-

Carver Federal Savings Bank in New York announced a loan program for small businesses on Monday.

April 18 -

The partnership with OnDeck will allow the megabank to approve and fund loans in as little as a day, according to CEO Jamie Dimon. Meanwhile, OnDeck is eyeing similar partnerships with other banks.

April 12 -

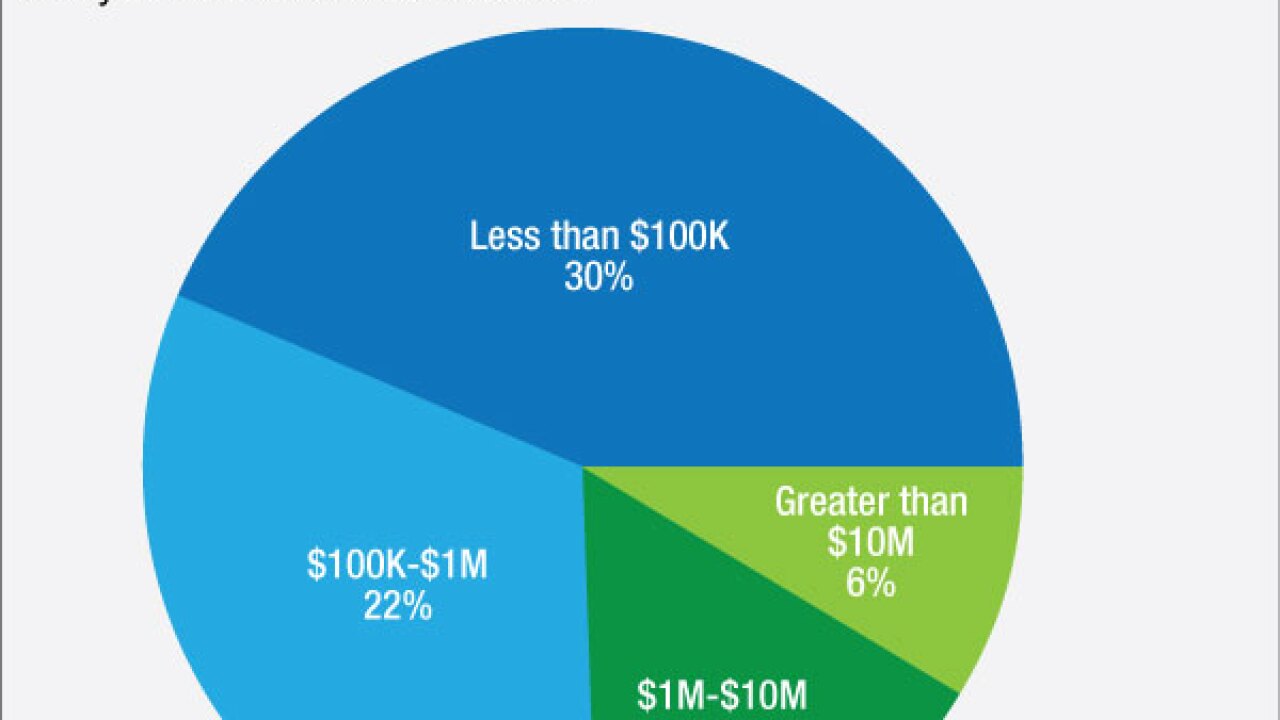

The findings from the California Department of Business Oversight, which also included data on interest rates and delinquencies, could be a precursor to new state regulations.

April 8 -

BlueVine, an online business lender based in Palo Alto, Calif., is branching into unsecured lending.

April 7 -

The payments pioneer is transforming its merchant cash advance into a business loan, a move that has significant legal and regulatory implications.

March 30 -

Huntington Bancshares has partnered with the owner of the NBA's Detroit Pistons to provide $25 million in financial support in Flint, Mich., in response to the city's drinking water crisis.

March 30 -

As online business lenders grow in number, size and prominence, a new trade group is being launched to represent their interests in Washington.

March 29 -

A program recently started in New York helps entrepreneurs improve their business plans and cash flow before sending them to a bank. The nonprofit lender behind the program, meanwhile, hopes to boost small-business borrowers' credit scores and lower their rates.

March 28 -

Online lender StreetShares' strategy is based on the premise that borrowers are more likely to repay when they have a genuine personal connection to the lender.

March 23 -

Berkshire Hills Bancorp in Massachusetts invested in technology to beef up its small-business lending, an area ripe for the picking by alternative lenders.

March 11