed for rapid development.

September 13 -

Executives from JPMorgan Chase, TD, U.S. Bank, M&T and other banks will gather to discuss how they serve small-business clients, what those customers want now and what they expect in 2025 and beyond.

September 12 -

A survey of 135 financial services companies conducted by LexisNexis Risk Solutions, a subsidiary of LexisNexis, found that a vast majority reported increased levels of fraud in 2023.

September 5 -

It's unclear what will happen when the Fed starts cutting interest rates, but community banks will be there to support their customers no matter what the economy looks like.

August 30 -

Banks burdened by excessive regulation are unable to provide the kind of support that growing small businesses in their communities need. The entire system is in dire need of an overhaul.

August 27 -

The core services provider partnered with Lendio to devise a cloud-native tool that will automate small business loan decisioning and onboarding for banks.

July 16 -

First Internet Bank and Nbkc bank are among those exploring ways to automate the traditionally manual task of verifying business customers.

July 12 -

By adopting more inclusive lending practices and actively seeking to support minority-owned businesses, banks can help bridge the financing gap that often stifles the growth of these businesses.

June 25 -

Nearly 20 years ago, the SEC made business development companies subject to an obscure reporting rule that pushed them out of major index funds. Reversing course would be a major boon to small businesses.

June 11 -

While the $800 billion in PPP loans has largely self-liquidated through the forgiveness process, SBA continues to service the longer-duration EIDL portfolio and will likely be doing so for years to come after opting to hold on to the loans.

May 22 -

Banks maintain lists of consulting firms that they trust to help troubled commercial borrowers to fix their businesses. These specialists say they're getting more calls, especially in areas such as multifamily and CRE, from business owners who need help.

May 2 -

Isabel Casillas Guzman, administrator of the Small Business Administration, wants the agency to get involved in direct lending, a practice that was discontinued during the Clinton administration. Congress has not embraced the idea, to put it mildly.

April 29 -

Republicans on the House and Senate Small Business committees are accusing the SBA of being irresponsible in granting Funding Circle permission to participate in its flagship loan-guarantee program.

April 24 -

The decision to approve the fintech's application to make 7(a) loans came nearly a month after Funding Circle's U.K.-based CEO hinted it is considering a sale of its U.S. operations, alarming some members of Congress.

April 4 -

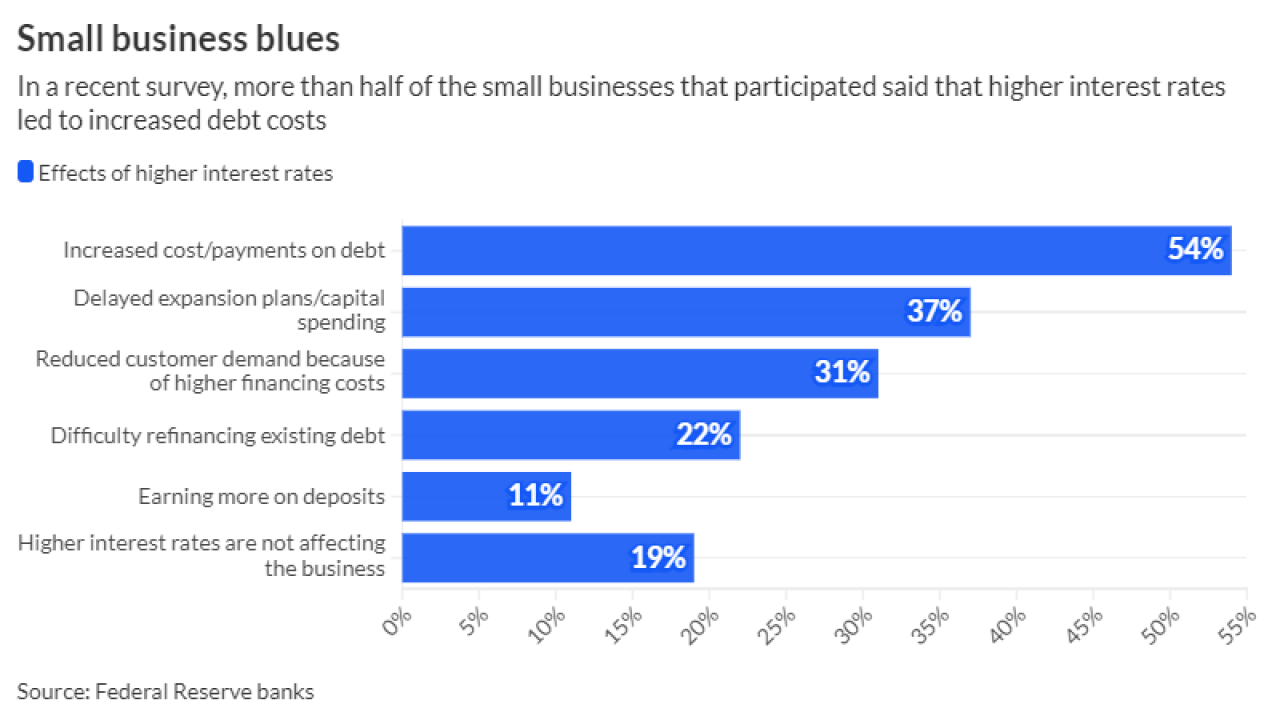

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18