-

Small-business owners are struggling to understand the cost of loans sold by marketplace lenders. To remedy this, the industry must embrace a disclosure box that includes these five principles.

August 11 Fundera

Fundera -

The marketplace lender OnDeck Capital is sticking with its lend-and-hold strategy even though the practice contributed to a second consecutive quarterly loss.

August 8 -

Banks need to improve their use of technology designed for small-business customers soon, or risk losing them.

July 28 -

Virgin Money Holdings, the bank backed by billionaire Richard Branson, postponed plans to start lending to small businesses as Britain faces a potential economic slowdown after voting to leave the European Union.

July 26 -

In an acknowledgement that many U.S. small businesses cannot qualify for a bank loan, a federal agency that assists minority-owned firms is now partnering with a pair of online lenders.

July 20 -

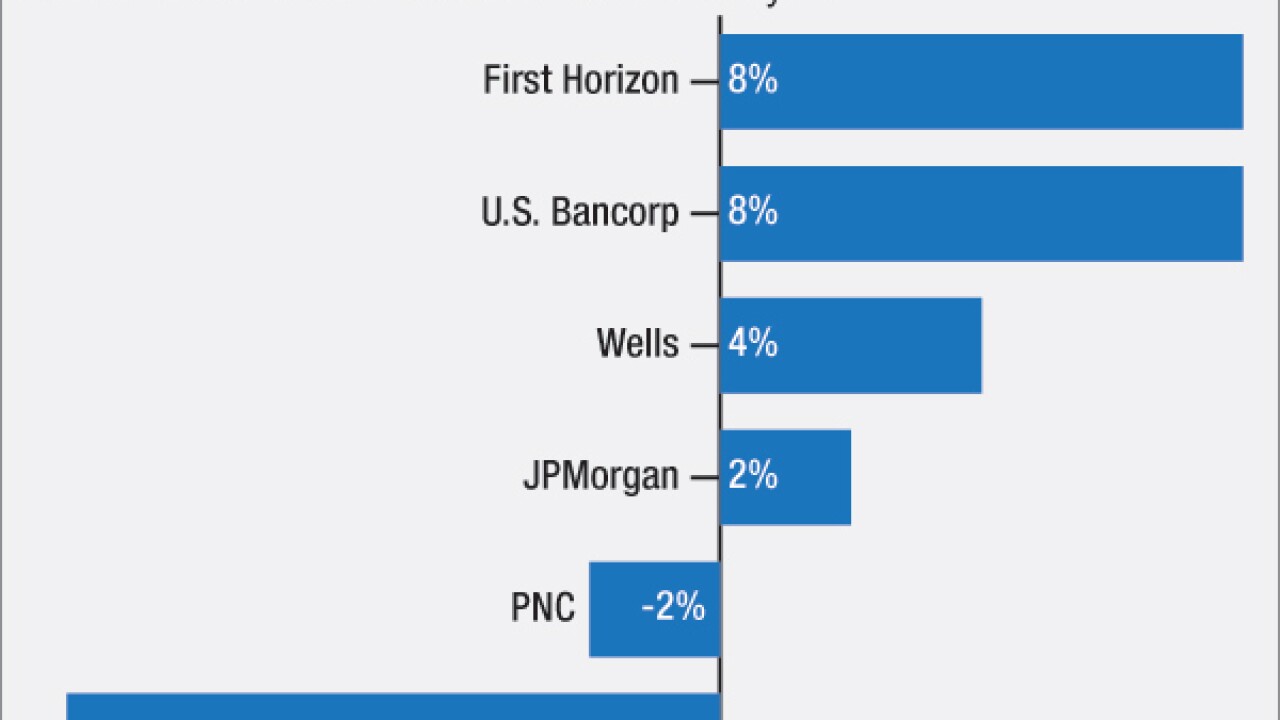

It's liable to be an uphill climb as banks try to boost revenue and hold profit steady over the rest of the year. Here's why.

July 15 -

Loans tied to franchises were often an area of concern for banks before the financial crisis. Industry growth, improved credit metrics and a need to diversify commercial loan portfolios are prompting several banks to take a second look at the business.

July 14 -

Online marketplace lenders found themselves in the congressional crosshairs Tuesday just as some lawmakers are attempting to provide the industry with sought-after reforms.

July 12 -

The $25 billion-asset company said in a press release Tuesday that BankUnited Small Business Finance is now making loans in Ohio, Washington and Wisconsin.

July 12 -

Charles Schwab Bank, BBVA Compass and Mechanics Bank are among the latest investors in a California microfinance firm that specializes in small-business lending.

July 12