-

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

July 2 -

The Main Street Lending Program is off to a slow start, while the PPP is extended five weeks to distribute the remaining $130 billion in loans; the European regulator is softening its stance to allow more deals.

July 2 -

With stimulus money running out and forbearances set to expire, consumer spending is bound to shrink. That's bad news for business owners and their landlords, the Pittsburgh bank's CEO says.

July 1 -

The Paycheck Protection Program propped up many banks' balance sheets in the first half of the year, but what will drive loan demand in the second half?

July 1 -

The extension to Aug. 8 was offered by Sen. Ben Cardin, a Maryland Democrat, and cleared the chamber by unanimous consent. The House has yet to take up the bill but could pass it as soon as Tuesday night.

June 30 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30 -

Banks are beginning to emphasize soft skills to help employees make “human” connections with customers in an environment of reduced face-to-face contact.

June 23 -

The Paycheck Protection Program put a premium on speed in processing and funding loans.

June 23 -

A global health crisis. Economic free fall. A reckoning over racism and inequality. We will not be the same after this — and neither will banking.

June 23 -

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

June 23 -

Funds from a certificate of deposit at Berkshire Bank will help fuel lending to minority-owned small businesses. Mellody Hobson explains why merely "working on diversity" is not good enough. And Wells Fargo ties compensation to progress on diversity targets.

June 22

-

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

June 21 -

The agencies said late Friday that they will provide information on small businesses that received $150,000 or more from the Paycheck Protection Program.

June 19 -

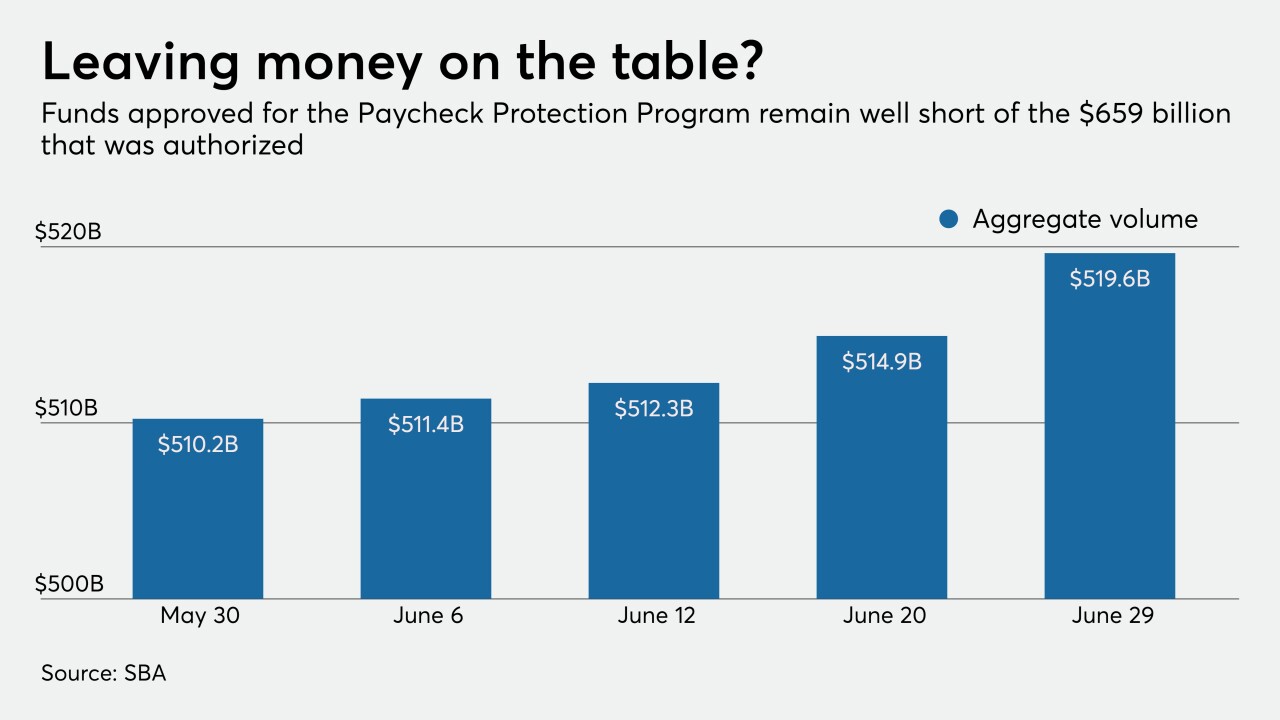

Activity in the Paycheck Protection Program has waned, but some argue that many small businesses, especially those owned by minorities, will miss out if the June 30 application deadline isn't extended.

June 19 -

Worried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

June 19 -

A blueprint that includes more CRA and tax credits for lower-income African Americans would help a demographic disproportionately harmed by the coronavirus pandemic.

June 19 Operation HOPE Inc.

Operation HOPE Inc. -

Fannie Mae has chosen Morgan Stanley while Freddie Mac is going with JPMorgan Chase; the bank’s overhaul plan has helped make it the best-performing big-bank stock so far this year.

June 16 -

In letters to administration officials and large banks, the lawmakers sought details about loan recipients following reports that financial institutions had favored their wealthiest clients.

June 15 -

The central bank also asked for public feedback on a proposal to extend support for coronavirus relief loans to nonprofit organizations that were in sound financial condition before the onset of the COVID-19 pandemic.

June 15 -

The lawmakers cited concerns from small businesses that the current application to have coronavirus relief loans forgiven is “especially burdensome, time-consuming, and costly.”

June 12